Form 5754 PDF

What is the Form 5754 PDF

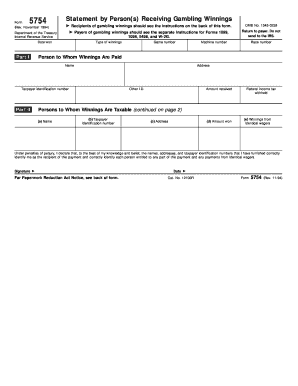

The Form 5754 is an IRS document used to report the allocation of winnings from gambling activities. It is particularly relevant for casinos and other gambling establishments, as it helps ensure that the correct taxes are withheld from winnings. The form is often referred to as the IRS Form 5754 PDF, which indicates its availability in a digital format for ease of use. This form is essential for both the payer and the recipient of gambling winnings, as it provides a clear record of the amounts won and the respective tax obligations.

How to Use the Form 5754 PDF

Using the Form 5754 PDF involves filling out the necessary details accurately. The form requires information such as the name and address of the winner, the type of gambling activity, and the amount won. Once completed, the form must be submitted to the IRS, typically by the gambling establishment. By using digital tools, users can fill out and sign the form electronically, ensuring a streamlined process that meets legal requirements.

Steps to Complete the Form 5754 PDF

Completing the Form 5754 PDF involves several key steps:

- Gather necessary information, including personal details and specifics about the gambling winnings.

- Access the Form 5754 PDF from a reliable source.

- Fill in the required fields accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, as per the guidelines provided by the IRS.

Legal Use of the Form 5754 PDF

The legal use of the Form 5754 PDF is crucial for compliance with IRS regulations. When filled out correctly, the form serves as a legal document that verifies the amount of gambling winnings and the taxes owed. To ensure its legal standing, it is important to use a reliable eSignature solution that complies with the ESIGN Act and UETA. This adds an extra layer of security and validity to the document.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 5754. These guidelines outline the circumstances under which the form must be completed and submitted. It is essential for both gambling establishments and winners to adhere to these guidelines to avoid penalties. The IRS emphasizes the importance of accurate reporting and timely submission to ensure compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5754 are critical to avoid penalties and interest. Typically, the form must be submitted by the end of the tax year in which the winnings were received. It is advisable to check the IRS website for any updates on deadlines, as they may vary based on specific circumstances or changes in regulations. Keeping track of these dates ensures that all parties involved remain compliant with IRS requirements.

Required Documents

When completing the Form 5754 PDF, certain documents may be required to support the information provided. These documents can include identification, proof of winnings, and any relevant tax documentation. Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is accurately reported on the form.

Quick guide on how to complete form 5754 pdf

Effortlessly Prepare Form 5754 Pdf on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Form 5754 Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Form 5754 Pdf with Ease

- Obtain Form 5754 Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or mask sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal status as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for delivering your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes requiring reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Revise and eSign Form 5754 Pdf and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5754 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5754?

The form 5754 is a tax form used primarily for reporting specific lottery winnings or gambling gains. Understanding this form is crucial for proper tax filing, especially for individuals who frequently engage in gambling activities.

-

How does airSlate SignNow help with form 5754 submission?

airSlate SignNow allows you to easily prepare and sign the form 5754 electronically. This streamlines the submission process, ensuring that all required signatures are captured quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for form 5754?

airSlate SignNow offers various pricing plans that cater to different business needs and budgets, all while ensuring easy handling of the form 5754. You can choose a plan that best suits your organization’s requirements for document management and e-signature solutions.

-

Are there any special features for managing form 5754 on airSlate SignNow?

Yes, airSlate SignNow includes templates and automated workflows specifically designed for managing form 5754. These features enhance productivity by pre-filling necessary fields and tracking the document's status throughout the approval process.

-

Is airSlate SignNow compliant with legal regulations for form 5754?

Absolutely! airSlate SignNow complies with all necessary legal regulations to ensure that your form 5754 submissions are valid and enforceable. This compliance gives users peace of mind when managing sensitive tax-related documents electronically.

-

Can I integrate airSlate SignNow with my existing software for form 5754?

Yes, airSlate SignNow integrates seamlessly with various software solutions, making it easy to incorporate the form 5754 into your existing workflows. Popular integrations include CRMs and accounting software, which helps centralize your document management.

-

What are the benefits of using airSlate SignNow for form 5754?

Using airSlate SignNow for form 5754 offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. The digital platform ensures that your forms are processed swiftly, allowing you to focus on what matters most.

Get more for Form 5754 Pdf

- Application for orange county civil grand jury form

- Crim 235 form

- The petitioner pursuant to the family violence act at o georgiacourts form

- Name and address of attorney or party without attorney telephone no form

- Fm 1051 2010 form

- Shylock agreement form in kenya

- California all purpose acknowledgement 2020 form

- Sample notice of proposed action form

Find out other Form 5754 Pdf

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document