Substitute Colorado W 2 Form for Income Tax Withheld DR 0084 Colorado

Understanding the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

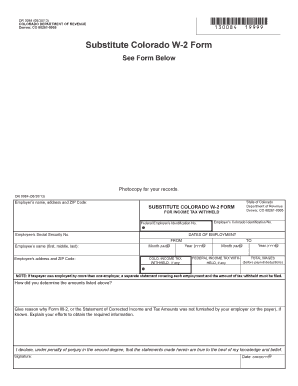

The Substitute Colorado W-2 Form, known as DR 0084, is essential for reporting state income tax withheld from employees' wages. This form serves as a substitute for the standard W-2 when the original document is unavailable or when a business opts to use this specific format for reporting. It ensures that the state tax authorities receive accurate information regarding the income tax withheld from employees, which is crucial for compliance with Colorado tax regulations.

Steps to Complete the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

Completing the Substitute Colorado W-2 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary employee information, including their Social Security number, total wages, and the amount of state tax withheld. Next, accurately fill out the form by entering this information in the designated fields. It's important to double-check all entries for errors. Once completed, the form should be signed and dated by the employer or authorized representative. Finally, ensure that copies are distributed to employees and submitted to the appropriate state tax authority.

Obtaining the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

The Substitute Colorado W-2 Form can be obtained through the Colorado Department of Revenue's website or directly from authorized tax software providers. Employers can also request physical copies from their tax professional or accountant. It is important to ensure that the latest version of the form is used to comply with current tax laws and regulations.

Legal Use of the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

The legal use of the Substitute Colorado W-2 Form is governed by state tax laws. Employers must ensure that they are using this form in accordance with Colorado regulations, which stipulate that all required information must be accurately reported. Failure to comply with these regulations can result in penalties or fines. The form must be filed with the state by the designated deadline to avoid any legal repercussions.

Key Elements of the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

Key elements of the Substitute Colorado W-2 Form include the employee's name, Social Security number, total wages, and the amount of state income tax withheld. Additionally, the form requires the employer's information, including the employer identification number (EIN) and business address. These components are critical for ensuring that the form is processed correctly by the Colorado Department of Revenue.

Filing Deadlines for the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

Employers must adhere to specific filing deadlines for the Substitute Colorado W-2 Form. Typically, the form must be submitted to the state by the end of January following the tax year. Employers should also provide copies to their employees by this same deadline to ensure compliance and allow employees to file their taxes accurately. Missing these deadlines can lead to penalties and interest on any unpaid taxes.

Examples of Using the Substitute Colorado W-2 Form for Income Tax Withheld DR 0084

Employers may use the Substitute Colorado W-2 Form in various scenarios. For instance, if an employee has lost their original W-2 or if a business has transitioned to a new payroll system that does not support the standard W-2 format, the DR 0084 provides a valid alternative. Additionally, small businesses that do not have a high volume of employees may find this form easier to manage for reporting purposes.

Quick guide on how to complete substitute colorado w 2 form for income tax withheld dr 0084 colorado

Complete Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado seamlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an excellent sustainable alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado with ease

- Obtain Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether via email, SMS, or through an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

If I am living in UK with T2 General visa and work as a contractor for a US company with W-8BEN form filled out, do I still need to pay income tax to the UK government?

Yes.Every country in the world taxes people who live there. The US (which claims global jurisdiction over its citizens) taxes you because you are a citizen, the UK (which accepts that its jurisdiction stops at its own border, like every other country except the US) taxes you because you are present and earning money.But you don’t pay tax twice.The UK gets the first bite of the cherry - you’re living there, so you should pay towards public services. If you’re resident, you are taxed like the British taxpayers alongside whom you work, except if you have US investment or rental income that you don’t transfer or remit to the UK, special rules for ‘non-domiciled’ visitors may mean there’s no UK tax on this non-UK income (this is a complex area - take proper advice).You then report all your income to Uncle Sam too. The IRS lets you exclude a certain amount of foreign earned income for US tax purposes (up to $103,900 for 2018). If, even with the exclusion, you still owe US income taxes on your UK compensation, you should be able to claim a credit for UK taxes paid that reduces your US tax liability.Again, this is a complex area - take proper advice.It’s actually even more complex, because social security taxes operate under different rules. You should pay in only the UK or the US, but which country’s rules apply depends on the exact circumstances and how they fit with the US-UK bilateral social security treaty.Take advice (I hope that is clear by now!).

Create this form in 5 minutes!

How to create an eSignature for the substitute colorado w 2 form for income tax withheld dr 0084 colorado

How to create an eSignature for your Substitute Colorado W 2 Form For Income Tax Withheld Dr 0084 Colorado online

How to create an electronic signature for the Substitute Colorado W 2 Form For Income Tax Withheld Dr 0084 Colorado in Google Chrome

How to create an electronic signature for putting it on the Substitute Colorado W 2 Form For Income Tax Withheld Dr 0084 Colorado in Gmail

How to create an electronic signature for the Substitute Colorado W 2 Form For Income Tax Withheld Dr 0084 Colorado from your mobile device

How to create an electronic signature for the Substitute Colorado W 2 Form For Income Tax Withheld Dr 0084 Colorado on iOS

How to generate an electronic signature for the Substitute Colorado W 2 Form For Income Tax Withheld Dr 0084 Colorado on Android

People also ask

-

What is the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

The Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado is a document used to report income and tax withholding for employees in Colorado. This form is crucial for ensuring accurate tax filings and compliance with state regulations. By using the correct form, you can streamline your tax preparation process and avoid potential penalties.

-

How can airSlate SignNow help me with the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

airSlate SignNow provides a seamless platform to create, send, and eSign the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado. Our intuitive interface allows you to easily fill out the form, ensuring that all necessary information is included for tax filing. Plus, you can track the document's status in real-time, making the process efficient and hassle-free.

-

What features does airSlate SignNow offer for managing the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

With airSlate SignNow, you get features like customizable templates, secure eSignature options, and document management tools specifically designed for the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado. These features help streamline the paperwork process and ensure compliance with Colorado tax regulations. Our platform also allows for easy collaboration between teams, making tax preparation more efficient.

-

Is there a cost associated with using airSlate SignNow for the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those that require the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado. Our cost-effective solutions ensure you have access to all the necessary features without breaking the bank. You can choose a plan that fits your budget and usage requirements.

-

Can I integrate airSlate SignNow with other software for handling the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

Absolutely! airSlate SignNow offers integrations with popular accounting and payroll software, allowing you to handle the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado seamlessly. This means you can sync your data, minimize manual entry, and streamline your workflow, making your tax preparation process more efficient.

-

What benefits does using airSlate SignNow provide for the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

Using airSlate SignNow for the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado offers numerous benefits, including time savings, accuracy, and compliance assurance. Our platform helps you complete and sign forms quickly, reducing the risk of errors that could lead to tax issues. By ensuring your documentation is in order, you can focus more on your business operations.

-

How secure is my information when using airSlate SignNow for the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado?

Security is a top priority at airSlate SignNow. When using our platform for the Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado, your information is protected by advanced encryption technologies and secure storage protocols. We are committed to ensuring that your sensitive tax data remains confidential and secure throughout the signing process.

Get more for Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado

Find out other Substitute Colorado W 2 Form For Income Tax Withheld DR 0084 Colorado

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe