Nantu Deduction Cancellation Form Nantuorgna Nantu Org

What is the Nantu Deduction Cancellation Form Nantuorgna Nantu Org

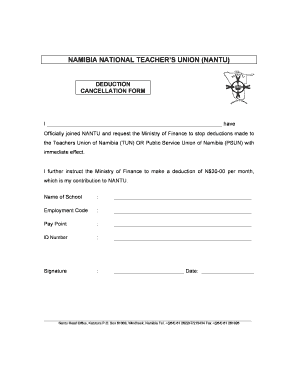

The Nantu Deduction Cancellation Form, often referred to as Nantuorgna or Nantu Org, is a specific document used within the context of tax deductions. This form allows individuals or businesses to formally cancel previously claimed deductions. It is essential for ensuring that the tax records are accurate and up-to-date, particularly when changes in financial circumstances occur. Understanding the purpose of this form is crucial for compliance with tax regulations.

Steps to complete the Nantu Deduction Cancellation Form Nantuorgna Nantu Org

Completing the Nantu Deduction Cancellation Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and the specific deductions you wish to cancel. Next, carefully fill out each section of the form, ensuring that all entries are clear and correct. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, whether electronically or via mail, to ensure it is processed in a timely manner.

Legal use of the Nantu Deduction Cancellation Form Nantuorgna Nantu Org

The legal use of the Nantu Deduction Cancellation Form is governed by various tax laws and regulations. For the form to be considered valid, it must be completed accurately and submitted within the appropriate time frames established by the IRS. Additionally, it is important to retain copies of the completed form for your records, as these may be required for future reference or in the event of an audit. Compliance with these legal requirements ensures that the cancellation of deductions is recognized and accepted by tax authorities.

Key elements of the Nantu Deduction Cancellation Form Nantuorgna Nantu Org

Key elements of the Nantu Deduction Cancellation Form include personal identification information, details of the deductions being canceled, and the reason for the cancellation. Each of these components plays a vital role in the processing of the form. Accurate identification ensures that the form is linked to the correct taxpayer, while detailed information about the deductions provides context for the cancellation. Including a clear reason for the cancellation can also aid in the review process by tax authorities.

How to obtain the Nantu Deduction Cancellation Form Nantuorgna Nantu Org

The Nantu Deduction Cancellation Form can typically be obtained through official tax resources, such as the IRS website or local tax offices. It may also be available through various tax preparation software that assists users in managing their tax documentation. Ensuring that you have the most current version of the form is essential, as tax regulations can change, and using outdated forms may lead to processing delays or rejections.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Nantu Deduction Cancellation Form can be done through multiple methods, depending on your preference and the guidelines provided. Online submission is often the most efficient option, allowing for immediate processing. Alternatively, the form can be mailed to the appropriate tax authority, which may take longer for processing. Some individuals may also choose to submit the form in person at local tax offices, which can provide immediate confirmation of receipt. Each method has its own advantages, so selecting the best option for your situation is important.

Quick guide on how to complete nantu deduction cancellation form nantuorgna nantu org

Prepare Nantu Deduction Cancellation Form Nantuorgna Nantu Org effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Nantu Deduction Cancellation Form Nantuorgna Nantu Org on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Nantu Deduction Cancellation Form Nantuorgna Nantu Org with ease

- Obtain Nantu Deduction Cancellation Form Nantuorgna Nantu Org and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Nantu Deduction Cancellation Form Nantuorgna Nantu Org and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nantu deduction cancellation form nantuorgna nantu org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nantu Deduction Cancellation Form Nantuorgna Nantu Org?

The Nantu Deduction Cancellation Form Nantuorgna Nantu Org is a specialized document designed for users to cancel unauthorized deductions efficiently. This form simplifies the process, making it easy for customers to manage their deductions. By utilizing this form, users can ensure their requests are processed quickly and accurately.

-

How much does it cost to use the Nantu Deduction Cancellation Form Nantuorgna Nantu Org?

Using the Nantu Deduction Cancellation Form Nantuorgna Nantu Org is part of the comprehensive services offered by airSlate SignNow. The pricing is competitive and varies based on usage and features selected. With affordable plans, users can maximize their efficiency while reducing document processing costs.

-

What features does the Nantu Deduction Cancellation Form Nantuorgna Nantu Org include?

The Nantu Deduction Cancellation Form Nantuorgna Nantu Org includes features such as electronic signatures, customizable templates, and real-time tracking. These features ensure that your document handling is streamlined, secure, and compliant. Users can also integrate this form easily into their existing workflows.

-

How can the Nantu Deduction Cancellation Form Nantuorgna Nantu Org benefit my business?

The Nantu Deduction Cancellation Form Nantuorgna Nantu Org helps businesses save time and minimize errors associated with manual form submissions. By automating the cancellation process, businesses can improve operational efficiency and focus on more strategic tasks. Additionally, it enhances customer satisfaction by simplifying communication.

-

Can I integrate the Nantu Deduction Cancellation Form Nantuorgna Nantu Org with my existing software?

Yes, the Nantu Deduction Cancellation Form Nantuorgna Nantu Org can be integrated seamlessly with various third-party applications and software platforms. This allows businesses to maintain their current workflows without interruptions. Integration enhances the overall efficiency of document management.

-

Is the Nantu Deduction Cancellation Form Nantuorgna Nantu Org secure?

Absolutely. The Nantu Deduction Cancellation Form Nantuorgna Nantu Org incorporates top-notch security features to protect user data. With encryption and secure server protocols in place, your sensitive information remains confidential and secure throughout the eSigning process.

-

How do I get started with the Nantu Deduction Cancellation Form Nantuorgna Nantu Org?

Getting started with the Nantu Deduction Cancellation Form Nantuorgna Nantu Org is simple. First, sign up for airSlate SignNow and select the Nantu Org services. You can then access the form and customize it to meet your specific needs, enabling you to start managing deductions efficiently.

Get more for Nantu Deduction Cancellation Form Nantuorgna Nantu Org

- Corporations telephone number form

- Appointment of agent form tr 128 appointment of agent form tr 128

- 1 2 3 4 5 6 7 8 9 10 state university of new york form

- Bureau of family assistance bfa form

- Application casac form

- Form 74 221 tax refund direct deposit authorization

- Application birth form

- Application for authority certificate of authority form

Find out other Nantu Deduction Cancellation Form Nantuorgna Nantu Org

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer