Virginia Request for Review and Adjustment Form 2006-2026

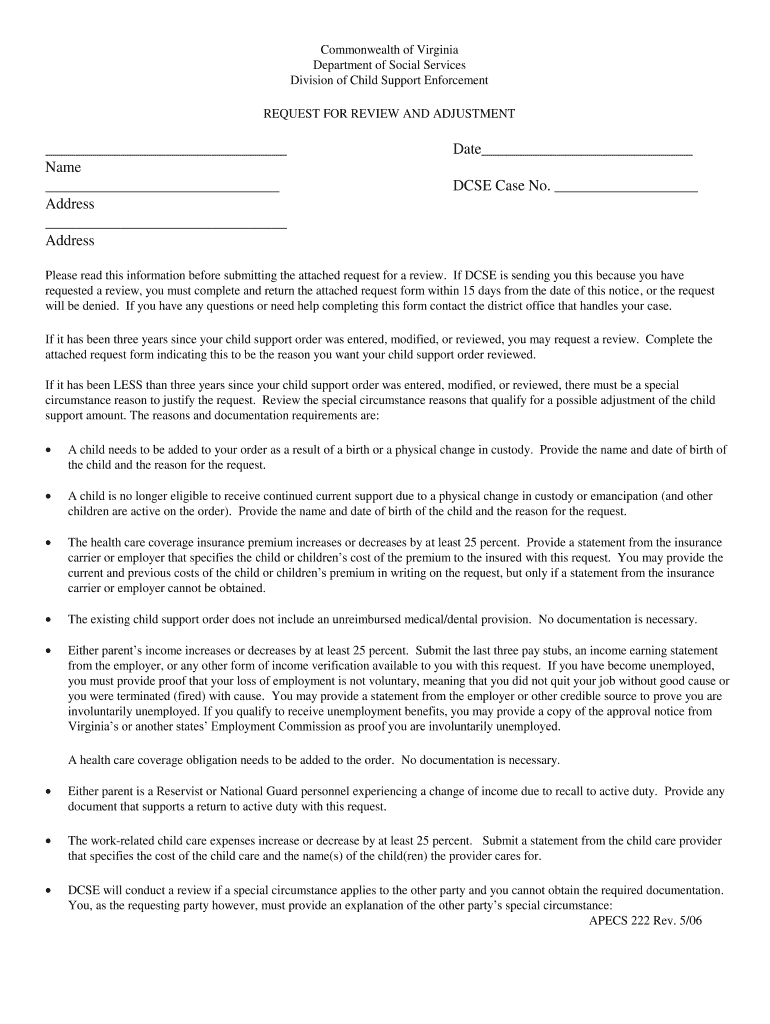

What is the Virginia Request For Review And Adjustment Form

The Virginia Request For Review And Adjustment Form is a document used by individuals and businesses to formally request a review and adjustment of their tax assessments or determinations made by the Virginia Department of Taxation. This form is essential for those who believe that their tax assessments are incorrect or unjustified. It allows taxpayers to present their case and provide necessary documentation to support their request. The form is designed to facilitate communication between taxpayers and tax authorities, ensuring that all parties have a clear understanding of the issues at hand.

How to use the Virginia Request For Review And Adjustment Form

Using the Virginia Request For Review And Adjustment Form involves several key steps. First, ensure that you have the correct version of the form, which can typically be found on the Virginia Department of Taxation's website. Next, fill out the form accurately, providing all required information, including your personal details, tax identification number, and specific reasons for the adjustment request. It is important to attach any supporting documents that substantiate your claims. After completing the form, submit it according to the provided instructions, either online, by mail, or in person, depending on your preference and the guidelines set forth by the tax authority.

Steps to complete the Virginia Request For Review And Adjustment Form

Completing the Virginia Request For Review And Adjustment Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the latest version of the form from the Virginia Department of Taxation.

- Fill in your personal information, including your name, address, and tax identification number.

- Clearly state the reasons for your request, providing specific details about the assessment you are challenging.

- Attach any relevant documentation that supports your case, such as previous tax returns or correspondence with tax authorities.

- Review the completed form for any errors or omissions before submission.

- Submit the form as directed, ensuring you keep a copy for your records.

Legal use of the Virginia Request For Review And Adjustment Form

The Virginia Request For Review And Adjustment Form is legally recognized as a formal method for taxpayers to contest tax assessments. When used correctly, it provides a structured process for addressing discrepancies in tax evaluations. The form must be completed in accordance with Virginia tax laws, and submissions should adhere to deadlines and procedural requirements outlined by the Virginia Department of Taxation. Failure to comply with these regulations may result in the rejection of the request or potential penalties.

Eligibility Criteria

To submit the Virginia Request For Review And Adjustment Form, taxpayers must meet certain eligibility criteria. Generally, individuals or businesses who have received a tax assessment from the Virginia Department of Taxation and believe it to be inaccurate can apply. It is important to demonstrate that the assessment does not reflect the correct tax liability based on applicable laws and regulations. Additionally, taxpayers must ensure that they are within the designated time frame for filing a request, as late submissions may not be considered.

Required Documents

When submitting the Virginia Request For Review And Adjustment Form, it is crucial to include all required documents to support your case. This may include:

- Copies of previous tax returns relevant to the assessment.

- Correspondence with the Virginia Department of Taxation regarding the assessment.

- Any additional documentation that substantiates your claims, such as financial statements or receipts.

Providing comprehensive documentation can strengthen your request and facilitate a smoother review process.

Quick guide on how to complete virginia request for review and adjustment form

Experience the simpler method to manage your Virginia Request For Review And Adjustment Form

The traditional approaches to finishing and approving paperwork consume an excessive amount of time compared to contemporary document management options. Previously, you had to search for suitable social forms, print them, fill in all the information, and dispatch them via postal mail. Now, you can locate, fill out, and sign your Virginia Request For Review And Adjustment Form in one web browser tab with airSlate SignNow. Preparing your Virginia Request For Review And Adjustment Form has never been easier.

Steps to complete your Virginia Request For Review And Adjustment Form with airSlate SignNow

- Access the category page you need and find your state-specific Virginia Request For Review And Adjustment Form. Alternatively, utilize the search bar.

- Verify the version of the form is accurate by previewing it.

- Select Get form and enter editing mode.

- Fill out your document with the necessary information using the editing features.

- Examine the information provided and click the Sign tool to confirm your form.

- Choose the easiest method to create your signature: generate it, draw your signature, or upload an image of it.

- Press DONE to save your modifications.

- Download the file to your device or go to Sharing settings to send it electronically.

Powerful online tools like airSlate SignNow simplify the process of completing and submitting your forms. Give it a try to discover how much time document management and approval processes are truly meant to take. You’ll save signNow time.

Create this form in 5 minutes or less

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Does a girlfriend have to fill out a leave request form for a US Army Soldier in Special Operations in Africa?

Let me guess, you've been contacted via email by somebody you’ve never met. they've told you a story about being a deployed soldier. At some stage in the dialogue they’ve told you about some kind of emotional drama, sick relative/kid etc. They tell you that because they are in a dangerous part of the world with no facilities they need you to fill in a leave application for them. Some part of this process will inevitably involve you having to pay some money on their behalf. The money will need to be paid via ‘Western Union’. Since you havent had much involvement with the military in the past you dont understand and are tempted to help out this poor soldier. they promise to pay you back once they get back from war.if this sounds familiar you are being scammed. There is no soldier just an online criminal trying to steal your money. If you send any money via Western Union it is gone, straight into the pockets of the scammer. you cant get it back, it is not traceable, this is why scammers love Western Union. They aernt going to pay you back, once they have your money you will only hear from them again if they think they can double down and squeeze more money out of you.Leave applications need to be completed by soldiers themselves. They are normally approved by their unit chain of command. If there is a problem the soldier’s commander will summon them internally to resolve the issue. This is all part of the fun of being a unit commander!! If the leave is not urgent they will wait for a convenient time during a rotation etc to work out the problems, if the leave is urgent (dying parent/spouse/kid etc) they will literally get that soldier out of an operational area ASAP. Operational requirements come first but it would need to be something unthinkable to prevent the Army giving immediate emergency leave to somebody to visit their dying kid in hospital etc.The process used by the scammers is known as ‘Advance fee fraud’ and if you want to read about the funny things people do to scam the scammers have a read over on The largest scambaiting community on the planet!

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the virginia request for review and adjustment form

How to make an eSignature for your Virginia Request For Review And Adjustment Form online

How to generate an electronic signature for your Virginia Request For Review And Adjustment Form in Google Chrome

How to make an electronic signature for putting it on the Virginia Request For Review And Adjustment Form in Gmail

How to generate an electronic signature for the Virginia Request For Review And Adjustment Form from your smartphone

How to make an electronic signature for the Virginia Request For Review And Adjustment Form on iOS devices

How to generate an electronic signature for the Virginia Request For Review And Adjustment Form on Android OS

People also ask

-

What is a 222 request adjustment in the context of airSlate SignNow?

A 222 request adjustment refers to the process of modifying or updating a previously submitted 222 request using airSlate SignNow. This feature allows users to easily edit adjustments to their requests efficiently. By utilizing our platform, businesses can ensure that their documentation is accurate and up-to-date.

-

How does airSlate SignNow handle 222 request adjustments securely?

AirSlate SignNow prioritizes your document security, especially when processing 222 request adjustments. We employ advanced encryption methods and secure storage options to protect your sensitive information. This helps to maintain confidentiality and integrity throughout the adjustment process.

-

What are the pricing options for using airSlate SignNow for 222 request adjustments?

AirSlate SignNow offers flexible pricing plans tailored to the needs of businesses of all sizes, including those handling 222 request adjustments. Our plans include a variety of features to ensure that you find a solution that fits your budget. You can explore our pricing page for specific details about monthly and annual subscription costs.

-

Can I integrate airSlate SignNow with other tools for managing 222 request adjustments?

Yes, airSlate SignNow seamlessly integrates with various business tools to enhance your workflow, including those used to manage 222 request adjustments. You can connect our platform with CRM systems, cloud storage, and other applications to streamline your processes. This ensures that adjustments are handled without breaking your operational flow.

-

What benefits does airSlate SignNow provide for managing 222 request adjustments?

Using airSlate SignNow for 222 request adjustments presents several benefits, including enhanced efficiency and improved accuracy. Our intuitive interface allows users to make adjustments quickly and easily, while also providing tracking features to monitor changes. This improves overall document management and collaboration among teams.

-

Is there a mobile app for airSlate SignNow to handle 222 request adjustments?

Yes, airSlate SignNow offers a mobile app that allows you to manage 222 request adjustments on-the-go. With our mobile app, you can access, edit, and sign documents from anywhere at any time. This flexibility is essential for businesses that need to respond quickly to changing document needs.

-

How user-friendly is the process to make a 222 request adjustment in airSlate SignNow?

AirSlate SignNow is designed with user experience in mind, making the process of executing a 222 request adjustment straightforward and intuitive. Users can easily navigate through the platform and make adjustments with just a few clicks. Our comprehensive support resources also ensure that help is readily available, enhancing usability.

Get more for Virginia Request For Review And Adjustment Form

- Release dog application bergin university of canine studies berginu form

- Clinical supervisor confirmation form njpn atwd login page atwd njpn

- Affidavit of impecuniosity utah form

- Application for classified employment berkeley unified school district form

- Request form for individuals to place items on the personnel

- Locker rental agreement template form

- Seascape teacher reference form sea education association sea

- Afbs withdrawal dates form

Find out other Virginia Request For Review And Adjustment Form

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself