FORM NO 61 Odisha

What is the FORM NO 61 Odisha

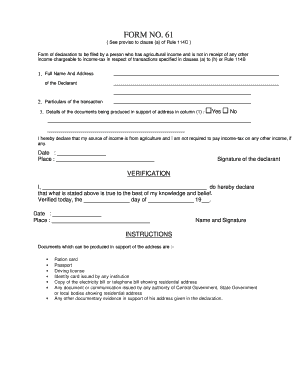

The FORM NO 61 Odisha is a specific document utilized primarily for tax purposes within the state of Odisha, India. It serves as a declaration for individuals who do not have a Permanent Account Number (PAN) but are required to provide certain financial information to the tax authorities. This form is essential for ensuring compliance with local tax regulations and is often used in transactions involving high-value assets or services.

How to use the FORM NO 61 Odisha

Using the FORM NO 61 Odisha involves a straightforward process. First, individuals must accurately fill out the form with the required personal and financial details. This includes information such as name, address, and the nature of the transaction. Once completed, the form should be submitted to the relevant tax authority or financial institution as specified. It is crucial to ensure that all information is correct to avoid any potential issues with tax compliance.

Steps to complete the FORM NO 61 Odisha

Completing the FORM NO 61 Odisha requires several key steps:

- Gather necessary personal information, including your name, address, and contact details.

- Provide details of the financial transaction or service for which the form is being submitted.

- Ensure that you sign and date the form to validate your declaration.

- Submit the form to the appropriate authority, either in person or through an online platform if available.

Legal use of the FORM NO 61 Odisha

The FORM NO 61 Odisha holds legal significance as it is recognized by tax authorities for compliance purposes. When properly filled out and submitted, it serves as a valid declaration for individuals without a PAN. This form helps in maintaining transparency in financial transactions and is crucial for avoiding penalties associated with non-compliance with tax regulations.

Key elements of the FORM NO 61 Odisha

Several key elements must be included in the FORM NO 61 Odisha to ensure its validity:

- Personal Information: Full name, address, and contact details of the individual.

- Transaction Details: Description of the financial transaction or service.

- Signature: The individual must sign the form to confirm the accuracy of the information provided.

- Date: The date of completion must be included to establish a timeline for the declaration.

Form Submission Methods

The FORM NO 61 Odisha can be submitted through various methods, depending on the requirements set by the local tax authority. Common submission methods include:

- In-Person: Submitting the completed form directly at the local tax office.

- Online: Utilizing any available digital platforms for electronic submission.

- Mail: Sending the completed form via postal service to the designated tax authority.

Quick guide on how to complete form no 61 odisha

Prepare FORM NO 61 Odisha effortlessly on any device

Online document handling has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage FORM NO 61 Odisha on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign FORM NO 61 Odisha with ease

- Obtain FORM NO 61 Odisha and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow supplies specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign FORM NO 61 Odisha to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 61 odisha

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM NO 61 Odisha?

FORM NO 61 Odisha is a declaration form that taxpayers in Odisha use to disclose their income and claim exemptions. It is particularly essential for individuals who do not have a taxable income in a given financial year. Understanding how to properly fill and submit this form can save you signNow time and effort during tax season.

-

How can airSlate SignNow help with FORM NO 61 Odisha submissions?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including FORM NO 61 Odisha. Our tool simplifies the process, ensuring that your submissions are completed accurately and on time, giving you peace of mind regarding your tax affairs.

-

Is airSlate SignNow cost-effective for managing FORM NO 61 Odisha?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling FORM NO 61 Odisha and other document needs. With our competitive pricing plans, businesses of all sizes can affordably streamline their eSigning process without sacrificing quality or functionality.

-

What features does airSlate SignNow offer for FORM NO 61 Odisha users?

airSlate SignNow offers a variety of features that benefit FORM NO 61 Odisha users, including customizable templates, secure cloud storage, and audit trails. These features ensure that you can easily create, sign, and manage your documents while maintaining compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software for FORM NO 61 Odisha?

Absolutely! airSlate SignNow supports integrations with numerous applications that enhance your experience with FORM NO 61 Odisha. Whether you're using CRM systems, cloud storage, or accounting software, our platform can seamlessly integrate to create a more efficient workflow.

-

What are the benefits of eSigning FORM NO 61 Odisha with airSlate SignNow?

ESigning FORM NO 61 Odisha with airSlate SignNow provides numerous benefits, including time savings, lower costs, and enhanced security. You can sign documents from any device, at any time, eliminating the need for physical paperwork and making compliance easier than ever.

-

Is there customer support available for questions about FORM NO 61 Odisha?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions related to FORM NO 61 Odisha. Our support team is knowledgeable and can guide you through the eSigning process to ensure you fully understand how to make the most of our platform.

Get more for FORM NO 61 Odisha

Find out other FORM NO 61 Odisha

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template