W9 Workers Compensation Form

What is the W-9 Workers Compensation?

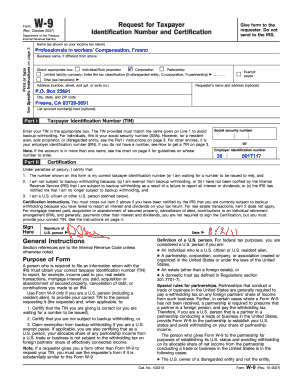

The W-9 Workers Compensation form is an essential document used in the United States for tax purposes. It is primarily utilized by businesses to request the taxpayer identification number (TIN) of a contractor or freelancer. This form ensures that the correct information is collected for reporting income to the IRS. The W-9 is crucial for independent contractors, as it allows them to provide their information to businesses that may need to report payments made to them. Understanding the purpose and function of this form is vital for both employers and workers in ensuring compliance with tax regulations.

Steps to Complete the W-9 Workers Compensation

Completing the W-9 Workers Compensation form involves several straightforward steps. First, ensure you have the correct version of the form, which can usually be obtained from the IRS website or your employer. Next, fill in your name as it appears on your tax return, followed by your business name if applicable. You will then need to provide your address, TIN, and the appropriate tax classification. After reviewing the information for accuracy, sign and date the form. It is important to submit the completed form to the requester, not the IRS, to ensure proper processing.

Legal Use of the W-9 Workers Compensation

The W-9 Workers Compensation form is legally recognized as a valid means of collecting taxpayer information. It is crucial for compliance with IRS regulations, as failure to provide accurate information can lead to penalties. The legal use of this form includes ensuring that the information provided is truthful and that it is submitted to the appropriate parties. Additionally, when using electronic signatures, it is important to comply with the ESIGN Act, which establishes the legality of electronic signatures in the United States.

Filing Deadlines / Important Dates

Awareness of filing deadlines for the W-9 Workers Compensation form is essential for both businesses and independent contractors. While the W-9 itself does not have a specific deadline for submission, it is typically requested before payments are made. Businesses must ensure they have a completed W-9 on file before issuing a Form 1099 at the end of the tax year. The deadline for filing Form 1099 is usually January 31 of the following year, making it crucial to collect W-9 forms promptly to avoid delays.

Required Documents

When completing the W-9 Workers Compensation form, certain documents may be necessary to provide accurate information. These documents typically include your Social Security card or Employer Identification Number (EIN) if you are a business entity. Additionally, having your tax return handy can help ensure that the name and TIN match what is on record with the IRS. It is important to keep these documents secure, as they contain sensitive information that should not be shared unnecessarily.

Who Issues the Form

The W-9 Workers Compensation form is issued by the Internal Revenue Service (IRS). While the IRS provides the form, it is typically completed by independent contractors or freelancers at the request of a business or individual who intends to pay them. This request is often made to ensure that the payer has the necessary information for tax reporting purposes. Understanding who issues the form helps clarify the roles of both the requester and the individual completing the form.

Quick guide on how to complete w9 workers compensation

Complete W9 Workers Compensation effortlessly on any gadget

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the needed forms and securely store them online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without any hold-ups. Manage W9 Workers Compensation on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and electronically sign W9 Workers Compensation seamlessly

- Locate W9 Workers Compensation and then click Get Form to begin.

- Utilize the features we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from a device of your choice. Modify and electronically sign W9 Workers Compensation and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 workers compensation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a workers comp tax form?

A workers comp tax form is a document used to report payroll taxes associated with workers' compensation insurance. This form is essential for businesses to accurately account for employee coverage and ensure compliance with tax regulations. By using airSlate SignNow, you can easily prepare and sign your workers comp tax form electronically, streamlining the process.

-

How can airSlate SignNow help with my workers comp tax form?

airSlate SignNow simplifies the process of managing your workers comp tax form by allowing you to eSign and send documents quickly. Our platform provides templates and integrations that make it easy to fill out and submit necessary information, saving you time and minimizing errors. With our solution, you can ensure that your workers comp tax forms are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for workers comp tax forms?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for handling workers comp tax forms. The cost-effective solutions allow you to streamline your document management process while ensuring compliance with tax regulations. Pricing is designed to be accessible for businesses of all sizes, making it a valuable investment.

-

What features does airSlate SignNow provide for managing workers comp tax forms?

airSlate SignNow offers a range of features specifically geared towards managing workers comp tax forms, such as customizable templates, electronic signatures, and automated workflows. These features enhance document tracking and ensure that all necessary approvals are captured promptly. With document storage and sharing capabilities, your team can collaborate effectively on tax-related forms.

-

Can I integrate airSlate SignNow with my existing accounting software for workers comp tax forms?

Yes, airSlate SignNow can easily integrate with popular accounting software to facilitate the completion of workers comp tax forms. This integration ensures seamless data transfer, reducing manual entry and potential errors. By connecting your systems, you can streamline your overall workflow and effectively manage financial documentation.

-

What benefits does eSigning my workers comp tax form offer?

eSigning your workers comp tax form using airSlate SignNow offers numerous benefits, including speed, convenience, and security. Electronic signatures reduce turnaround times signNowly compared to traditional methods, allowing you to submit forms promptly. Additionally, our secure platform ensures that sensitive information remains protected throughout the signing process.

-

How does airSlate SignNow ensure the security of my workers comp tax forms?

airSlate SignNow prioritizes the security of your workers comp tax forms by implementing robust encryption and access controls. Our platform complies with industry standards to protect sensitive data and ensure that only authorized users can access your documents. This focus on security provides peace of mind as you manage important tax information.

Get more for W9 Workers Compensation

Find out other W9 Workers Compensation

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online