How Do I Claim for it 245 on Form it 201

What is the How Do I Claim For It 245 On Form It 201

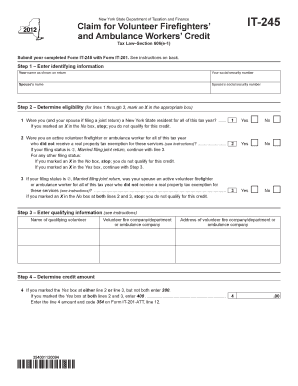

The How Do I Claim For It 245 On Form It 201 is a specific form used for claiming certain tax benefits or credits under U.S. tax regulations. This form is typically associated with specific tax situations that require detailed information about the taxpayer's financial status and eligibility for the claim. Understanding the purpose of this form is crucial for ensuring compliance with tax laws and maximizing potential refunds or credits.

Steps to complete the How Do I Claim For It 245 On Form It 201

Completing the How Do I Claim For It 245 On Form It 201 involves several important steps:

- Gather all necessary documentation, including income statements and any relevant tax forms.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check for any errors or omissions before submission.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the How Do I Claim For It 245 On Form It 201

The legal use of the How Do I Claim For It 245 On Form It 201 requires adherence to federal and state tax laws. It is essential to provide truthful and accurate information when filling out the form, as any discrepancies may lead to penalties or audits. The form must be signed and dated, and electronic submissions must comply with eSignature laws to ensure validity.

Required Documents

To successfully complete the How Do I Claim For It 245 On Form It 201, certain documents are required:

- Income statements, such as W-2s or 1099s.

- Documentation supporting the claim, such as receipts or tax credit eligibility proof.

- Previous tax returns, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the How Do I Claim For It 245 On Form It 201 are typically aligned with the general tax filing dates. It is crucial to be aware of these dates to avoid late penalties:

- Annual tax return deadline: April 15 of the following year.

- Extensions may be available, but must be filed before the original deadline.

Who Issues the Form

The How Do I Claim For It 245 On Form It 201 is issued by the Internal Revenue Service (IRS). The IRS provides guidance and resources for taxpayers to understand how to properly fill out and submit the form, ensuring compliance with tax regulations.

Quick guide on how to complete how do i claim for it 245 on form it 201

Effortlessly Prepare How Do I Claim For It 245 On Form It 201 on Any Gadget

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork since you can access the needed form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly, without any delays. Manage How Do I Claim For It 245 On Form It 201 on any gadget using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Alter and eSign How Do I Claim For It 245 On Form It 201 with Ease

- Find How Do I Claim For It 245 On Form It 201 and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign How Do I Claim For It 245 On Form It 201 to ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how do i claim for it 245 on form it 201

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to understand How Do I Claim For It 245 On Form It 201?

To understand how to claim for IT 245 on Form IT 201, begin by reviewing the specific instructions provided by your tax authority. They will provide detailed guidelines on eligibility and documentation required. Ensure you also have all necessary forms completed to facilitate a smooth claiming process.

-

What are the costs associated with using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Depending on your choice of plan, you can gain access to features that simplify the process of how to claim for IT 245 on Form IT 201 while keeping costs manageable. A free trial is also available for you to explore the platform.

-

Can I use airSlate SignNow to submit Form IT 201 electronically?

Yes, airSlate SignNow allows you to easily eSign and send documents electronically, including Form IT 201. This streamlines the process of how to claim for IT 245 on Form IT 201. You can complete the form and send it directly to the relevant authorities from our platform.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as document templates, eSignature workflows, and real-time tracking. These functionalities simplify the process of how to claim for IT 245 on Form IT 201 by ensuring that you have all the necessary documents and approvals in place. It's designed to improve efficiency in your business operations.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various CRM and productivity tools. This means you can easily manage your documents related to how to claim for IT 245 on Form IT 201 within your existing workflows. A few popular integrations include Salesforce and Google Workspace.

-

What benefits does airSlate SignNow provide for businesses?

With airSlate SignNow, businesses can save time and resources by automating their document signing processes. This assists in managing claims like how to claim for IT 245 on Form IT 201 more effectively. Additionally, it ensures compliance and security for your important documents.

-

Is airSlate SignNow user-friendly for first-time users?

Yes, airSlate SignNow is designed to be intuitive and easy to use for individuals of all skill levels. You’ll find it helpful in understanding how to claim for IT 245 on Form IT 201, regardless of your experience with digital tools. Our support resources are available to guide first-time users.

Get more for How Do I Claim For It 245 On Form It 201

- Courts state co 6968394 form

- Courts state co 6968390 form

- District court denver juvenile courtcounty courts state co form

- Courts state co 6968392 form

- District courtdenver juvenile courtcounty courts state co form

- Name changeclerk ampamp comptroller palm beach county form

- Courts state co 6968344 form

- Jdf 1095 form

Find out other How Do I Claim For It 245 On Form It 201

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now