Wage and Tax Statement Form W 2 Fillable

What is the Wage And Tax Statement Form W-2 Fillable

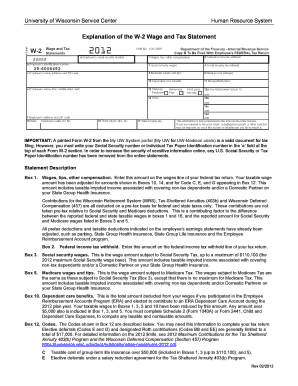

The Wage and Tax Statement Form W-2 is a crucial document used in the United States to report an employee's annual wages and the taxes withheld from their paychecks. This form is issued by employers to their employees and is essential for filing income tax returns. A fillable version of the W-2 allows users to enter their information digitally, making the process more efficient and reducing the chances of errors. The form includes important details such as the employee's Social Security number, the employer's identification number, and various tax withholding amounts.

How to use the Wage And Tax Statement Form W-2 Fillable

Using the Wage and Tax Statement Form W-2 fillable is straightforward. First, download the form from a reliable source. Once you have the form open, you can enter your personal information, including your name, address, and Social Security number. Next, input the employer's details and the financial information regarding wages and taxes withheld. After filling out the necessary fields, review the form for accuracy. Finally, save the completed document securely for your records and use it to file your taxes.

Steps to complete the Wage And Tax Statement Form W-2 Fillable

Completing the Wage and Tax Statement Form W-2 fillable involves several key steps:

- Download the fillable W-2 form from a trusted source.

- Open the form using a compatible PDF editor.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter your employer's information, including their name and Employer Identification Number (EIN).

- Input your total wages, tips, and other compensation in the appropriate boxes.

- Record the federal income tax withheld and any other relevant tax information.

- Review all entries for accuracy before saving the document.

Legal use of the Wage And Tax Statement Form W-2 Fillable

The Wage and Tax Statement Form W-2 fillable is legally recognized when filled out correctly and submitted to the appropriate tax authorities. For the form to be considered valid, it must include accurate information regarding the employee's earnings and tax withholdings. Employers are required to provide employees with a W-2 by January thirty-first of each year, ensuring that employees have the necessary documentation for their tax filings. Compliance with IRS regulations is essential to avoid penalties.

Key elements of the Wage And Tax Statement Form W-2 Fillable

The key elements of the Wage and Tax Statement Form W-2 fillable include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and Employer Identification Number (EIN).

- Wage Information: Total wages, tips, and other compensation.

- Tax Withholdings: Federal income tax withheld, Social Security tax, and Medicare tax.

- State Information: State wages and state tax withheld, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Wage and Tax Statement Form W-2. Employers must ensure that the form is filled out accurately and submitted to both the employee and the IRS by the designated deadlines. The IRS also outlines penalties for late filing or incorrect information, emphasizing the importance of compliance. Employees should review their W-2 forms carefully to ensure that all information is correct before filing their tax returns.

Quick guide on how to complete wage and tax statement form w 2 fillable

Manage Wage And Tax Statement Form W 2 Fillable seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without holdup. Handle Wage And Tax Statement Form W 2 Fillable on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Wage And Tax Statement Form W 2 Fillable effortlessly

- Obtain Wage And Tax Statement Form W 2 Fillable and click Get Form to begin.

- Employ the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to store your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and electronically sign Wage And Tax Statement Form W 2 Fillable and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage and tax statement form w 2 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wage And Tax Statement Form W 2 Fillable?

The Wage And Tax Statement Form W 2 Fillable is a digital version of the IRS form used by employers to report an employee’s annual wages and the taxes withheld. This fillable form allows for effortless completion and submission, ensuring accuracy and compliance with tax regulations.

-

How can I access the Wage And Tax Statement Form W 2 Fillable using airSlate SignNow?

To access the Wage And Tax Statement Form W 2 Fillable, simply sign up for an airSlate SignNow account. Once registered, you can easily locate the form in our template library and start filling it out digitally, streamlining your document process.

-

What are the key features of the Wage And Tax Statement Form W 2 Fillable in airSlate SignNow?

Key features of the Wage And Tax Statement Form W 2 Fillable include easy customization, electronic signing capabilities, and secure document storage. Users can fill out the form conveniently on any device and ensure that their information is securely managed and accessible.

-

Is there a cost associated with using the Wage And Tax Statement Form W 2 Fillable?

Yes, while airSlate SignNow offers various pricing plans, accessing the Wage And Tax Statement Form W 2 Fillable is included in all subscription tiers. Each plan provides different features, allowing you to choose the best fit for your business needs.

-

Can I integrate the Wage And Tax Statement Form W 2 Fillable with other applications?

Absolutely! airSlate SignNow allows for seamless integration with numerous applications, making it easy to incorporate the Wage And Tax Statement Form W 2 Fillable into your existing workflow. This integration enhances efficiency and helps maintain accurate records.

-

What are the benefits of using the Wage And Tax Statement Form W 2 Fillable?

Using the Wage And Tax Statement Form W 2 Fillable provides time-saving benefits as it eliminates the need for paper forms and manual entries. Additionally, it reduces the chances of errors, ensuring that all tax documents are accurate and compliant.

-

Can multiple users fill out the Wage And Tax Statement Form W 2 Fillable?

Yes, multiple users can collaborate on the Wage And Tax Statement Form W 2 Fillable through airSlate SignNow. This collaborative feature enables teams to work together efficiently, ensuring that the form is completed accurately and comprehensively.

Get more for Wage And Tax Statement Form W 2 Fillable

- Reimbursement agreement and authorization form costco benefits

- Application pg 2 compressor millwright labor summit staffing inc form

- Fax the scea friends helping friends application to the scea norcal office at 925 467 2006 form

- Employee warning notice form

- 2018 w 2 forms please visit www

- Truck driver application form

- 31519 employer intake form for public completion v21

- Cinemark jobs fill online printable fillable blankpdffiller form

Find out other Wage And Tax Statement Form W 2 Fillable

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online