Wisconsin Form F01812

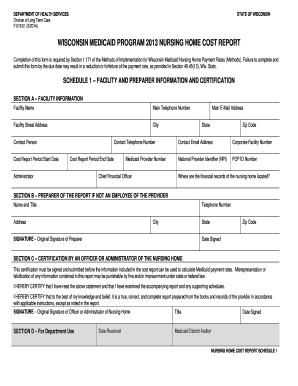

What is the Wisconsin Form F01812

The Wisconsin Form F01812 is a specific document used within the state of Wisconsin for various administrative purposes. It typically relates to financial or tax-related matters, serving as an official means for individuals or businesses to report information to state authorities. Understanding the purpose and requirements of this form is essential for compliance with state regulations.

How to use the Wisconsin Form F01812

Using the Wisconsin Form F01812 involves several steps to ensure accurate completion and submission. First, gather all necessary information and documents that pertain to the form’s requirements. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once filled, the form can be submitted electronically or via traditional mail, depending on the specific instructions provided with the form.

Steps to complete the Wisconsin Form F01812

Completing the Wisconsin Form F01812 requires a systematic approach:

- Review the form to understand its structure and requirements.

- Collect all relevant information, such as identification numbers and financial data.

- Fill in each section of the form, ensuring accuracy and completeness.

- Double-check all entries for errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified submission methods.

Legal use of the Wisconsin Form F01812

The legal use of the Wisconsin Form F01812 is governed by state regulations. When completed and submitted correctly, this form serves as a legally binding document. It is important to adhere to all guidelines to ensure that the form is accepted by state authorities. This includes using proper signatures and following any additional requirements outlined in the form’s instructions.

Key elements of the Wisconsin Form F01812

Key elements of the Wisconsin Form F01812 include:

- Identification Information: Essential details about the individual or business submitting the form.

- Financial Data: Relevant financial information that must be reported.

- Signature Section: A designated area for the signer to authenticate the document.

- Submission Instructions: Clear guidelines on how to submit the form, either electronically or by mail.

Who Issues the Form

The Wisconsin Form F01812 is issued by the Wisconsin Department of Revenue or another relevant state agency. This ensures that the form is standardized and meets the necessary legal requirements for use within the state. It is important to obtain the most current version of the form directly from the issuing authority to avoid any compliance issues.

Quick guide on how to complete wisconsin form f01812

Effortlessly Prepare Wisconsin Form F01812 on Any Device

Digital document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without hassle. Manage Wisconsin Form F01812 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Wisconsin Form F01812 with Ease

- Find Wisconsin Form F01812 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Wisconsin Form F01812 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form f01812

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Form F01812 and why is it important?

The Wisconsin Form F01812 is a crucial document used for specific administrative processes in the state. It ensures compliance with Wisconsin regulations and helps streamline workflows. Utilizing airSlate SignNow to manage this form enhances efficiency and accuracy in submission.

-

How can airSlate SignNow help me complete the Wisconsin Form F01812?

airSlate SignNow provides a user-friendly platform to fill out the Wisconsin Form F01812 electronically. You can easily add signatures, dates, and other required information. This digital approach eliminates paperwork and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Form F01812?

Yes, there is a pricing structure for using airSlate SignNow, but it offers a cost-effective solution for handling the Wisconsin Form F01812. Plans vary based on the features and volume of documents processed. Overall, using SignNow can save you time and resources compared to traditional methods.

-

What features does airSlate SignNow offer for the Wisconsin Form F01812?

airSlate SignNow provides features such as customizable templates, e-signatures, and document tracking for the Wisconsin Form F01812. These tools simplify the workflow, ensuring that your documents are processed quickly and efficiently. Additionally, users benefit from secure cloud storage.

-

Can I integrate airSlate SignNow with other applications when working on the Wisconsin Form F01812?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more. This allows you to easily import and manage the Wisconsin Form F01812 alongside your other business documents, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the Wisconsin Form F01812?

Using airSlate SignNow for the Wisconsin Form F01812 offers numerous benefits, including reduced processing time, improved accuracy, and enhanced collaboration. The platform eliminates the need for physical signatures, making it more convenient. These advantages contribute to better overall productivity.

-

Is airSlate SignNow compliant with Wisconsin regulations for the Form F01812?

Yes, airSlate SignNow complies with all relevant Wisconsin regulations for electronic signatures and document submission, including the Wisconsin Form F01812. By using this platform, you can ensure that your processes meet legal standards, reducing the risk of non-compliance.

Get more for Wisconsin Form F01812

Find out other Wisconsin Form F01812

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer