T 2 Form

What is the T 2 Form

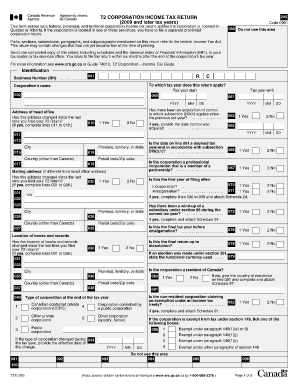

The T 2 form is a corporate income tax return used by Canadian corporations to report their income, deductions, and taxes owed. Specifically, the CRA T2 short fillable form is designed for smaller corporations with simpler tax situations. This form allows businesses to calculate their taxable income, claim deductions, and determine their tax liability in a streamlined manner. It is essential for compliance with Canadian tax laws and must be filed annually.

Steps to complete the T 2 Form

Completing the T 2 short fillable form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Access the fillable T 2 form through a reliable platform that supports electronic signatures and secure submissions.

- Fill out the required sections, including identification information, income details, and deductions.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or print it for mailing, depending on your preference and compliance requirements.

Legal use of the T 2 Form

The T 2 form is legally binding when completed and signed appropriately. To ensure its validity, businesses must adhere to the guidelines set forth by the CRA. This includes using a reliable eSignature solution that complies with legal frameworks such as ESIGN and UETA. Proper execution of the form, including the inclusion of digital certificates and audit trails, enhances its legal standing and protects against disputes.

Required Documents

When preparing to fill out the T 2 short form, specific documents are necessary to ensure accurate reporting. These typically include:

- Financial statements, including balance sheets and income statements.

- Records of all income earned during the tax year.

- Documentation of any deductions claimed, such as business expenses.

- Previous year's tax returns for reference and consistency.

Form Submission Methods

The T 2 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Electronic submission via the CRA's online services, which is often the fastest and most efficient method.

- Mailing a printed version of the completed form to the appropriate CRA office.

- In-person submission at designated CRA locations, although this option may be less common.

Examples of using the T 2 Form

There are various scenarios in which a business might use the T 2 short fillable form. For instance:

- A small corporation with straightforward income and expenses can use the T 2 form to report its annual earnings and claim deductions.

- A newly incorporated business may file its first T 2 return to establish its tax history with the CRA.

- Corporations undergoing changes, such as mergers or acquisitions, may need to file a T 2 to reflect their new financial status.

Quick guide on how to complete t 2 form

Effortlessly Prepare T 2 Form on Any Gadget

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without waiting. Handle T 2 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign T 2 Form with Ease

- Locate T 2 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign T 2 Form and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t 2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cra t2 short fillable form?

The cra t2 short fillable form is a simplified version of the corporate tax return suited for small businesses in Canada. It allows businesses to report their income and expenses in an easy-to-fill format, streamlining the tax filing process. By using airSlate SignNow, you can easily access and complete the cra t2 short fillable form.

-

How can airSlate SignNow assist with the cra t2 short fillable form?

airSlate SignNow empowers users to digitally fill, sign, and send the cra t2 short fillable form with efficiency. Our platform offers an intuitive interface that simplifies document management, making it easier for businesses to comply with tax deadlines. Additionally, features like cloud storage ensure that your completed forms are securely accessible at any time.

-

Is there a cost associated with using airSlate SignNow for the cra t2 short fillable form?

airSlate SignNow offers a range of pricing plans tailored to various business needs, making it cost-effective for users. While completing the cra t2 short fillable form is free, certain premium features may incur charges. You can explore our pricing page to find a plan that suits your budget while maximizing the benefits of our service.

-

What are the key features of airSlate SignNow related to the cra t2 short fillable form?

Key features of airSlate SignNow include easy document collaboration, customizable templates, and electronic signature capabilities for the cra t2 short fillable form. Users can also benefit from real-time tracking and notifications, ensuring that you stay informed about the document status. These features enhance the overall efficiency of tax filing for small businesses.

-

Can I integrate airSlate SignNow with other software for my cra t2 short fillable form?

Yes, airSlate SignNow seamlessly integrates with various business applications, allowing you to enhance your workflow when handling the cra t2 short fillable form. Popular integrations include CRM systems, accounting software, and file storage solutions. This flexibility enables users to streamline their processes and improve productivity.

-

What benefits does airSlate SignNow provide when using the cra t2 short fillable form?

The primary benefits of using airSlate SignNow for the cra t2 short fillable form include saving time, reducing paperwork, and enhancing accuracy. By digitizing the process, you can eliminate manual errors and ensure timely submissions. Furthermore, the ability to eSign documents means you can finalize your tax return from anywhere without the need for printing.

-

Is airSlate SignNow user-friendly for completing the cra t2 short fillable form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the cra t2 short fillable form. The platform's intuitive interface guides users through each step, ensuring that even those with limited tech skills can efficiently manage their tax filings. Plus, customer support is readily available to assist with any questions.

Get more for T 2 Form

Find out other T 2 Form

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself