Soonersave Withdrawal Form

What is the Soonersave Withdrawal

The Soonersave withdrawal refers to the process by which participants in the Soonersave retirement plan can access their funds. This plan is designed to help individuals save for retirement while offering various options for withdrawals. Understanding the specifics of the Soonersave withdrawal is crucial for anyone looking to manage their retirement savings effectively.

Steps to Complete the Soonersave Withdrawal

Completing the Soonersave withdrawal involves several key steps:

- Log in to your Soonersave account using your credentials.

- Navigate to the withdrawal section of the platform.

- Select the type of withdrawal you wish to make, such as a partial or full withdrawal.

- Fill out the required information on the withdrawal form, ensuring accuracy to avoid delays.

- Submit the form electronically or print it for mailing, depending on your preference.

Each step is designed to ensure that your withdrawal request is processed smoothly and efficiently.

Legal Use of the Soonersave Withdrawal

The Soonersave withdrawal is governed by specific legal frameworks that ensure compliance with federal and state regulations. To be considered valid, the withdrawal must adhere to the guidelines established by the Employee Retirement Income Security Act (ERISA) and other relevant laws. This ensures that participants are protected and that their rights are upheld during the withdrawal process.

Required Documents

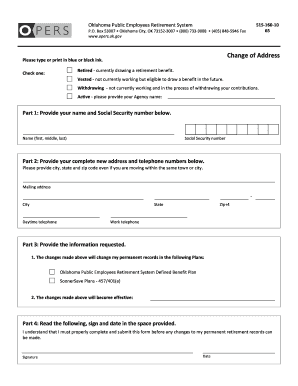

To successfully complete a Soonersave withdrawal, participants typically need to provide certain documents, which may include:

- A completed Soonersave withdrawal form.

- Proof of identity, such as a government-issued ID.

- Any additional documentation requested by the plan administrator.

Having these documents ready can expedite the withdrawal process and help avoid any potential issues.

Who Issues the Form

The Soonersave withdrawal form is issued by the plan administrator, which is responsible for managing the retirement plan. This entity ensures that all participants have access to the necessary forms and information required for making withdrawals. It is important to obtain the correct form directly from the official source to ensure compliance with all regulations.

Form Submission Methods

Participants can submit their Soonersave withdrawal forms through various methods, including:

- Online submission via the Soonersave platform.

- Mailing the completed form to the designated address provided by the plan administrator.

- In-person submission at designated locations, if available.

Choosing the appropriate submission method can help ensure that your request is processed in a timely manner.

Quick guide on how to complete soonersave withdrawal

Complete Soonersave Withdrawal effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Soonersave Withdrawal on any device with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

How to modify and eSign Soonersave Withdrawal effortlessly

- Find Soonersave Withdrawal and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Soonersave Withdrawal and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the soonersave withdrawal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the soonersave withdrawal form?

The soonersave withdrawal form is a specific document used for processing withdrawal requests from the Soonersave account. This form can be easily filled out and submitted using the airSlate SignNow platform, ensuring a seamless and efficient process for users. Utilizing this form helps maintain compliance and speed up your withdrawal transactions.

-

How do I access the soonersave withdrawal form?

You can access the soonersave withdrawal form directly through the airSlate SignNow interface. Once logged in, navigate to the forms section to find and customize your withdrawal form. It's designed to be user-friendly, allowing for quick access and easy modifications to fit your specific needs.

-

Are there any fees associated with the soonersave withdrawal form?

While airSlate SignNow provides a cost-effective solution for document management, any transaction fees related to withdrawals using the soonersave withdrawal form depend on your financial institution’s policies. It's advisable to consult with your financial provider for any applicable fees when processing withdrawals.

-

Can I integrate the soonersave withdrawal form with other tools?

Yes, the soonersave withdrawal form can be integrated with various third-party applications and services via airSlate SignNow’s API. This allows for streamlined workflows and enhances efficiency in managing your withdrawal processes along with other document workflows. Such integrations can signNowly improve your operational capabilities.

-

What are the benefits of using the soonersave withdrawal form?

The soonersave withdrawal form offers a number of benefits such as simplified document signing, reduced processing times, and enhanced security features. By using airSlate SignNow, you can track the status of your form in real-time, ensuring transparency and reliability. Furthermore, it saves time by eliminating the need for paper forms.

-

Is the soonersave withdrawal form mobile-friendly?

Absolutely! The soonersave withdrawal form is fully optimized for mobile devices through the airSlate SignNow app. This means you can fill out and sign the form on-the-go, making it convenient for users who need to execute withdrawals from anywhere, at any time.

-

How secure is the soonersave withdrawal form?

The soonersave withdrawal form is secured with advanced encryption methods, ensuring that your personal and financial information remains protected. airSlate SignNow follows strict compliance standards, providing users with a trustworthy platform to manage their withdrawal documents. Your data's privacy and security is a top priority.

Get more for Soonersave Withdrawal

Find out other Soonersave Withdrawal

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe