Reminder Letter Gst Not Paid by Supplier Letter Format

What is the Reminder Letter Gst Not Paid By Supplier Letter Format

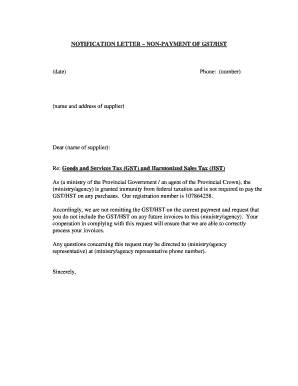

The reminder letter for GST not paid by a supplier is a formal document used to notify a vendor about their failure to remit Goods and Services Tax (GST) payments. This letter serves as a reminder and can be essential for maintaining compliance with tax regulations. It typically outlines the amount owed, the due date, and any relevant details regarding the transaction. By using this format, businesses can ensure that their communication is clear and professional, which is crucial for maintaining good relationships with suppliers.

Key Elements of the Reminder Letter Gst Not Paid By Supplier Letter Format

When drafting a reminder letter for GST not paid by a supplier, it is important to include several key elements to ensure clarity and effectiveness. These elements typically include:

- Date: The date the letter is issued.

- Supplier Information: Name, address, and contact details of the supplier.

- Invoice Details: Reference to the specific invoice number and date.

- Amount Due: The total GST amount that remains unpaid.

- Payment Instructions: Clear instructions on how to make the payment.

- Contact Information: A point of contact for any questions or clarifications.

Steps to Complete the Reminder Letter Gst Not Paid By Supplier Letter Format

Completing the reminder letter for GST not paid by a supplier involves several straightforward steps. Follow these guidelines to ensure your letter is effective:

- Gather Information: Collect all necessary details, including the supplier's information, invoice number, and the amount due.

- Draft the Letter: Use a professional tone and include all key elements mentioned earlier.

- Review the Content: Ensure the letter is free of errors and clearly communicates the necessary information.

- Send the Letter: Choose a method of delivery, whether digital or physical, and ensure it reaches the supplier promptly.

Legal Use of the Reminder Letter Gst Not Paid By Supplier Letter Format

The reminder letter for GST not paid by a supplier can hold legal significance, especially if disputes arise regarding payment. To ensure the letter is legally valid, it should adhere to the following guidelines:

- Compliance: Ensure the letter complies with relevant tax laws and regulations.

- Documentation: Keep a copy of the letter for your records, as it may be required for future reference or legal proceedings.

- Delivery Confirmation: Use a method that provides proof of delivery, such as certified mail or a digital signature service.

Examples of Using the Reminder Letter Gst Not Paid By Supplier Letter Format

Using the reminder letter format can vary based on specific situations. Here are a few examples of how this letter can be applied:

- A supplier fails to pay GST on a recent invoice, prompting a reminder to ensure compliance.

- A business may need to send multiple reminders for different invoices that remain unpaid, each tailored to the specific amounts and due dates.

- In cases of repeated non-payment, the letter can serve as a formal record before escalating the issue to legal action.

How to Use the Reminder Letter Gst Not Paid By Supplier Letter Format

To effectively use the reminder letter format, follow these steps:

- Identify the Situation: Determine the need for a reminder based on unpaid GST.

- Customize the Template: Use a standard template but personalize it with specific details related to the supplier and transaction.

- Send Promptly: Deliver the letter as soon as you notice the payment is overdue to encourage timely resolution.

Quick guide on how to complete reminder letter gst not paid by supplier letter format

Complete Reminder Letter Gst Not Paid By Supplier Letter Format effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Reminder Letter Gst Not Paid By Supplier Letter Format on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to modify and electronically sign Reminder Letter Gst Not Paid By Supplier Letter Format with ease

- Find Reminder Letter Gst Not Paid By Supplier Letter Format and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form - via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Adjust and electronically sign Reminder Letter Gst Not Paid By Supplier Letter Format and ensure seamless communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reminder letter gst not paid by supplier letter format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gst not paid by supplier letter format?

The gst not paid by supplier letter format is a standardized template used to formally request suppliers to address any outstanding GST payments. It ensures clarity and provides a structured way to communicate the issue, aiding in efficient resolution. Using this format can streamline the communication process with suppliers and minimize disputes.

-

How can I create a gst not paid by supplier letter?

Creating a gst not paid by supplier letter can be done easily with airSlate SignNow. Simply use our templates or build your own document quickly using our user-friendly interface. With our eSignature capabilities, you can also ensure that the letter is signed and acknowledged swiftly.

-

Is the gst not paid by supplier letter format customizable?

Yes, the gst not paid by supplier letter format is fully customizable in airSlate SignNow. You can modify the content to suit your specific requirements and include relevant details. Ensure that your message is clear and concise to enhance communication with your suppliers.

-

What are the benefits of using airSlate SignNow for gst not paid by supplier letters?

Using airSlate SignNow for gst not paid by supplier letters offers numerous benefits, including ease of use, quick document turnaround, and enhanced legal compliance through eSignatures. Additionally, our platform allows for tracking the status of your documents, ensuring that you stay informed throughout the process. This can greatly improve your efficiency when handling supplier communication.

-

Can I integrate airSlate SignNow with other applications for managing gst not paid by supplier letters?

Absolutely! airSlate SignNow supports integration with various applications, making it easy to manage your gst not paid by supplier letters alongside your other business processes. This can help you automate workflows and keep everything organized, enhancing overall productivity.

-

What is the pricing model for using airSlate SignNow?

airSlate SignNow offers a cost-effective pricing model that provides great value for businesses of all sizes. Whether you need basic functionality or advanced features for handling documents like the gst not paid by supplier letter format, our plans are designed to fit within your budget. Visit our pricing page for detailed information.

-

Is there customer support available if I need help with the gst not paid by supplier letter format?

Yes, airSlate SignNow provides robust customer support for any questions about using the gst not paid by supplier letter format. Our support team is available through multiple channels, ensuring you receive assistance whenever needed. We are committed to helping you utilize our solution effectively.

Get more for Reminder Letter Gst Not Paid By Supplier Letter Format

Find out other Reminder Letter Gst Not Paid By Supplier Letter Format

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation