MO NRI Missouri Income Percentage Dor Mo Form

What is the MO NRI Missouri Income Percentage Dor Mo

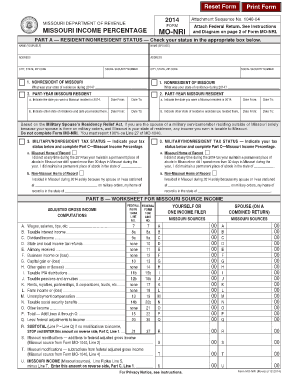

The MO NRI form, or Missouri Non-Resident Income Percentage form, is a critical document for individuals who earn income in Missouri but do not reside in the state. This form is used to determine the percentage of income that is subject to Missouri state tax. Understanding this form is essential for ensuring compliance with state tax regulations and accurately reporting income. By properly completing the MO NRI form, non-residents can calculate their tax obligations based on the income earned within Missouri, which helps avoid overpayment or underpayment of taxes.

Steps to complete the MO NRI Missouri Income Percentage Dor Mo

Completing the MO NRI form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s and 1099s, that reflect your income earned in Missouri. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, accurately report your total income and the portion that was earned in Missouri. After completing the calculations, review the form for any errors before submitting it. Finally, ensure you keep a copy of the completed form for your records.

Legal use of the MO NRI Missouri Income Percentage Dor Mo

The MO NRI form is legally binding and must be filled out accurately to comply with Missouri tax laws. It serves as an official declaration of the income earned in the state by non-residents. When submitted, it helps the Missouri Department of Revenue assess the correct tax amount owed by the filer. To ensure the legal validity of the form, it is crucial to adhere to all instructions and guidelines provided by the state. This includes maintaining records that support the income figures reported on the form, as they may be requested during an audit.

Required Documents

To complete the MO NRI form, certain documents are required to substantiate the income reported. These typically include:

- W-2 forms from employers indicating income earned in Missouri.

- 1099 forms for any freelance or contract work completed in the state.

- Any other relevant income statements or documentation that detail earnings from Missouri sources.

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The MO NRI form can be submitted through various methods, providing flexibility for non-residents. The available submission methods include:

- Online: Filers can complete and submit the form electronically through the Missouri Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address as specified on the form.

- In-Person: Non-residents may also submit the form in person at designated Missouri Department of Revenue offices.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Eligibility Criteria

To be eligible to file the MO NRI form, individuals must meet specific criteria. Primarily, they must be non-residents of Missouri who have earned income sourced from within the state. This includes individuals who work in Missouri but reside in another state. Additionally, filers should ensure they have the necessary documentation to support their income claims. Understanding these criteria is essential for determining whether the MO NRI form must be filed, ensuring compliance with Missouri tax laws.

Quick guide on how to complete mo nri missouri income percentage dor mo

Complete MO NRI Missouri Income Percentage Dor Mo effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage MO NRI Missouri Income Percentage Dor Mo on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign MO NRI Missouri Income Percentage Dor Mo with ease

- Find MO NRI Missouri Income Percentage Dor Mo and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Alter and eSign MO NRI Missouri Income Percentage Dor Mo while ensuring exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo nri missouri income percentage dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo nri form 2023 and how can I access it?

The mo nri form 2023 is a specific document designed for Non-Resident Indians (NRIs) to manage their financial affairs in India. You can easily access the mo nri form 2023 through the airSlate SignNow platform, which provides a user-friendly interface for filling and signing essential documents.

-

Is there a cost associated with using the airSlate SignNow platform for the mo nri form 2023?

Yes, while airSlate SignNow offers a range of pricing plans, using the platform for the mo nri form 2023 is cost-effective. You can choose a plan that fits your needs, ensuring that you get the best value for sending and eSigning important documents.

-

What features does airSlate SignNow offer for the mo nri form 2023?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking that enhance your experience while handling the mo nri form 2023. These tools make it easy to manage documents efficiently, ensuring you complete the process quickly and securely.

-

Can I integrate airSlate SignNow with other applications when using the mo nri form 2023?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when processing the mo nri form 2023. This flexibility helps you connect with your existing tools, making document management seamless.

-

What are the benefits of using airSlate SignNow for the mo nri form 2023?

Using airSlate SignNow for the mo nri form 2023 provides numerous benefits, such as increased efficiency, enhanced security, and ease of use. By digitizing the form processing, you can save time, reduce paperwork, and eliminate the risk of losing important documents.

-

Is the airSlate SignNow platform secure for submitting the mo nri form 2023?

Yes, airSlate SignNow ensures that your data is secure when submitting the mo nri form 2023. The platform uses advanced encryption and security protocols to protect your sensitive information, providing peace of mind while managing your documents.

-

How does airSlate SignNow simplify the completion of the mo nri form 2023?

airSlate SignNow simplifies the completion of the mo nri form 2023 by offering an intuitive interface and step-by-step guidance. This user-friendly experience allows you to fill out and eSign the form quickly without any technical knowledge required.

Get more for MO NRI Missouri Income Percentage Dor Mo

- Motor voter english illinois secretary of state form

- Illinois 2017 offense code book cyberdrive illinois form

- Il ld form

- Information regarding filing a registration as a loan broker under

- Illinois request change residence address form

- School service guide for teachers amp students illinois secretary of form

- Il a authors form

- Illinois farm mileage form

Find out other MO NRI Missouri Income Percentage Dor Mo

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast