City of Detroit Income Tax Withholding Guide Form

What is the City of Detroit Income Tax Withholding Guide

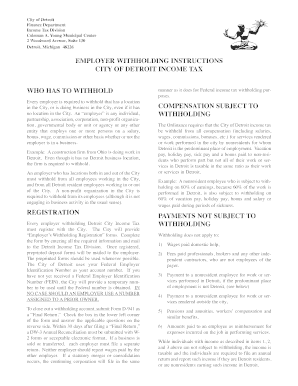

The City of Detroit Income Tax Withholding Guide provides essential information for employers and employees regarding the withholding of city income taxes. This guide outlines the necessary steps to ensure compliance with local tax regulations. It includes details on tax rates, exemptions, and the proper completion of the city of Detroit withholding form 2019. Understanding this guide is crucial for accurate payroll processing and to avoid potential penalties associated with incorrect withholding.

Steps to Complete the City of Detroit Income Tax Withholding Form

Completing the city of Detroit withholding form requires careful attention to detail. Start by gathering all necessary employee information, including name, address, and Social Security number. Next, determine the appropriate withholding amount based on the employee's earnings and filing status. Fill out the form accurately, ensuring that all sections are completed. After reviewing the information for accuracy, submit the form to the appropriate city tax authority. Keeping a copy for your records is also advisable for future reference.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the city of Detroit withholding form. Typically, employers must submit the completed form by the end of the first quarter of the tax year. Additionally, regular payroll tax payments are due on a monthly or quarterly basis, depending on the employer's tax liability. Staying informed about these deadlines helps prevent late fees and ensures compliance with local tax laws.

Legal Use of the City of Detroit Income Tax Withholding Guide

The legal use of the city of Detroit income tax withholding guide is governed by local tax laws and regulations. Employers are required to adhere to the guidelines set forth in the guide to ensure proper tax withholding. Failure to comply can result in penalties, including fines or interest on unpaid taxes. It is advisable for employers to consult with a tax professional to ensure that they are following all legal requirements when utilizing the withholding guide.

Required Documents for Filing

When completing the city of Detroit withholding form, several documents are necessary to ensure accurate filing. Employers should have employee W-2 forms, previous payroll records, and any relevant tax exemption certificates. Additionally, it may be beneficial to have the latest version of the withholding guide on hand. These documents help verify the information provided on the form and support compliance with local tax regulations.

Who Issues the Form

The city of Detroit withholding form is issued by the City of Detroit's Finance Department. This department is responsible for collecting city income taxes and ensuring that employers comply with withholding requirements. Employers can obtain the form directly from the city’s official resources, ensuring they are using the most current version available.

Penalties for Non-Compliance

Employers who fail to comply with the city of Detroit's income tax withholding requirements may face various penalties. These can include monetary fines, interest on unpaid taxes, and potential legal action. It is crucial for employers to understand their responsibilities and ensure timely and accurate withholding to avoid these consequences. Regular training and updates on tax regulations can help mitigate the risk of non-compliance.

Quick guide on how to complete city of detroit income tax withholding guide

Complete City Of Detroit Income Tax Withholding Guide seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Manage City Of Detroit Income Tax Withholding Guide on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest method to modify and eSign City Of Detroit Income Tax Withholding Guide effortlessly

- Obtain City Of Detroit Income Tax Withholding Guide and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiresome document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign City Of Detroit Income Tax Withholding Guide and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of detroit income tax withholding guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Detroit withholding form 2019?

The city of Detroit withholding form 2019 is a tax document required for businesses operating within Detroit. This form helps employers report and remit the appropriate city income tax withheld from their employees' wages. Understanding this form is crucial for compliance with local tax regulations.

-

How can airSlate SignNow help with the city of Detroit withholding form 2019?

airSlate SignNow offers an easy-to-use platform to eSign and manage the city of Detroit withholding form 2019 efficiently. Our solution empowers businesses to send documents for eSignature, ensuring that all required forms are completed properly and submitted on time. This streamlines your compliance process signNowly.

-

Is there a cost associated with using airSlate SignNow for the city of Detroit withholding form 2019?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective. Our pricing plans cater to various business needs, ensuring access to all features necessary for managing forms like the city of Detroit withholding form 2019 without breaking the bank.

-

What features does airSlate SignNow offer for managing the city of Detroit withholding form 2019?

airSlate SignNow provides several features to manage the city of Detroit withholding form 2019 effectively, including document templates, secure eSigning options, and automated workflows. These features ensure that you can handle all your documentation requirements seamlessly and efficiently.

-

Can I integrate airSlate SignNow with other applications for handling the city of Detroit withholding form 2019?

Absolutely! airSlate SignNow offers various integrations with popular business applications, which can be leveraged to streamline the management of the city of Detroit withholding form 2019. Whether it's accounting software or HR management systems, our integrations help maintain a smooth workflow.

-

How does airSlate SignNow ensure the security of the city of Detroit withholding form 2019?

Security is a top priority for airSlate SignNow. We utilize industry-standard encryption and secure cloud storage to ensure that your city of Detroit withholding form 2019 and other sensitive documents remain protected from unauthorized access. Our platform complies with regulatory standards to safeguard your data.

-

What are the benefits of using airSlate SignNow for tax documents like the city of Detroit withholding form 2019?

One signNow benefit of using airSlate SignNow for documents such as the city of Detroit withholding form 2019 is the speed of eSigning, which reduces turnaround time signNowly. Furthermore, our platform enhances collaboration, allowing multiple stakeholders to review and sign documents promptly, improving overall efficiency.

Get more for City Of Detroit Income Tax Withholding Guide

Find out other City Of Detroit Income Tax Withholding Guide

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship