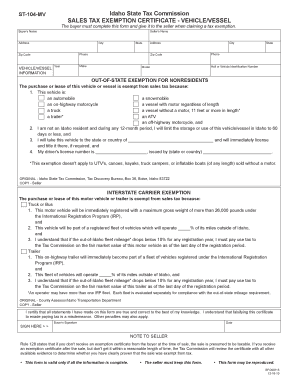

St 104v Tax Exempt Form Idaho

What is the St 104v Tax Exempt Form Idaho

The St 104v Tax Exempt Form Idaho is a document used by organizations and individuals in Idaho to claim exemption from sales tax on certain purchases. This form is essential for entities that qualify under specific tax-exempt categories, such as non-profit organizations, government entities, and certain educational institutions. By completing this form, eligible entities can avoid paying sales tax on qualifying purchases, thereby reducing their overall expenses.

How to use the St 104v Tax Exempt Form Idaho

To use the St 104v Tax Exempt Form Idaho effectively, follow these steps:

- Determine eligibility: Ensure that your organization qualifies for tax exemption under Idaho law.

- Obtain the form: Access the St 104v form through the Idaho State Tax Commission website or other official sources.

- Complete the form: Fill out the required fields accurately, including the name of the organization, tax identification number, and the reason for exemption.

- Submit the form: Provide the completed form to vendors at the time of purchase to avoid sales tax charges.

Steps to complete the St 104v Tax Exempt Form Idaho

Completing the St 104v Tax Exempt Form Idaho involves several key steps:

- Gather necessary information, including your organization’s name, address, and tax identification number.

- Clearly state the purpose of the exemption, citing the specific category under which your organization qualifies.

- Sign and date the form to certify that the information provided is accurate and complete.

- Keep a copy of the completed form for your records and provide the original to the vendor.

Legal use of the St 104v Tax Exempt Form Idaho

The legal use of the St 104v Tax Exempt Form Idaho is governed by state tax laws. It is crucial to ensure that the form is used only by eligible entities and for qualifying purchases. Misuse of the form can lead to penalties, including back taxes owed and potential fines. Organizations should maintain proper documentation to support their tax-exempt status and be prepared for any audits by the Idaho State Tax Commission.

Key elements of the St 104v Tax Exempt Form Idaho

Key elements of the St 104v Tax Exempt Form Idaho include:

- Organization Information: Name, address, and tax identification number of the exempt entity.

- Exemption Reason: A clear statement of the specific exemption category being claimed.

- Signature: An authorized representative must sign and date the form to validate it.

Eligibility Criteria

Eligibility for using the St 104v Tax Exempt Form Idaho generally includes:

- Non-profit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government entities at the local, state, or federal level.

- Certain educational institutions and charitable organizations.

Quick guide on how to complete st 104v tax exempt form idaho

Effortlessly prepare St 104v Tax Exempt Form Idaho on any gadget

Digital document organization has become increasingly favored by businesses and individuals alike. It offers a flawless eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage St 104v Tax Exempt Form Idaho on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign St 104v Tax Exempt Form Idaho with ease

- Find St 104v Tax Exempt Form Idaho and click on Get Form to begin.

- Use the available tools to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign St 104v Tax Exempt Form Idaho and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 104v tax exempt form idaho

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the St 104v Tax Exempt Form Idaho?

The St 104v Tax Exempt Form Idaho is a document used by organizations to claim tax exemption status in Idaho. It allows eligible entities to make purchases without paying sales tax. Understanding and utilizing this form is essential for tax compliance and for maximizing savings on qualifying purchases.

-

How do I complete the St 104v Tax Exempt Form Idaho?

To complete the St 104v Tax Exempt Form Idaho, you must accurately fill in your organization's details, including the name, address, and exemption reason. Be sure to provide all required information to avoid delays. After completing the form, it should be submitted to the vendor from whom you are making the purchase for validation.

-

What are the benefits of using the St 104v Tax Exempt Form Idaho?

The main benefit of using the St 104v Tax Exempt Form Idaho is the ability to save money on tax-exempt purchases. It also streamlines the purchasing process for eligible organizations. Utilizing this form can signNowly reduce operational costs over time.

-

Are there fees associated with using the St 104v Tax Exempt Form Idaho?

There are no direct fees associated with using the St 104v Tax Exempt Form Idaho. However, it's important to ensure you meet Idaho's eligibility requirements to avoid penalties. Proper compliance ensures that you can use the form effectively without incurring additional costs.

-

Can businesses integrate the St 104v Tax Exempt Form Idaho with airSlate SignNow?

Yes, businesses can integrate the St 104v Tax Exempt Form Idaho with airSlate SignNow, as our platform allows for seamless eSigning and document management. This integration enhances efficiency and helps maintain organized records. Users can easily send and sign the form electronically, simplifying the entire process.

-

What features does airSlate SignNow offer for managing the St 104v Tax Exempt Form Idaho?

airSlate SignNow provides various features for managing the St 104v Tax Exempt Form Idaho, including template creation, document tracking, and secure eSigning. These features enhance usability and ensure that all forms are completed accurately and on time. With airSlate SignNow, you can streamline your workflow for tax-exempt transactions.

-

Is airSlate SignNow a cost-effective solution for handling the St 104v Tax Exempt Form Idaho?

Absolutely, airSlate SignNow is a cost-effective solution for handling the St 104v Tax Exempt Form Idaho. Our pricing plans cater to businesses of all sizes, ensuring affordability while providing essential features. This allows organizations to save both time and money in their document management processes.

Get more for St 104v Tax Exempt Form Idaho

Find out other St 104v Tax Exempt Form Idaho

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile