Additional Insured Form

What is the Additional Insured

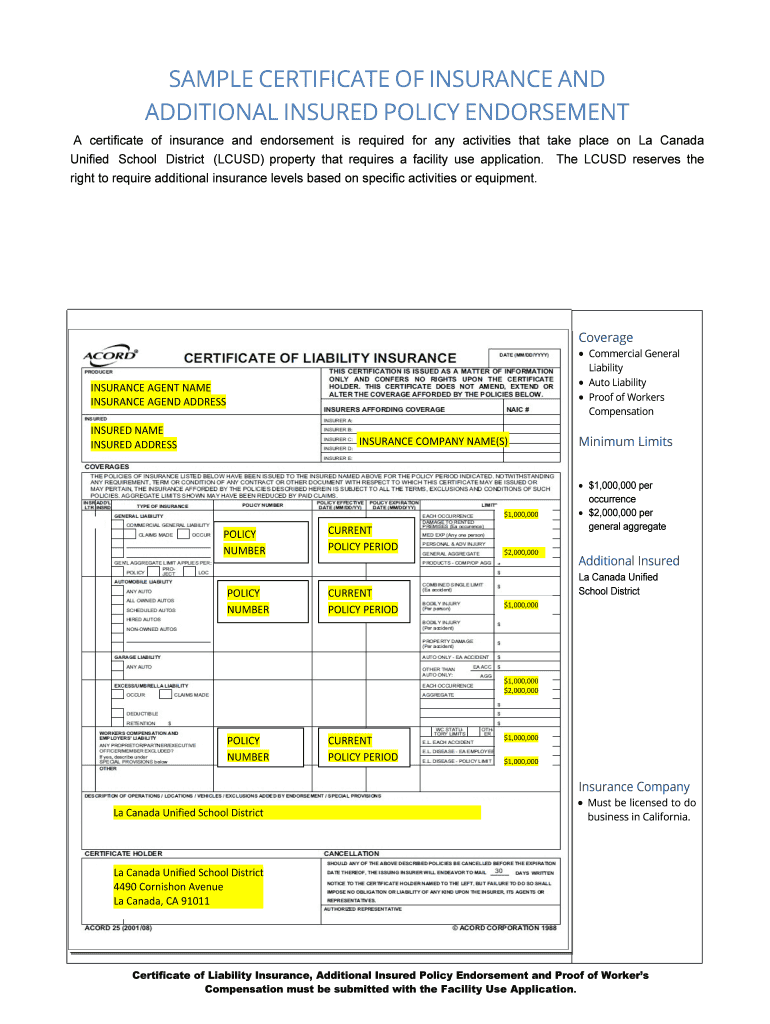

The additional insured endorsement is a provision in an insurance policy that extends coverage to another party, typically a client or contractor. This endorsement allows the additional insured to benefit from the policyholder's insurance protection in the event of a claim. It is commonly used in various industries, including construction and real estate, to ensure that all parties involved in a project are adequately covered against potential liabilities.

How to Use the Additional Insured

To effectively use the additional insured endorsement, the policyholder must specify the additional insured parties in their insurance policy. This can be done by requesting an endorsement from the insurance provider. The endorsement should clearly state the names of the additional insured parties and the scope of coverage. It is essential to review the terms of the endorsement to understand the extent of protection it offers, including any limitations or exclusions that may apply.

Steps to Complete the Additional Insured

Completing the additional insured endorsement involves several key steps:

- Identify the parties that need to be added as additional insureds.

- Contact your insurance provider to request the endorsement.

- Provide necessary information about the additional insured parties, including their names and relationship to the policyholder.

- Review the endorsement document for accuracy and ensure it includes all required details.

- Obtain signatures from all relevant parties to finalize the endorsement.

Key Elements of the Additional Insured

Several key elements define the additional insured endorsement, including:

- Coverage Scope: Specifies what types of claims are covered under the endorsement.

- Limitations: Outlines any exclusions or limitations that may affect the coverage.

- Duration: Indicates the time frame during which the additional insured status is valid.

- Notification Requirements: Details any obligations for notifying the additional insured in the event of a claim.

Legal Use of the Additional Insured

The legal use of the additional insured endorsement is governed by state laws and insurance regulations. It is crucial for policyholders to ensure that their endorsements comply with these legal requirements to avoid potential disputes. Courts generally uphold the validity of additional insured endorsements as long as they are properly executed and meet the necessary legal standards.

Examples of Using the Additional Insured

Common examples of using the additional insured endorsement include:

- A general contractor adding a subcontractor as an additional insured on their liability policy.

- A property owner requiring tenants to list them as additional insured on their renter's insurance.

- A business owner adding clients as additional insureds to protect against claims arising from services provided.

Quick guide on how to complete additional insured 479750643

Effortlessly Prepare Additional Insured on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Additional Insured across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Additional Insured with Ease

- Find Additional Insured and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal standing as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign Additional Insured and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the additional insured 479750643

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an additional insured endorsement?

An additional insured endorsement is a provision in an insurance policy that extends coverage to a third party, ensuring they are protected under the policy. This endorsement is critical for businesses that require proof of insurance from their vendors or subcontractors. By adding an additional insured endorsement, companies can mitigate risks and enhance their liability protection.

-

How does airSlate SignNow help streamline the process of obtaining an additional insured endorsement?

airSlate SignNow simplifies the process of requesting and managing additional insured endorsements by allowing users to create and send documents electronically. The platform ensures that all parties can easily sign and return the necessary paperwork quickly. This efficiency helps businesses save time and maintain compliance with contract requirements.

-

Are there any costs associated with adding an additional insured endorsement through airSlate SignNow?

The cost of obtaining an additional insured endorsement may vary based on your insurance provider and the specific terms of your policy. However, airSlate SignNow offers cost-effective solutions for managing documentation, which can reduce administrative expenses related to insurance endorsements. Our platform is designed to enhance productivity without breaking your budget.

-

Can I integrate airSlate SignNow with my existing insurance management software?

Yes, airSlate SignNow can be seamlessly integrated with various insurance management software solutions. This integration allows you to automate the workflow related to additional insured endorsements and track documents efficiently. By combining tools, you can optimize your insurance processes and enhance operational efficiency.

-

What are the benefits of using airSlate SignNow for additional insured endorsements?

Using airSlate SignNow for additional insured endorsements offers numerous benefits, including improved document management, faster turnaround times, and enhanced security. The platform provides easy eSigning capabilities, ensuring that all parties receive the necessary endorsements promptly. Additionally, airSlate SignNow helps businesses maintain compliance with legal and contractual obligations.

-

How can I ensure my additional insured endorsement documents are secure with airSlate SignNow?

airSlate SignNow prioritizes document security by implementing advanced encryption and authentication protocols. All documents, including additional insured endorsements, are stored securely and can only be accessed by authorized personnel. This commitment to security ensures that sensitive information is protected throughout the entire signing process.

-

Is it easy to track the status of my additional insured endorsement requests with airSlate SignNow?

Absolutely! airSlate SignNow includes features that enable users to track the status of additional insured endorsement requests in real-time. You can easily see when documents are sent, viewed, or signed, allowing for greater visibility and control throughout the endorsement process. This tracking feature helps ensure timely completion and compliance.

Get more for Additional Insured

- Blank motion form larimer county colorado

- Courts state co 6968678 form

- Jdf 306 order to expunge pursuant to 42 4 1715 1 b i doc courts state co form

- Courts state co 6968657 form

- If you choose to represent yourself you are bound by the same rules form

- Current legal name of petitioner courts state co form

- Child name change colorado pd filler form

- Courts state co 6968608 form

Find out other Additional Insured

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now