B 202a Form

What is the B 202a

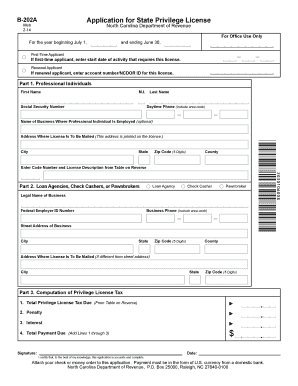

The B 202a form, also known as the Statement of Financial Affairs, is a crucial document used in bankruptcy proceedings in the United States. It provides a comprehensive overview of an individual's financial situation, including assets, liabilities, income, and expenses. This form is typically required by the bankruptcy court to assess the debtor's financial status and determine eligibility for bankruptcy relief. Completing the B 202a accurately is essential for a successful bankruptcy filing, as it helps the court understand the debtor's financial circumstances and obligations.

How to use the B 202a

Using the B 202a form involves several key steps. First, gather all necessary financial documents, including bank statements, pay stubs, tax returns, and any other relevant financial information. Next, fill out the form by providing detailed information about your financial affairs, including your income sources, monthly expenses, and any outstanding debts. It is important to be thorough and honest when completing the form, as inaccuracies can lead to complications in your bankruptcy case. Once completed, the form should be submitted to the bankruptcy court along with other required documents.

Steps to complete the B 202a

Completing the B 202a form requires careful attention to detail. The following steps outline the process:

- Gather financial documents: Collect all relevant financial records, including income statements, bank statements, and tax returns.

- Fill out personal information: Provide your name, address, and other identifying details at the top of the form.

- Detail income sources: List all sources of income, including employment, rental income, and any government benefits.

- Outline monthly expenses: Include all regular monthly expenses, such as housing, utilities, and transportation costs.

- List assets and liabilities: Provide a complete inventory of your assets, including real estate and personal property, as well as outstanding debts.

- Review for accuracy: Double-check all entries for completeness and accuracy before submitting.

- Submit the form: File the completed B 202a with the bankruptcy court as part of your bankruptcy petition.

Legal use of the B 202a

The B 202a form is legally binding and must be completed in accordance with U.S. bankruptcy laws. It serves as an official record of a debtor's financial situation and is used by the court to evaluate the bankruptcy case. Accurate and honest disclosure of financial information is crucial, as any misrepresentation can result in legal penalties, including the dismissal of the bankruptcy case or potential criminal charges. Therefore, it is advisable to consult with a bankruptcy attorney to ensure compliance with all legal requirements when completing the B 202a.

Key elements of the B 202a

Several key elements must be included in the B 202a form to ensure it meets legal standards. These elements include:

- Personal information: Full name, address, and contact information of the debtor.

- Income details: Comprehensive listing of all income sources, including employment and other earnings.

- Expense breakdown: Detailed account of monthly expenses, categorized by type.

- Asset inventory: A list of all assets, including real estate, vehicles, and personal property.

- Liabilities: Complete disclosure of all debts, including credit cards, loans, and any other financial obligations.

Filing Deadlines / Important Dates

Filing deadlines for the B 202a form are critical in the bankruptcy process. It is essential to submit the form along with the bankruptcy petition within the timeframes set by the bankruptcy court. Missing these deadlines can lead to delays in the bankruptcy process or dismissal of the case. Typically, the B 202a must be filed within a specific period after the bankruptcy petition is submitted. It is advisable to consult the court's guidelines or an attorney to ensure compliance with all filing deadlines.

Quick guide on how to complete b 202a 60252

Prepare B 202a effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and efficiently. Manage B 202a on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign B 202a with ease

- Obtain B 202a and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Alter and eSign B 202a and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the b 202a 60252

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is b 202a and how does it relate to airSlate SignNow?

b 202a refers to the advanced features and benefits offered by airSlate SignNow. It encompasses the platform's capabilities in streamlining document management and electronic signing processes for businesses of all sizes.

-

What pricing options are available for airSlate SignNow under b 202a?

airSlate SignNow provides various pricing plans that fall under b 202a to cater to different business needs. Each plan includes features that enable seamless document signing and management, ensuring cost-effective solutions for all users.

-

What features does b 202a include in airSlate SignNow?

Under the b 202a framework, airSlate SignNow offers features such as template creation, team collaboration, and advanced security settings. These tools are designed to enhance user experience and facilitate efficient document workflows.

-

How can b 202a benefit my business?

By utilizing b 202a, businesses can signNowly reduce the time and costs associated with document management. airSlate SignNow empowers teams to manage eSignatures and documents efficiently, ensuring faster turnaround times and improved workflow.

-

Are there integrations available with b 202a on airSlate SignNow?

Yes, b 202a includes various integrations that allow airSlate SignNow to work seamlessly with popular platforms like Google Drive, Salesforce, and Zapier. These integrations enhance productivity and allow for a more personalized document management experience.

-

Is airSlate SignNow user-friendly with b 202a features?

Absolutely! The b 202a features of airSlate SignNow are designed with user experience in mind. The platform's intuitive interface ensures that users can easily navigate the solution, making it accessible for individuals and businesses alike.

-

Can I access b 202a features on mobile devices?

Yes, airSlate SignNow’s b 202a features are accessible on mobile devices, allowing users to send and eSign documents on the go. This flexibility helps businesses maintain productivity outside of traditional office settings.

Get more for B 202a

Find out other B 202a

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure