Form 8863 Instructions

What is the Form 8863 Instructions

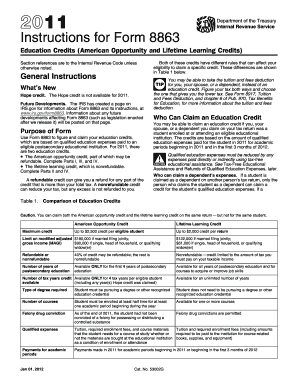

The Form 8863 Instructions provide guidance on how to claim education credits for qualified tuition and related expenses. This form is essential for taxpayers seeking to benefit from the American Opportunity Credit and the Lifetime Learning Credit. Understanding these instructions is crucial for accurately completing the form and ensuring eligibility for these valuable tax credits. The form is designed to help taxpayers navigate the complexities of education-related tax benefits, making it easier to maximize potential savings on their tax returns.

Steps to Complete the Form 8863 Instructions

Completing the Form 8863 requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documentation, including Form 1098-T from educational institutions.

- Determine eligibility for the American Opportunity Credit or the Lifetime Learning Credit.

- Fill out Part I of the form, which pertains to the American Opportunity Credit, if applicable.

- Complete Part II for the Lifetime Learning Credit, if applicable.

- Calculate the credits and fill in the appropriate amounts on the form.

- Transfer the totals to your Form 1040 or 1040-SR tax return.

How to Obtain the Form 8863 Instructions

The Form 8863 Instructions can be obtained directly from the IRS website. They are available in PDF format for easy download and printing. Additionally, many tax preparation software programs include the form and its instructions as part of their offerings, allowing users to complete the form digitally. Ensure you are using the most current version of the instructions to avoid any discrepancies in your filing.

Legal Use of the Form 8863 Instructions

The Form 8863 Instructions are legally binding when completed accurately and submitted according to IRS guidelines. It is important to ensure that all information provided is truthful and verifiable to avoid penalties. The IRS requires that taxpayers maintain records of their education expenses and any related documentation to support their claims. Understanding the legal implications of the form can help taxpayers navigate potential audits and compliance issues effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8863 coincide with the annual tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to file as early as possible to ensure that all credits are claimed and to avoid any last-minute issues. Additionally, taxpayers should be aware of any extensions that may apply to their specific circumstances.

Eligibility Criteria

To qualify for the education credits outlined in the Form 8863 Instructions, taxpayers must meet specific eligibility criteria. These include:

- Enrollment in an eligible educational institution.

- Meeting income limits set by the IRS.

- Not having felony drug convictions for the American Opportunity Credit.

- Providing proof of qualified expenses, such as tuition and fees.

Understanding these criteria is vital to ensure that you can successfully claim the credits and maximize your tax benefits.

Quick guide on how to complete form 8863 instructions 1560088

Accomplish Form 8863 Instructions seamlessly on any device

Online document administration has gained traction among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Form 8863 Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and eSign Form 8863 Instructions effortlessly

- Locate Form 8863 Instructions and then click Get Form to initiate.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such tasks.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to preserve your changes.

- Select your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management within several clicks from any device of your choice. Modify and eSign Form 8863 Instructions and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8863 instructions 1560088

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8863 instructions for filing education credits?

The form 8863 instructions guide taxpayers on how to claim education credits, specifically the American Opportunity and Lifetime Learning Credits. These instructions outline eligibility, how to complete the form, and what documentation is needed to support your claims. Following these instructions ensures you can maximize your educational tax benefits.

-

How can airSlate SignNow assist with obtaining form 8863 instructions?

airSlate SignNow doesn't provide tax instructions directly, but it offers a platform for eSigning and sending important tax documents securely. You can easily upload your completed form 8863 and share it with your tax professional for any clarifications needed on the instructions. This helps streamline your filing process.

-

Are there any costs associated with using airSlate SignNow for form 8863 instructions?

Yes, airSlate SignNow operates on a subscription-based model with different pricing tiers. The costs vary based on features you require for managing and signing documents, but the robust offerings can often save you time and money during your tax season, especially when handling form 8863 instructions.

-

What features does airSlate SignNow offer that relate to form 8863 instructions?

airSlate SignNow provides features like document templates, real-time tracking, and secure sharing that can simplify your interaction with tax-related documents, including form 8863 instructions. This functionality allows you to ensure that all necessary tax forms are filled out correctly and signed promptly.

-

Can I integrate airSlate SignNow with my tax software to assist with form 8863 instructions?

Yes, airSlate SignNow offers integration capabilities with various tax software, which can enhance your experience when dealing with form 8863 instructions. These integrations facilitate smoother document transfers, allowing you to sign and submit your forms directly from your preferred tax software.

-

What benefits does airSlate SignNow provide for managing form 8863 instructions?

Using airSlate SignNow allows you to manage your form 8863 instructions efficiently by providing a secure platform for document signing and sharing. This can reduce the hassle of printing, signing, and scanning physical documents, enabling you to focus more on your tax credits without unnecessary delays.

-

Is there support available for understanding form 8863 instructions while using airSlate SignNow?

While airSlate SignNow does not provide tax advice, their customer support team can assist you with navigating the platform and ensuring you understand the functionalities. For specific queries about form 8863 instructions, it's recommended to consult a tax professional who can offer detailed guidance.

Get more for Form 8863 Instructions

- Online birth certificate copy form

- Fillable online azdhs pm form 3141 con 8 1 07 final

- Cw 5 form

- Application for renewal clinical lab license for labs out of california lab 144 ros form

- Asw weekly tracking log california board of behavioral bbs ca form

- Claim of inaccuracy ca dept of justice form 8706

- Na 960y sar korean california department of social services cdss ca form

- Mc210a form

Find out other Form 8863 Instructions

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure