PA Schedule RK 1 Resident Schedule of Shareholder Form

What is the PA Schedule RK 1 Resident Schedule of Shareholder

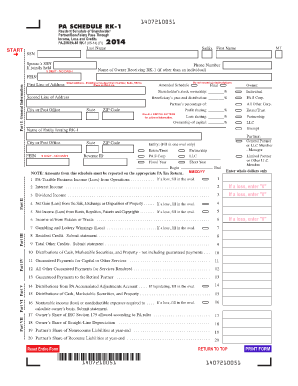

The PA Schedule RK 1 Resident Schedule of Shareholder is a tax form used by shareholders in Pennsylvania to report their share of income, gains, losses, and deductions from partnerships, S corporations, and other pass-through entities. This form is crucial for accurately reflecting the income that shareholders must report on their personal tax returns. It provides detailed information on the income received from these entities, ensuring compliance with state tax regulations.

How to use the PA Schedule RK 1 Resident Schedule of Shareholder

To use the PA Schedule RK 1, shareholders must first receive the form from the entity in which they hold shares. This form includes essential details such as the shareholder's name, address, and taxpayer identification number, along with the income allocated to them. Shareholders should carefully review the information provided, ensuring it aligns with their records. Once verified, the information from the PA Schedule RK 1 must be transferred to the appropriate sections of the Pennsylvania personal income tax return.

Steps to complete the PA Schedule RK 1 Resident Schedule of Shareholder

Completing the PA Schedule RK 1 involves several key steps:

- Obtain the form from the partnership or S corporation.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Review the income, gains, losses, and deductions reported on the form.

- Transfer the relevant figures to your Pennsylvania personal income tax return.

- Keep a copy of the completed form for your records.

Legal use of the PA Schedule RK 1 Resident Schedule of Shareholder

The PA Schedule RK 1 is legally recognized as a valid document for reporting income from pass-through entities in Pennsylvania. To ensure its legal validity, it must be completed accurately and submitted in accordance with state tax laws. The information reported on this form is subject to review by the Pennsylvania Department of Revenue, making it essential for shareholders to maintain accurate records and comply with all reporting requirements.

Filing Deadlines / Important Dates

Shareholders must be aware of specific deadlines for filing the PA Schedule RK 1. Typically, the form should be submitted along with the Pennsylvania personal income tax return by April 15 of each year. It is important to check for any updates or changes to these deadlines, as they may vary based on state regulations or specific circumstances.

Who Issues the Form

The PA Schedule RK 1 is issued by partnerships and S corporations operating in Pennsylvania. These entities are responsible for providing their shareholders with the completed form, which details each shareholder's share of income, losses, and deductions. It is essential for shareholders to receive this document to ensure accurate reporting on their personal tax returns.

Quick guide on how to complete pa schedule rk 1 resident schedule of shareholder

Complete PA Schedule RK 1 Resident Schedule Of Shareholder effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without delays. Manage PA Schedule RK 1 Resident Schedule Of Shareholder on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign PA Schedule RK 1 Resident Schedule Of Shareholder without hassle

- Locate PA Schedule RK 1 Resident Schedule Of Shareholder and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign PA Schedule RK 1 Resident Schedule Of Shareholder and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule rk 1 resident schedule of shareholder

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Schedule RK 1 and how does it work?

The PA Schedule RK 1 is a pricing schedule used by airSlate SignNow to outline the costs associated with using our eSigning services. This schedule allows businesses to select a plan that fits their usage needs, ensuring that they only pay for the features they actually use. With transparent pricing, organizations can easily assess how airSlate SignNow can enhance their document management process.

-

What features are included in the PA Schedule RK 1 pricing?

The PA Schedule RK 1 pricing includes a wide range of features such as document templates, bulk sending, and advanced eSigning capabilities. Users also benefit from secure storage, audit trails, and integration with other tools they may already be using. This comprehensive feature set ensures that businesses can efficiently manage their document workflows.

-

Are there any hidden fees in the PA Schedule RK 1?

No, the PA Schedule RK 1 comes with transparent pricing, meaning there are no hidden fees. What you see in the pricing breakdown is what you pay, allowing your organization to budget effectively without unexpected costs. airSlate SignNow strives to provide a cost-effective solution for all eSigning needs.

-

How can the PA Schedule RK 1 benefit my business?

The PA Schedule RK 1 provides signNow benefits, including reduced time in document processing and improved client relations through fast eSigning. By utilizing airSlate SignNow, businesses can streamline their workflows and reduce paperwork, ultimately leading to increased productivity. This holistic approach saves valuable resources, allowing teams to focus on their core objectives.

-

What types of integrations are available with PA Schedule RK 1?

With the PA Schedule RK 1, airSlate SignNow seamlessly integrates with various applications such as CRM systems, cloud storage services, and productivity tools. This ensures that your existing technology stack works efficiently with our eSigning platform. Enhanced integrations mean that users can automate workflows and further improve their document handling processes.

-

Is support available for businesses using PA Schedule RK 1?

Yes, businesses using the PA Schedule RK 1 have access to dedicated customer support to assist with any questions or issues. Our team is available through multiple channels including chat, email, and phone to ensure that you can efficiently navigate the airSlate SignNow platform. We prioritize customer satisfaction and aim to help you maximize the benefits of your eSigning experience.

-

Can I try the PA Schedule RK 1 before committing?

Absolutely! airSlate SignNow offers a free trial allowing potential users to explore the PA Schedule RK 1 features before making a commitment. During the trial, you can experience firsthand how our eSigning solutions integrate into your workflow. This approach helps you make an informed decision that aligns with your business needs.

Get more for PA Schedule RK 1 Resident Schedule Of Shareholder

Find out other PA Schedule RK 1 Resident Schedule Of Shareholder

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure