IRA Distribution Request Instructions Form

What is the IRA Distribution Request Instructions

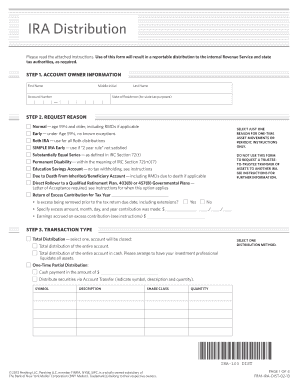

The IRA Distribution Request Instructions form is a critical document used by individuals to request distributions from their Individual Retirement Accounts (IRAs). This form outlines the necessary steps and requirements for accessing funds from an IRA, whether for retirement income, hardship withdrawals, or other qualifying distributions. Understanding this form is essential for ensuring compliance with IRS regulations and for managing your retirement funds effectively.

Steps to complete the IRA Distribution Request Instructions

Completing the IRA Distribution Request Instructions involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your IRA account number and identification details. Next, carefully read the instructions provided on the form to understand the types of distributions available and any associated tax implications. Fill out the form completely, ensuring that all required fields are filled in correctly. After completing the form, review it for any errors before submitting it to the financial institution managing your IRA.

Legal use of the IRA Distribution Request Instructions

The legal use of the IRA Distribution Request Instructions is governed by IRS regulations. It is essential to ensure that the form is filled out accurately to avoid any potential penalties or issues with the IRS. The completed form must be submitted to the financial institution that holds your IRA, which will process the request in accordance with legal requirements. Additionally, understanding the tax implications of different types of distributions is crucial for maintaining compliance and avoiding unexpected tax liabilities.

Required Documents

When completing the IRA Distribution Request Instructions, certain documents may be required to support your request. These typically include a government-issued identification, such as a driver's license or passport, proof of residency, and any relevant financial statements related to your IRA. Depending on the type of distribution requested, additional documentation may also be necessary, such as proof of hardship or medical expenses. Having these documents ready can facilitate a smoother processing of your distribution request.

Form Submission Methods

The IRA Distribution Request Instructions can be submitted through various methods, depending on the policies of the financial institution managing your IRA. Common submission methods include online submission via a secure portal, mailing a hard copy of the completed form, or delivering it in person to a local branch. Each method has its own processing times, so it is advisable to check with your institution for the most efficient way to submit your request.

IRS Guidelines

The IRS provides specific guidelines regarding distributions from IRAs, which are crucial to understand when filling out the IRA Distribution Request Instructions. These guidelines include rules about the age at which distributions can begin without penalties, the tax implications of early withdrawals, and the required minimum distributions (RMDs) for account holders over a certain age. Familiarizing yourself with these guidelines can help ensure that your distribution request is compliant and that you avoid unnecessary penalties.

Quick guide on how to complete ira distribution request instructions

Complete IRA Distribution Request Instructions effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle IRA Distribution Request Instructions on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Effortlessly modify and eSign IRA Distribution Request Instructions

- Obtain IRA Distribution Request Instructions and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign IRA Distribution Request Instructions to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira distribution request instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IRA Distribution Request Instructions?

IRA Distribution Request Instructions provide a detailed guide on how to properly request distributions from your Individual Retirement Account (IRA). These instructions are crucial for ensuring compliance with IRS regulations and avoiding penalties. Following these guidelines helps streamline the distribution process.

-

How can I access IRA Distribution Request Instructions using airSlate SignNow?

To access IRA Distribution Request Instructions through airSlate SignNow, simply log in to your account and search for distribution templates. The platform offers easy access to necessary forms and detailed instructions on completing them. This ensures you have everything you need to manage your IRA efficiently.

-

Are there any fees associated with using airSlate SignNow for IRA Distribution Request Instructions?

Yes, airSlate SignNow offers various pricing plans depending on the features you need. The costs are designed to be budget-friendly, ensuring you can manage your IRA Distribution Request Instructions without breaking the bank. Check the pricing page for a detailed breakdown of our offerings.

-

What benefits does airSlate SignNow provide for managing IRA Distribution Requests?

Using airSlate SignNow for IRA Distribution Requests simplifies the document signing process, making it faster and more secure. The platform allows for electronic signatures, which comply with legal standards, ensuring your instructions are quickly processed. Additionally, it enhances overall efficiency by automating workflows.

-

Can I integrate airSlate SignNow with other tools for processing IRA Distribution Request Instructions?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, making it easy to manage your IRA Distribution Request Instructions. Whether you are using CRM systems, document management solutions, or other productivity apps, integration enhances your workflow and ensures all your documents are in one place.

-

What features should I look for in an IRA Distribution Request Instructions solution?

When choosing a solution for IRA Distribution Request Instructions, look for features such as electronic signing, template creation, and document tracking. These features not only save time but also provide a clear audit trail for compliance. AirSlate SignNow excels in these areas, ensuring you have a comprehensive solution.

-

Is airSlate SignNow secure for handling IRA Distribution Request Instructions?

Yes, airSlate SignNow prioritizes security and compliance, employing advanced encryption and secure data storage. This means your IRA Distribution Request Instructions and any related documents are protected throughout the signing and distribution process. Trust us to help you manage your sensitive information safely.

Get more for IRA Distribution Request Instructions

- Verification of mental health treatment services ibs4youcom form

- Alameda county behavioral health acbhcs form

- California blue cobra form

- Aboutintegrity medical transportation form

- Caedrs form

- Motherhood matterssm car seat safety molina healthcare form

- Facilityagency application form

- Contra costa mental health plan cchealth form

Find out other IRA Distribution Request Instructions

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer