Hawaii Form N 342 Instructions

What is the Hawaii Form N 342 Instructions

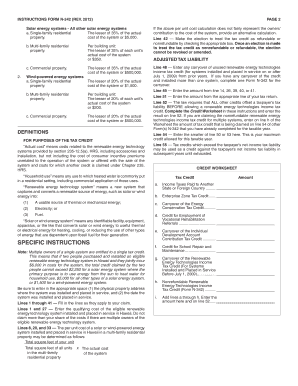

The Hawaii Form N 342 Instructions provide essential guidance for individuals and businesses preparing to file their income tax returns in the state of Hawaii. This form is specifically designed to assist taxpayers in understanding the requirements for reporting income, deductions, and credits accurately. It outlines the necessary steps to ensure compliance with state tax laws and helps avoid potential penalties.

Steps to complete the Hawaii Form N 342 Instructions

Completing the Hawaii Form N 342 Instructions involves several key steps:

- Gather relevant financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand the specific requirements for your tax situation.

- Fill out the form accurately, ensuring all necessary fields are completed.

- Double-check your calculations to avoid errors that could lead to delays or penalties.

- Submit the form by the specified deadline to ensure timely processing.

Legal use of the Hawaii Form N 342 Instructions

The Hawaii Form N 342 Instructions are legally binding when completed and submitted in accordance with state tax regulations. To ensure that your submission is recognized as valid, it is crucial to follow the guidelines provided in the instructions. This includes using electronic signature solutions that comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Hawaii Form N 342 Instructions. Typically, the filing deadline aligns with the federal tax filing date, which is usually April fifteenth. However, it is essential to verify any state-specific extensions or changes that may apply. Marking these dates on your calendar can help ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form N 342 Instructions can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using approved e-filing services, which offer convenience and faster processing times. Alternatively, forms can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its advantages, so consider your circumstances when deciding how to submit your form.

Who Issues the Form

The Hawaii Form N 342 Instructions are issued by the Hawaii Department of Taxation. This state agency is responsible for overseeing tax compliance and providing the necessary forms and instructions to taxpayers. It is advisable to refer to the official website or contact the department directly for the most current information regarding the form and its requirements.

Quick guide on how to complete hawaii form n 342 instructions

Effortlessly Prepare Hawaii Form N 342 Instructions on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Hawaii Form N 342 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric process today.

The simplest way to alter and electronically sign Hawaii Form N 342 Instructions with ease

- Locate Hawaii Form N 342 Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Hawaii Form N 342 Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 342 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form n 342 instructions?

The form n 342 instructions provide detailed guidance on how to complete the form correctly. This includes steps for filling out the form, submitting it, and common errors to avoid. Understanding these instructions is crucial to ensure compliance and timely processing.

-

How can airSlate SignNow assist with following form n 342 instructions?

airSlate SignNow simplifies the process by allowing users to electronically fill out and sign documents, including the form n 342. With features that ensure accuracy and compliance, users can seamlessly adhere to the form n 342 instructions without the hassle of printing or manual entry.

-

Is there a cost associated with using airSlate SignNow for form n 342 instructions?

AirSlate SignNow offers various pricing plans designed to suit different needs, including access to tools that help with the form n 342 instructions. Whether you are a small business or a large enterprise, there are cost-effective solutions available that can streamline your document management process.

-

What integrations does airSlate SignNow offer to enhance the use of form n 342 instructions?

airSlate SignNow integrates seamlessly with various applications, allowing users to manage their documents efficiently while following the form n 342 instructions. Popular tools like Google Drive, Salesforce, and Microsoft Office can be connected to create a more streamlined workflow.

-

How do I ensure compliance while following form n 342 instructions using airSlate SignNow?

By using airSlate SignNow, you can ensure compliance with the form n 342 instructions through automated workflows and built-in validation checks. The platform's features guide users in adhering to compliance requirements, reducing the risk of errors or rejections.

-

Can I track the status of my form n 342 submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your submissions, including those following form n 342 instructions. This real-time tracking ensures that you stay informed about the progress and any necessary actions required.

-

What are the benefits of using airSlate SignNow for managing form n 342 instructions?

Using airSlate SignNow for managing form n 342 instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for document handling. Businesses can save time and ensure accuracy, leading to improved productivity and compliance.

Get more for Hawaii Form N 342 Instructions

- We the undersigned qualified voters in the of in the county of and form

- Hospital form

- Iema flm001m a form

- 69 15 sample notification letter direct certification isbe form

- Fillable online azaap informationregister the arizona

- For office use only 502 new or added commercial form

- Apostille form

- Chapter 80 forms national interagency fire center

Find out other Hawaii Form N 342 Instructions

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document