Instructions for Mt 151 Form

What is the Instructions For Mt 151 Form

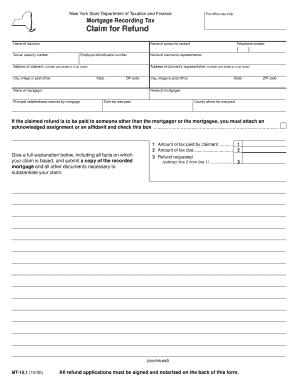

The Instructions For Mt 151 Form is a document used primarily for tax purposes in the United States. This form provides guidance on how to accurately complete and submit the Mt 151 Form, which is often required for specific financial reporting or compliance needs. Understanding the purpose of this form is crucial for individuals and businesses to ensure they meet their tax obligations and avoid potential penalties.

Steps to complete the Instructions For Mt 151 Form

Completing the Instructions For Mt 151 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including financial records and identification information. Next, carefully read through the instructions provided with the form to understand each section's requirements. Fill out the form methodically, ensuring all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Instructions For Mt 151 Form

The legal use of the Instructions For Mt 151 Form is essential for ensuring that the information provided is valid and recognized by tax authorities. This form must be completed in accordance with federal and state regulations to be considered legally binding. Utilizing electronic signatures and secure submission methods can further enhance the legitimacy of the form. It's important to be aware of the legal implications of submitting inaccurate or incomplete information, as this could lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Mt 151 Form are critical to ensure compliance with tax regulations. Generally, the form must be submitted by a specific date each tax year, which can vary based on individual circumstances or changes in tax law. Keeping track of these deadlines helps avoid late fees and ensures that all tax obligations are met in a timely manner. It is advisable to mark these dates on your calendar and set reminders as the deadline approaches.

Required Documents

To complete the Instructions For Mt 151 Form, certain documents are typically required. These may include personal identification, financial statements, and any previous tax returns relevant to the current filing. Having these documents on hand can streamline the process and help ensure that all necessary information is accurately reported. It is also beneficial to check for any additional documentation that may be specific to your situation or state requirements.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions For Mt 151 Form can be done through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient option, allowing for immediate processing. Mailing the form requires careful attention to ensure it is sent to the correct address and postmarked by the deadline. In-person submission may be necessary in certain situations, such as when additional documentation is required. Each method has its advantages, and choosing the right one depends on personal preference and specific circumstances.

Eligibility Criteria

Eligibility criteria for using the Instructions For Mt 151 Form can vary based on individual or business circumstances. Generally, the form is intended for specific taxpayers who meet certain financial thresholds or reporting requirements. Understanding these criteria is important to determine whether this form is applicable to your situation. It is advisable to review the eligibility guidelines carefully to ensure compliance and avoid unnecessary complications during the filing process.

Quick guide on how to complete instructions for mt 151 form

Complete Instructions For Mt 151 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents rapidly without holdups. Manage Instructions For Mt 151 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Instructions For Mt 151 Form effortlessly

- Obtain Instructions For Mt 151 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Instructions For Mt 151 Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for mt 151 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Mt 151 Form?

The Instructions For Mt 151 Form provide detailed guidelines on how to properly fill out and submit the form. They cover the essential steps to ensure compliance with state requirements, making the process straightforward and efficient.

-

How can airSlate SignNow assist with the Instructions For Mt 151 Form?

airSlate SignNow streamlines the process of filling out the Instructions For Mt 151 Form by allowing users to eSign and manage documents online. This platform simplifies tracking, storage, and sharing, ensuring your forms are completed accurately and efficiently.

-

Are there any costs associated with using airSlate SignNow for the Instructions For Mt 151 Form?

Yes, airSlate SignNow offers several pricing plans, including a free trial, to accommodate various business needs. The costs are competitive and provide a cost-effective solution for managing Instructions For Mt 151 Form and other documents.

-

What features does airSlate SignNow offer for the Instructions For Mt 151 Form?

airSlate SignNow includes features such as customizable templates, cloud storage, and secure eSigning, which enhance the experience when working on the Instructions For Mt 151 Form. These tools ensure your documents are both user-friendly and secure.

-

Can I integrate airSlate SignNow with other applications for the Instructions For Mt 151 Form?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM and project management tools. This allows you to efficiently work on the Instructions For Mt 151 Form alongside your other business processes.

-

What are the benefits of using airSlate SignNow for the Instructions For Mt 151 Form?

Using airSlate SignNow for the Instructions For Mt 151 Form streamlines the workflow, reduces turnaround times, and eliminates the need for paper-based processes. This leads to increased productivity and ensures that your documents are always accessible and secure.

-

Is there customer support available when using airSlate SignNow for the Instructions For Mt 151 Form?

Yes, airSlate SignNow offers robust customer support to assist users with the Instructions For Mt 151 Form and any other queries. Their team is readily available to provide help via chat, email, or phone to ensure a seamless experience.

Get more for Instructions For Mt 151 Form

- Name change self help packet unt division of student form

- Distributee form 488315559

- Texas department of criminal justice office of justice form

- Disclosure of all facts and circumstances known to himher at the time the complaint is made form

- Form 304 general information application for registration of

- Scheduling order form

- Texas department of criminal justice employment verification form

- Texas commission on law enforcement licensee tcole texasgov form

Find out other Instructions For Mt 151 Form

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer