D 2848 POA Pmd Office of Tax and Revenue Otr Cfo Dc Form

What is the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC?

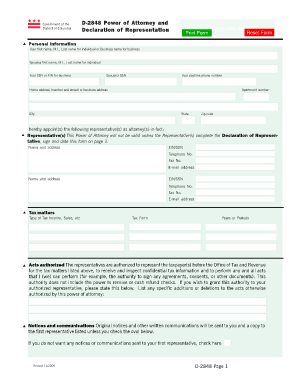

The D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC form is a Power of Attorney document specifically designed for taxpayers in Washington, D.C. This form allows individuals to authorize another person to act on their behalf in tax matters. It is particularly useful for those who may not be able to handle their tax affairs personally due to various reasons, such as being out of the country or needing assistance with complex tax issues. By completing this form, the taxpayer grants permission for the designated representative to access their tax information and communicate with the Office of Tax and Revenue (OTR) on their behalf.

How to use the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC

To use the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC form, the taxpayer must fill out the required sections accurately. This includes providing personal information such as the taxpayer's name, address, and Social Security number, along with the representative's details. Once completed, the form should be signed and dated by the taxpayer. It is essential to ensure that the representative understands their responsibilities and the scope of authority granted. After signing, the form can be submitted to the OTR for processing, allowing the representative to act on behalf of the taxpayer in tax-related matters.

Steps to complete the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC

Completing the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC form involves several steps:

- Obtain the form from the Office of Tax and Revenue or a reliable source.

- Fill in the taxpayer's information, including name, address, and Social Security number.

- Provide the representative's details, including their name and contact information.

- Clearly define the scope of authority you wish to grant to your representative.

- Sign and date the form to validate it.

- Submit the completed form to the Office of Tax and Revenue.

Legal use of the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC

The D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC form is legally binding, provided it is completed correctly and submitted in accordance with the regulations set forth by the Office of Tax and Revenue. This form complies with the legal requirements for power of attorney documents, allowing the designated representative to act on behalf of the taxpayer in tax matters. It is important for both the taxpayer and the representative to understand the legal implications of the authority granted and to ensure that the form is used solely for the intended purposes.

Key elements of the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC

Several key elements are essential when completing the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC form:

- Taxpayer Information: Accurate details about the taxpayer, including name, address, and Social Security number.

- Representative Information: Complete information about the individual authorized to act on behalf of the taxpayer.

- Scope of Authority: Clear definition of the powers granted to the representative, such as the ability to receive information or represent the taxpayer in hearings.

- Signature: The taxpayer's signature is required to validate the document.

Who Issues the D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC?

The D-2848 POA PMD Office Of Tax And Revenue OTR CFO DC form is issued by the Office of Tax and Revenue in Washington, D.C. This office is responsible for administering the city's tax laws and ensuring compliance among taxpayers. The form can typically be obtained directly from their official website or by visiting their office in person. It is important for taxpayers to ensure they are using the most current version of the form to avoid any issues with processing.

Quick guide on how to complete d 2848 poa pmd office of tax and revenue otr cfo dc

Effortlessly Prepare D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and electronically sign your documents swiftly without hassles. Handle D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc on any platform using airSlate SignNow's Android or iOS apps and elevate your document-driven processes today.

The Simplest Way to Edit and Electronically Sign D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc

- Find D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and electronically sign D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc and guarantee outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 2848 poa pmd office of tax and revenue otr cfo dc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 2848 POA PMD form and why is it important for the Office Of Tax And Revenue?

The D 2848 POA PMD form is a power of attorney that allows a representative to act on your behalf regarding tax matters with the Office Of Tax And Revenue. It is crucial for delegating authority, ensuring that your tax filings and payments are properly handled. By using the D 2848 POA PMD Office Of Tax And Revenue Otr Cfo Dc, you can simplify your tax processes and avoid potential penalties.

-

How can airSlate SignNow help with the D 2848 POA PMD form?

airSlate SignNow offers a straightforward and efficient way to complete and eSign the D 2848 POA PMD form. With our platform, you can quickly fill out the necessary fields, add signatures, and securely send it to the Office Of Tax And Revenue. This minimizes paperwork and speeds up the approval process.

-

Is airSlate SignNow cost-effective for signing the D 2848 POA PMD form?

Yes, airSlate SignNow provides a cost-effective solution for signing the D 2848 POA PMD form without incurring excessive fees. Our subscription models are designed to suit various business needs, allowing you to efficiently manage your documents while staying within budget. Plus, the time saved in processing documents can lead to additional savings.

-

What are the key features of airSlate SignNow for handling the D 2848 POA PMD form?

airSlate SignNow offers features such as easy document uploading, customizable templates, and multi-party eSigning. These capabilities are particularly beneficial when dealing with the D 2848 POA PMD Office Of Tax And Revenue Otr Cfo Dc, ensuring that all parties can sign the form seamlessly. Additionally, you can track the document's status in real-time.

-

Can I integrate airSlate SignNow with other tools for managing my D 2848 POA PMD form?

Absolutely! airSlate SignNow integrates with various applications, including CRM and accounting software, making it easy to manage the D 2848 POA PMD form alongside your other business processes. This integration enhances workflow efficiency and reduces the chances of errors when submitting to the Office Of Tax And Revenue.

-

What are the benefits of using airSlate SignNow for my D 2848 POA PMD submissions?

Using airSlate SignNow for D 2848 POA PMD submissions streamlines the entire process, from document creation to final eSignature. This not only saves time but also ensures compliance with the Office Of Tax And Revenue requirements. Moreover, it provides a secure way to manage sensitive tax-related documents.

-

How secure is my information when using airSlate SignNow for the D 2848 POA PMD form?

airSlate SignNow prioritizes your privacy and data security. Our platform is equipped with industry-standard encryption and security measures to protect your information while handling the D 2848 POA PMD Office Of Tax And Revenue Otr Cfo Dc form. You can feel confident that your data is safe during transit and storage.

Get more for D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc

- Financial disclosure affidavit form

- Nypd auxiliary application form

- Complaintreporting form student to student sexual harassment chancellors regulation a 831

- City of new york department of correction job nycgov form

- Opwdd forms

- Pre employment background sheet form

- Linked deposit program empire state development new york state esd ny form

- Sealink card form

Find out other D 2848 POA pmd Office Of Tax And Revenue Otr Cfo Dc

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now