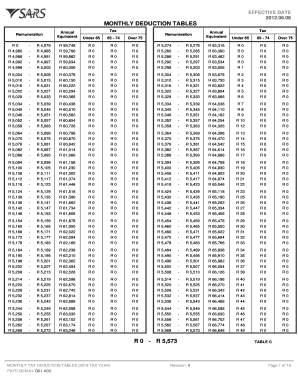

Paye Tax Tables Form

What is the PAYE Tax Tables?

The PAYE (Pay As You Earn) tax tables are essential tools for employers in the United States to determine the amount of income tax to withhold from employees' paychecks. These tables provide a structured format that outlines the tax rates applicable based on various income brackets. Employers use these tables to ensure compliance with federal tax regulations, thereby facilitating accurate tax withholding and reporting. Understanding the PAYE tax tables is crucial for both employers and employees to ensure that the correct amount of tax is deducted from wages.

How to Use the PAYE Tax Tables

Using the PAYE tax tables involves several straightforward steps. First, employers must identify the employee's gross pay for the pay period. Next, they should reference the appropriate PAYE tax table based on the employee's filing status, such as single or married. The table will indicate the withholding amount corresponding to the employee's income level. Employers must then deduct this amount from the employee's gross pay before issuing the paycheck. Regularly reviewing and updating the tax tables is essential to remain compliant with any changes in tax laws or rates.

Steps to Complete the PAYE Tax Tables

Completing the PAYE tax tables requires careful attention to detail. Here are the steps involved:

- Gather employee information, including filing status and income level.

- Refer to the latest PAYE tax tables for the current tax year.

- Locate the appropriate tax bracket for the employee's income.

- Calculate the withholding amount based on the table's guidance.

- Deduct the calculated amount from the employee's gross pay.

- Document the withholding for payroll records and tax reporting purposes.

Legal Use of the PAYE Tax Tables

The legal use of the PAYE tax tables ensures that employers comply with federal and state tax laws. Proper application of these tables is vital for accurate tax withholding, which protects both the employer and employee from potential legal issues related to tax underpayment or overpayment. Employers should regularly consult the IRS guidelines and updates to ensure their use of the PAYE tax tables aligns with current legal requirements.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the use of PAYE tax tables. These guidelines outline the responsibilities of employers in withholding taxes, reporting income, and filing tax returns. Employers should stay informed about any updates or changes to the tax tables issued by the IRS to ensure compliance. Regular training and resources for payroll staff can help maintain adherence to these guidelines.

Filing Deadlines / Important Dates

Understanding filing deadlines and important dates related to the PAYE tax tables is crucial for compliance. Employers must be aware of the following key dates:

- Quarterly payroll tax filing deadlines for federal and state taxes.

- Annual tax return deadlines for employers.

- Deadlines for issuing W-2 forms to employees.

Missing these deadlines can result in penalties and interest charges, making it essential for employers to maintain a calendar of important tax dates.

Quick guide on how to complete 2022 tax tables

Complete 2022 tax tables effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents swiftly without any hold-ups. Manage tax table 2022 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest method to alter and eSign 2022 tax table with ease

- Obtain tax bracket for 2022 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you choose. Alter and eSign sa tax brackets and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to paye tax tables

Create this form in 5 minutes!

How to create an eSignature for the monthly tax tables 2021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask sars paye monthly deduction tables 2019

-

What is the tax table 2022 used for in airSlate SignNow?

The tax table 2022 is crucial for businesses using airSlate SignNow to ensure accurate tax calculations on transactions. It helps to streamline document signing when tax-related documents require precise transactional details. By integrating the tax table 2022, users can avoid errors in their financial documentation.

-

How can airSlate SignNow help me manage my tax documents using the tax table 2022?

With airSlate SignNow, you can easily manage your tax documents by integrating the tax table 2022 into your workflows. This enables seamless eSigning and transaction tracking for all your tax-related documents. Plus, it ensures compliance with the latest tax regulations.

-

Is there a cost associated with using tax table 2022 in airSlate SignNow?

Integrating the tax table 2022 in airSlate SignNow is part of our competitive pricing plan, designed to be cost-effective for businesses of all sizes. You will find that our subscription options provide great value while enhancing your document management and signing needs. For details on pricing, please visit our pricing page.

-

What features does airSlate SignNow offer that utilize the tax table 2022?

AirSlate SignNow offers features such as customizable templates and automatic tax calculations using the tax table 2022. These tools enable you to streamline your workflow and ensure accuracy in your tax documentation. Additionally, features like real-time collaboration enhance team efficiency.

-

How does airSlate SignNow ensure accuracy when using the tax table 2022?

AirSlate SignNow uses the latest updates and data from the tax table 2022 to ensure accurate calculations of taxes in your documents. Our automated system minimizes human error, allowing you to focus on your core business activities. Trust us for reliable tax document management.

-

Can I integrate airSlate SignNow with other software to work with the tax table 2022?

Yes, airSlate SignNow supports integrations with various software solutions that can use the tax table 2022. This allows for seamless data transfer and document management across platforms. Check our integration options to see how you can optimize your workflows.

-

What benefits can I gain by using airSlate SignNow with the tax table 2022?

Using airSlate SignNow with the tax table 2022 provides numerous benefits including enhanced efficiency, cost-effectiveness, and improved compliance. You can simplify your workflow by automating tax calculations and document signing. This ultimately saves time and reduces overhead costs.

Get more for tax table for 2022

- Oregon landlord in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497323683 form

- Oregon landlord notice form

- Oregon landlord tenant 497323685 form

- Oregon landlord rent form

- Letter from tenant to landlord about insufficient notice of rent increase oregon form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease oregon form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase oregon form

Find out other table ke paye

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF