Payoff Authorization Form

What is the payoff authorization form?

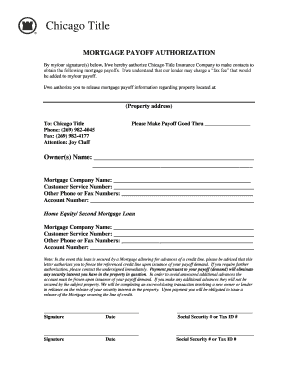

The payoff authorization form is a crucial document that allows a borrower to authorize a lender or financial institution to obtain information regarding the payoff amount of a loan. This form is commonly used in various financial transactions, including mortgages and auto loans. By completing this form, the borrower grants permission for the lender to disclose the necessary details to the requesting party, typically a new lender or a title company involved in refinancing or selling the property.

How to use the payoff authorization form

Using the payoff authorization form involves several straightforward steps. First, ensure that you have the correct form, which may vary slightly depending on the lender or financial institution. Next, fill out the required fields, including your personal information, loan details, and the recipient's information who will receive the payoff amount. After completing the form, sign and date it to validate your authorization. Finally, submit the form to your lender, either electronically or via traditional mail, as per the instructions provided by the lender.

Key elements of the payoff authorization form

Several key elements must be included in a payoff authorization form to ensure its effectiveness. These elements typically include:

- Borrower's Information: Full name, address, and contact details.

- Loan Information: Loan number, type of loan, and any relevant account details.

- Recipient's Information: Name and address of the entity authorized to receive the payoff information.

- Authorization Statement: A clear statement indicating that the borrower authorizes the lender to disclose the payoff amount.

- Signature: The borrower's signature and date to validate the authorization.

Steps to complete the payoff authorization form

Completing the payoff authorization form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Obtain the correct payoff authorization form from your lender or financial institution.

- Carefully read the instructions provided with the form.

- Fill in your personal information, including your name, address, and contact number.

- Enter the loan information, ensuring that all details are accurate.

- Provide the recipient's details who will receive the payoff information.

- Include a clear authorization statement, if not already provided on the form.

- Sign and date the form to complete the authorization process.

- Submit the completed form according to the lender's submission guidelines.

Legal use of the payoff authorization form

The payoff authorization form is legally binding when completed correctly. For it to be valid, it must comply with relevant laws governing electronic signatures and document execution. In the United States, the ESIGN Act and UETA provide the legal framework for electronic signatures, ensuring that digital forms hold the same weight as traditional paper documents. It is essential to ensure that all parties involved understand the terms of the authorization to avoid any disputes.

Examples of using the payoff authorization form

There are several scenarios where a payoff authorization form is utilized. Common examples include:

- Refinancing a Mortgage: When a borrower seeks to refinance their mortgage, the new lender may request a payoff authorization form to obtain the current payoff amount from the existing lender.

- Selling a Property: In real estate transactions, the title company may require a payoff authorization form to ensure that all existing liens are settled before closing.

- Paying Off an Auto Loan: If a borrower is selling their vehicle, the buyer may request a payoff authorization form to confirm the amount owed on the auto loan before finalizing the sale.

Quick guide on how to complete payoff authorization form

Effortlessly Prepare Payoff Authorization Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Payoff Authorization Form on any platform with the airSlate SignNow apps available for Android or iOS and simplify your document-related processes today.

The Simplest Way to Edit and Electronically Sign Payoff Authorization Form with Ease

- Locate Payoff Authorization Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhaustive form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Payoff Authorization Form and enhance communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payoff authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payoff authorization form?

A payoff authorization form is a document that allows a lender to request a payoff statement from a borrower. This form ensures that the loan balance and any accrued interest are accurately calculated. Using airSlate SignNow, you can easily create and eSign this important document to streamline your financial dealings.

-

How can I create a payoff authorization form using airSlate SignNow?

Creating a payoff authorization form with airSlate SignNow is simple. Just log in to your account, select the template for a payoff authorization form, customize it as needed, and send it out for electronic signatures. The intuitive interface makes the process quick and efficient.

-

Are there any costs associated with using airSlate SignNow for a payoff authorization form?

airSlate SignNow offers a variety of pricing plans, including a free trial, allowing you to assess its suitability for your needs. Creating and signing a payoff authorization form comes at no additional cost beyond your selected plan. Explore our pricing options to find the best fit for your business.

-

What features does airSlate SignNow offer for managing payoff authorization forms?

airSlate SignNow provides robust features for managing payoff authorization forms, including eSignature capabilities, document tracking, and secure cloud storage. You can also automate workflows and set reminders to ensure timely signatures. These features enhance the efficiency of handling important documents.

-

Is it secure to send a payoff authorization form using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. All documents, including the payoff authorization form, are protected with encryption protocols during transmission and storage. You can trust that your sensitive information remains secure while utilizing our platform.

-

Can I integrate airSlate SignNow with other applications to manage my payoff authorization forms?

Absolutely! airSlate SignNow offers integrations with various third-party applications like CRM systems, cloud storage services, and more. This allows you to automate your processes and manage payoff authorization forms seamlessly alongside other tools your business uses.

-

What benefits does electronic signing of a payoff authorization form provide?

Using airSlate SignNow for electronic signing of a payoff authorization form signNowly speeds up the process. It allows for quick turnaround times on approvals and eliminates the need for printing and faxing. Overall, eSigning enhances the efficiency and convenience of your business transactions.

Get more for Payoff Authorization Form

- William ampamp mary instructions for po box 8795 declaration form

- Determination questionnaire form

- Sap appeal form enterprise state community college

- University of texas at el paso professional and public utep form

- New patient registration form urn title mr mrs ms miss

- Graduate application for graduation clark atlanta university form

- Brookline college is an equal opportunity educational institution form

- Changed text okay radiologic nursing certification board inc form

Find out other Payoff Authorization Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document