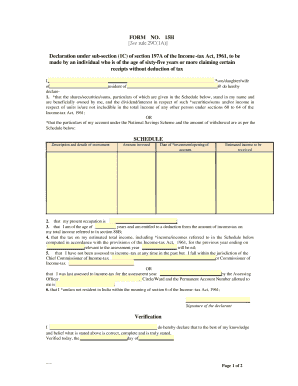

Form No 15h See Section 197a 1c and Rule 29c

What is the Form No 15h See Section 197a 1c And Rule 29c

The Form No 15h is a declaration form under Section 197A(1)(c) of the Income Tax Act, primarily used by individuals to claim exemption from tax deduction at source (TDS) on certain income. This form is relevant for those who expect their total income to be below the taxable limit for the financial year. By submitting this form, taxpayers can ensure that their income is not subjected to TDS, allowing them to receive the full payment without deductions.

How to use the Form No 15h See Section 197a 1c And Rule 29c

Using the Form No 15h involves a straightforward process. Taxpayers must fill out the form with accurate personal details, including their name, address, and PAN (Permanent Account Number). It is essential to provide information about the income for which the exemption is being claimed. After completing the form, it should be submitted to the relevant deductor, such as an employer or bank, before the payment is made to ensure TDS is not deducted.

Steps to complete the Form No 15h See Section 197a 1c And Rule 29c

Completing the Form No 15h requires careful attention to detail. Here are the steps to follow:

- Download the Form No 15h from a reliable source.

- Fill in your personal information, including your name, address, and PAN.

- Specify the income details for which you are claiming exemption.

- Sign and date the form to affirm the accuracy of the information provided.

- Submit the completed form to the deductor before the payment is processed.

Key elements of the Form No 15h See Section 197a 1c And Rule 29c

The Form No 15h contains several key elements that are crucial for its validity:

- Name and Address: Accurate personal identification is essential.

- PAN: The Permanent Account Number must be provided for tax identification.

- Income Details: Clearly specify the type of income for which the exemption is sought.

- Declaration: A declaration stating that the total income is below the taxable limit is required.

- Signature: The form must be signed and dated by the taxpayer.

Legal use of the Form No 15h See Section 197a 1c And Rule 29c

The legal use of Form No 15h is governed by the Income Tax Act, which outlines the conditions under which taxpayers can claim exemption from TDS. It is important to ensure that the information provided is accurate and truthful. Misrepresentation can lead to penalties or legal repercussions. By adhering to the guidelines set forth in Section 197A(1)(c), taxpayers can utilize this form to their advantage while remaining compliant with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form No 15h are typically aligned with the financial year and the payment schedules of the deductors. It is advisable to submit the form well in advance of the payment date to avoid any TDS deductions. Taxpayers should keep track of important dates, such as the end of the financial year and any specific deadlines set by the deductor for submitting the form.

Quick guide on how to complete form no 15h see section 197a 1c and rule 29c

Effortlessly Prepare Form No 15h See Section 197a 1c And Rule 29c on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form No 15h See Section 197a 1c And Rule 29c on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Form No 15h See Section 197a 1c And Rule 29c with Ease

- Locate Form No 15h See Section 197a 1c And Rule 29c and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form No 15h See Section 197a 1c And Rule 29c to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 15h see section 197a 1c and rule 29c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is section 197a 1c of income tax act?

Section 197A 1C of the Income Tax Act provides a framework for certain taxpayers to claim a tax deduction on specified income sources. This section is crucial for understanding how to maximize tax benefits while ensuring compliance with tax regulations. Accessing proper documentation and eSigning through airSlate SignNow can simplify the process of claiming these deductions.

-

How does airSlate SignNow support compliance with section 197a 1c of income tax act?

airSlate SignNow enables businesses to easily eSign and send critical documents required for compliance with section 197A 1C of the Income Tax Act. With our platform, users can ensure that all documentation is properly executed and securely stored. This minimizes the risk of non-compliance, making tax filing straightforward and efficient.

-

What features does airSlate SignNow offer that help with tax documentation?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and automated workflows that facilitate the preparation of tax documentation under section 197A 1C of the Income Tax Act. These tools streamline the eSigning process, ensuring that all relevant parties can review and sign documents with ease. This improves efficiency and reduces errors in tax submissions.

-

Is airSlate SignNow cost-effective for small businesses handling section 197a 1c of income tax act-related tasks?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to manage documentation related to section 197A 1C of the Income Tax Act. Our pricing plans are designed to accommodate various business sizes and needs, ensuring that even small enterprises can benefit from professional eSigning solutions without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for handling section 197a 1c of income tax act?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, allowing you to efficiently manage the documentation related to section 197A 1C of the Income Tax Act. This means you can automate the eSigning process while keeping all your financial records aligned, facilitating better organization and compliance.

-

What are the benefits of using airSlate SignNow for document signing related to section 197a 1c of income tax act?

Using airSlate SignNow for document signing related to section 197A 1C of the Income Tax Act offers numerous benefits, including enhanced security, quick turnaround on document signing, and easy access from any device. Additionally, our user-friendly interface simplifies the signing process for all parties involved, ultimately saving time and reducing the administrative burden.

-

How secure is the airSlate SignNow platform for handling sensitive tax-related documents?

The airSlate SignNow platform employs advanced security protocols to protect sensitive tax-related documents, including those pertinent to section 197A 1C of the Income Tax Act. Our platform utilizes encryption, secure data storage, and compliant practices to ensure that your documents are safeguarded against unauthorized access. You can trust us to keep your information secure.

Get more for Form No 15h See Section 197a 1c And Rule 29c

- Wv 115 info how to ask for a new hearing date judicial council forms

- Fl 273 declaration in support of motion to cancel set aside judgment of parentage family law governmental judicial council forms

- Ch 115 info how to ask for a new hearing date civil harassment prevention judicial council forms

- To the parent indian custodian or guardian of the above named child you must provide all the requested information

- Instructions use this form to ask the court to reschedule the court date listed

- Page high school senior project 2017 brag sheet all final wcs form

- Respond to a request for firearms restraining order form

- 21 0304 application for benefits for certain children with disabilities born or vietnam and certain korea service veterans form

Find out other Form No 15h See Section 197a 1c And Rule 29c

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe