Form 540

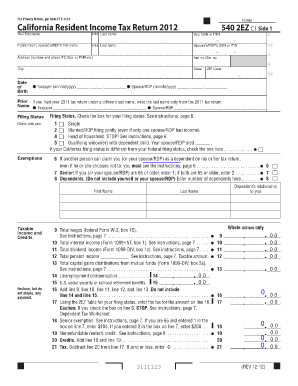

What is the Form 5402ez?

The Form 5402ez is a simplified tax form used for filing state income taxes in California. It is designed for individuals who meet specific criteria, allowing for a more straightforward filing process. This form is particularly beneficial for taxpayers with uncomplicated tax situations, such as those who do not have dependents or significant deductions. Understanding the purpose of the Form 5402ez is essential for ensuring compliance with state tax regulations.

Steps to Complete the Form 5402ez

Completing the Form 5402ez involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as W-2 forms and any relevant income statements. Next, follow these steps:

- Enter personal information, including your name, address, and Social Security number.

- Report your total income, ensuring to include all sources of taxable income.

- Calculate your state tax liability based on the provided tax tables.

- Review the form for accuracy and completeness before submission.

Each step is crucial for avoiding errors that could lead to delays or penalties.

Legal Use of the Form 5402ez

The Form 5402ez is legally recognized for filing state income taxes in California, provided that it is completed accurately and submitted on time. Compliance with state tax laws ensures that the form is valid and can be processed by the California Franchise Tax Board. It is essential for taxpayers to understand the legal implications of submitting this form, including the requirement to report all income and adhere to filing deadlines.

Filing Deadlines / Important Dates

Timely submission of the Form 5402ez is critical to avoid penalties. The standard filing deadline for California state income tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure that they file their forms by the designated dates to maintain compliance.

Required Documents

To complete the Form 5402ez, taxpayers need to gather specific documents that support their income and deductions. Essential documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources, such as interest or dividends

- Documentation for any applicable deductions or credits

Having these documents on hand will streamline the completion process and help ensure accuracy.

Form Submission Methods

The Form 5402ez can be submitted through various methods, providing flexibility for taxpayers. Options for submission include:

- Online filing through the California Franchise Tax Board's website

- Mailing a paper copy of the form to the appropriate tax office

- In-person submission at designated tax offices

Each method has its own set of guidelines and timelines, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete form 540 100104948

Easily Prepare Form 540 on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly and without any hold-ups. Manage Form 540 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

Effortlessly Modify and eSign Form 540

- Find Form 540 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 540, ensuring effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 100104948

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5402ez feature in airSlate SignNow?

The 5402ez feature in airSlate SignNow streamlines the document signing process, enabling businesses to easily create, send, and eSign documents. This feature is designed for efficiency, reducing the time and effort needed to manage document workflows.

-

How much does airSlate SignNow with the 5402ez functionality cost?

airSlate SignNow offers various pricing plans that include the 5402ez functionality, tailored to meet different business needs. Prices are competitive and typically start at an affordable monthly rate, ensuring a cost-effective solution for document management.

-

What are the main benefits of using airSlate SignNow's 5402ez?

Using the 5402ez feature in airSlate SignNow enhances productivity by simplifying the eSignature process. Businesses benefit from reduced turnaround times for documents, improved compliance, and the ability to track document status in real-time.

-

Is 5402ez compatible with other applications?

Yes, the 5402ez functionality in airSlate SignNow integrates seamlessly with various third-party applications. This compatibility ensures that businesses can incorporate eSigning into their existing workflows without disruption.

-

How secure is the 5402ez eSignature process?

The 5402ez eSignature process in airSlate SignNow adheres to the highest security standards. All documents are encrypted, ensuring that sensitive information is protected throughout the signing process, giving users peace of mind.

-

Can I customize templates using the 5402ez feature?

Absolutely! The 5402ez functionality in airSlate SignNow allows users to create and customize templates tailored to their business needs. This feature simplifies the eSigning process for frequently used documents, enhancing efficiency.

-

How does the 5402ez feature improve document tracking?

With the 5402ez feature, airSlate SignNow provides advanced document tracking capabilities. Users can monitor when documents are viewed, signed, and completed, which helps in maintaining better communication and accountability.

Get more for Form 540

- Physicians certification of borrowers ability to engage in substantial gainful activity form

- Realidades 1 textbook pdf form

- Safety merit badge worksheet answers form

- Fir format pdf

- Mcl 565 152 form

- Veterinary hospitalisation sheet template form

- Mcd 467 form

- Quickbooks test questions and answers pdf form

Find out other Form 540

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure