City of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi Form

What is the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi

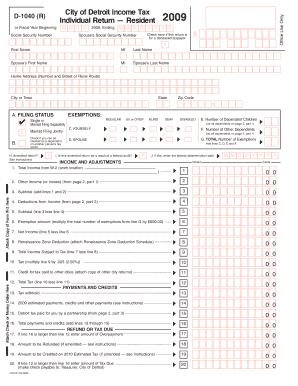

The City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi is a specific tax form used by residents of Detroit to report their income and calculate their city income tax obligations. This form is essential for individuals who earn income within the city limits, ensuring compliance with local tax regulations. The D 1040 R form captures various income sources, deductions, and credits applicable to Detroit residents, ultimately determining the amount of tax owed or refund due.

Steps to complete the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi

Completing the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number at the top of the form.

- Report all sources of income, including wages, self-employment income, and interest.

- Claim any eligible deductions and credits that may reduce your taxable income.

- Calculate your total tax liability using the provided tax tables or software.

- Sign and date the form to certify the information is accurate.

- Submit the completed form by the designated filing deadline.

Legal use of the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi

The City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi is legally binding once completed and submitted. To ensure its validity, the form must be signed by the taxpayer, affirming that the information provided is true and accurate. Adhering to local tax laws and regulations is crucial, as failure to do so may result in penalties or legal consequences. Additionally, using a secure platform for electronic submission can further enhance the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi typically align with federal tax deadlines. Generally, individuals must file their income tax returns by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to stay informed about any changes to deadlines or additional extensions that may be granted by the city.

Required Documents

To accurately complete the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi, taxpayers should prepare the following documents:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation of eligible deductions, including receipts for business expenses or educational costs.

- Previous year’s tax return for reference.

Who Issues the Form

The City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi is issued by the City of Detroit's Finance Department. This department is responsible for administering the city's income tax laws and ensuring compliance among residents. Taxpayers can access the form through the city’s official website or at designated city offices. It is important for residents to use the most current version of the form to avoid any issues during filing.

Quick guide on how to complete city of detroit income tax d 1040 r ly individual ci detroit mi

Prepare City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The most efficient way to modify and eSign City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi effortlessly

- Find City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigating, or errors necessitating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of detroit income tax d 1040 r ly individual ci detroit mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi?

The City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi form is a tax document that individuals in Detroit must use to report their income and calculate their tax liability. By filing this form, you ensure compliance with local tax regulations and take advantage of possible deductions.

-

How can airSlate SignNow help with the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi?

airSlate SignNow streamlines the process of sending and eSigning documents like the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi. With an easy-to-use platform, users can complete, sign, and submit their tax documents efficiently, saving time and reducing the likelihood of errors.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans to accommodate different needs when dealing with documents like the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi. Each plan is designed to provide cost-effective solutions for businesses and individuals, ensuring that you only pay for the features you need.

-

Is airSlate SignNow secure for submitting sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a reliable choice for submitting sensitive documents like the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi. The platform uses advanced encryption methods to keep your information safe during transmission and storage.

-

Can I integrate airSlate SignNow with other software to manage my tax documents?

Absolutely! airSlate SignNow offers seamless integrations with various software tools to help you manage your tax documents, including the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi. This connectivity enhances your workflow, allowing for easy access and sharing of important files.

-

What features make airSlate SignNow suitable for handling the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi?

Key features of airSlate SignNow include electronic signing, document templates, and collaboration tools, making it particularly suited for handling forms like the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi. These features enhance user experience, making tax document management more efficient.

-

How long does it take to complete the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi using airSlate SignNow?

Using airSlate SignNow, completing the City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi can be done in just a matter of minutes. The platform's user-friendly interface and intuitive tools simplify the process, allowing you to focus on accuracy and timely submission.

Get more for City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi

- Power of attorney poa forms and templates

- Pupil activity first aid program provider guidelines ohio form

- Coaching permits ohio department of education form

- State of new york office of temporary and disability bidnet form

- What happens when states go hunting for welfare fraud form

- Application to register temporary use of land to govuk form

- Ira75 form

- Osap disability verification form students attending ontario public postsecondary institutions

Find out other City Of Detroit Income Tax D 1040 R Ly Individual Ci Detroit Mi

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast