Tc 721 Utah Form

What is the TC 721 Utah?

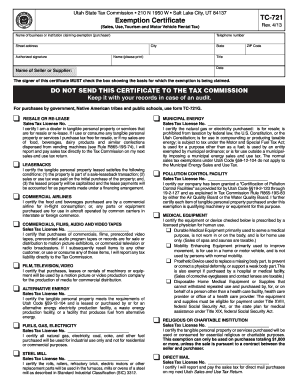

The TC 721 is a specific form used in Utah for sales tax exemptions. It serves as a declaration for organizations or individuals who qualify for certain sales tax exemptions under state law. This form is essential for those who wish to purchase items without incurring sales tax, provided they meet the criteria established by the Utah State Tax Commission.

How to use the TC 721 Utah

To use the TC 721, individuals or organizations must complete the form accurately, ensuring that all required information is provided. The completed form should be presented to the seller at the time of purchase. It is crucial to retain a copy of the TC 721 for your records, as it serves as proof of the tax-exempt status during transactions.

Steps to complete the TC 721 Utah

Completing the TC 721 involves several straightforward steps:

- Download the TC 721 form from the Utah State Tax Commission website or obtain a physical copy.

- Fill in the required fields, including your name, address, and the reason for the exemption.

- Provide any necessary identification numbers, such as a sales tax identification number if applicable.

- Sign and date the form to certify the information provided is accurate.

- Present the completed form to the seller during your purchase.

Legal use of the TC 721 Utah

The TC 721 form must be used in compliance with Utah's sales tax laws. It is legally binding when completed correctly and presented to a seller. Misuse of the form, such as providing false information or using it for ineligible purchases, can result in penalties. It is essential to understand the specific exemptions that qualify for the TC 721 to ensure compliance with state regulations.

Key elements of the TC 721 Utah

Key elements of the TC 721 include:

- Exemption Reason: Clearly state the reason for the exemption, such as being a nonprofit organization or purchasing items for resale.

- Identification Information: Provide any relevant identification numbers to validate the exemption.

- Signature: The form must be signed by an authorized representative of the organization or the individual claiming the exemption.

Form Submission Methods (Online / Mail / In-Person)

The TC 721 does not require submission to the Utah State Tax Commission prior to use. Instead, it is presented to the seller at the point of sale. However, it is advisable to keep a copy for your records. If needed for audits or verification, the form may be requested by tax authorities.

Quick guide on how to complete tc 721 utah

Effortlessly prepare Tc 721 Utah on any device

Digital document management has gained traction among both organizations and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your paperwork swiftly and without complications. Manage Tc 721 Utah on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Tc 721 Utah effortlessly

- Locate Tc 721 Utah and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information thoroughly and then click on the Done button to finalize your edits.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Tc 721 Utah and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 721 utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 721 Utah and how does it relate to airSlate SignNow?

The tc 721 Utah is a crucial document used for various legal and business processes in Utah. airSlate SignNow provides an efficient platform to eSign this document, offering an easy-to-use interface that streamlines the signing process.

-

What features does airSlate SignNow offer for managing tc 721 Utah?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure storage specifically for managing documents like tc 721 Utah. These features enhance the efficiency and reliability of your document signing needs.

-

Is airSlate SignNow cost-effective for processing tc 721 Utah?

Yes, airSlate SignNow is a cost-effective solution for processing tc 721 Utah documents. With flexible pricing plans, it accommodates businesses of all sizes, ensuring you get valuable features without straining your budget.

-

Can I integrate airSlate SignNow with other services for my tc 721 Utah?

Absolutely! airSlate SignNow can seamlessly integrate with various apps and services, enhancing the workflow for managing tc 721 Utah. Popular integrations include CRM systems and document management tools that help streamline your processes.

-

What are the benefits of using airSlate SignNow for tc 721 Utah?

Using airSlate SignNow for tc 721 Utah signNowly reduces the time and effort required for document signing. It enhances collaboration, ensures compliance, and provides a secure process, so you can focus on your core business activities.

-

How secure is airSlate SignNow when handling tc 721 Utah documents?

airSlate SignNow prioritizes security, implementing top-notch encryption and compliance standards when handling tc 721 Utah documents. You can trust that your sensitive information remains protected throughout the signing and storage process.

-

Is there a mobile app for signing tc 721 Utah on the go?

Yes, airSlate SignNow offers a mobile app that allows users to sign tc 721 Utah documents anytime, anywhere. This flexibility ensures you can manage your documents efficiently, even when you're away from your desk.

Get more for Tc 721 Utah

Find out other Tc 721 Utah

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe