Cpap Form

What is the CPAP Form

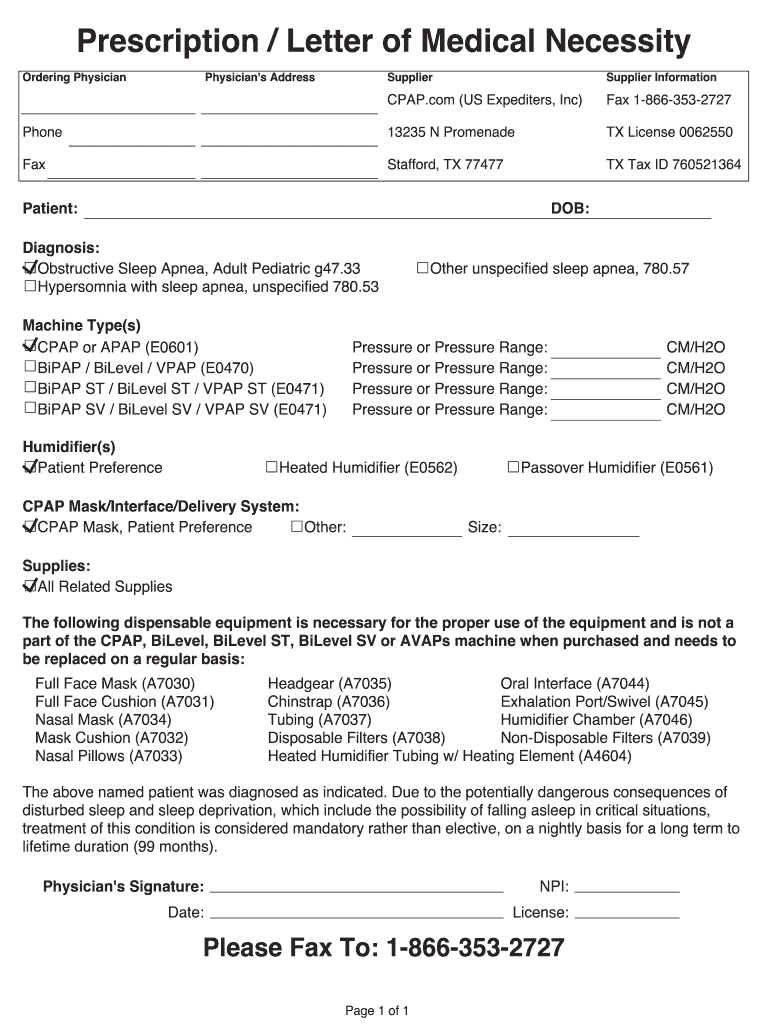

The CPAP form is a medical document that outlines the prescription for Continuous Positive Airway Pressure (CPAP) therapy. It is essential for individuals diagnosed with sleep apnea, as it provides the necessary authorization for obtaining a CPAP machine and related supplies. The form typically includes the patient's personal information, medical history, and specific details about the prescribed equipment, ensuring that healthcare providers and suppliers have the required information to fulfill the prescription.

How to Obtain the CPAP Form

To obtain a CPAP prescription form, patients must first consult a healthcare provider, such as a sleep specialist or primary care physician. During the consultation, the provider will assess the patient's symptoms and may conduct a sleep study to confirm a diagnosis of sleep apnea. Once diagnosed, the provider will issue a CPAP prescription, which can be documented on a standard CPAP prescription form. Patients can request a copy of this form for their records and to share with equipment suppliers.

Steps to Complete the CPAP Form

Completing a CPAP form involves several key steps:

- Gather necessary patient information, including name, date of birth, and contact details.

- Provide medical history relevant to sleep apnea, including symptoms and previous treatments.

- Include specific details about the prescribed CPAP machine, such as pressure settings and type of device.

- Sign and date the form to validate the prescription.

Once completed, the form can be submitted to a medical equipment supplier or kept for personal records.

Key Elements of the CPAP Form

Several key elements must be included in a CPAP prescription form to ensure its validity:

- Patient's full name and contact information.

- Diagnosis of sleep apnea or other relevant medical conditions.

- Details of the prescribed CPAP device, including model and pressure settings.

- Healthcare provider's name, contact information, and signature.

- Date of the prescription.

Including these elements helps ensure that the prescription is clear and can be fulfilled by suppliers without confusion.

Legal Use of the CPAP Form

The legal use of a CPAP form is governed by healthcare regulations and patient privacy laws. It is important that the form is completed accurately and signed by a licensed healthcare provider to be considered valid. Patients should be aware of their rights regarding the use of their medical information, and the form should be handled in compliance with HIPAA regulations to protect patient confidentiality. Misuse of the form, such as altering prescriptions or using it without proper authorization, can lead to legal consequences.

Examples of Using the CPAP Form

Examples of using the CPAP form include:

- Submitting the form to a durable medical equipment supplier to obtain a CPAP machine.

- Providing the form to insurance companies for reimbursement of CPAP equipment costs.

- Using the form during follow-up appointments to ensure ongoing compliance with therapy.

These examples illustrate the practical applications of the CPAP form in managing sleep apnea treatment.

Quick guide on how to complete tax id 760521364 for form

The optimal method to obtain and endorse Cpap Form

On the scale of an entire organization, ineffective procedures surrounding paper verification can consume a signNow amount of work hours. Endorsing documents like Cpap Form is an inherent aspect of operations across all sectors, which is why the productivity of each agreement’s lifecycle has a profound impact on the organization’s overall efficiency. With airSlate SignNow, endorsing your Cpap Form is as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can endorse it instantly without needing to install external applications on your device or print any physical copies.

Steps to obtain and endorse your Cpap Form

- Browse our collection by category or use the search bar to find the document you require.

- View the document preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your document and input any required information using the toolbar.

- Once completed, click the Sign tool to endorse your Cpap Form.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can find, complete, edit, and even dispatch your Cpap Form all in one tab without any complications. Optimize your operations by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the tax id 760521364 for form

How to generate an electronic signature for the Tax Id 760521364 For Form in the online mode

How to create an eSignature for your Tax Id 760521364 For Form in Chrome

How to make an electronic signature for signing the Tax Id 760521364 For Form in Gmail

How to create an eSignature for the Tax Id 760521364 For Form from your smartphone

How to generate an eSignature for the Tax Id 760521364 For Form on iOS devices

How to make an eSignature for the Tax Id 760521364 For Form on Android OS

People also ask

-

What are the key features of the passover humidifiers market?

The passover humidifiers market offers a variety of essential features, including adjustable humidity levels, easy-to-clean designs, and compatibility with different CPAP machines. Many models also include built-in hygrometers and automatic shut-off functions for added convenience. These features ensure optimal performance in maintaining moisture levels.

-

How do passover humidifiers benefit users?

Users of passover humidifiers can experience signNow benefits, such as improved comfort during sleep and reduced respiratory issues. By maintaining optimal humidity, they help soothe dry nasal passages and alleviate irritation. This is especially beneficial for those with sleep apnea or chronic respiratory conditions.

-

What is the price range in the passover humidifiers market?

The passover humidifiers market has a diverse price range, typically starting from around $30 and going up to $200 or more, depending on the features and brand. It's important for customers to evaluate their needs to select a model that offers the right balance of functionality and affordability. Budget models can provide basic features, while premium options offer advanced capabilities.

-

Are there different types of passover humidifiers available?

Yes, the passover humidifiers market includes various types such as heated and cool mist models, as well as integrated CPAP humidifiers. Each type has its advantages depending on user preferences and specific use cases. It's essential to select the type that best suits individual needs and comfort levels.

-

Can passover humidifiers integrate with other devices?

Many passover humidifiers in the market can be integrated with CPAP machines, enhancing overall sleep quality. Some advanced models may offer smart features such as app connectivity for remote control and monitoring. Users should check product specifications to ensure compatibility with their existing devices.

-

How often should I replace my passover humidifier?

The lifespan of a passover humidifier can vary, but it is recommended to replace it every 1-3 years, depending on usage and maintenance. Regular cleaning and care can extend its life and efficiency. Always refer to the manufacturer's guidelines for specific recommendations tailored to your model.

-

Are passover humidifiers easy to maintain?

Yes, passover humidifiers are generally designed for ease of maintenance. Most models feature removable components that can be easily cleaned or replaced. Regular maintenance ensures optimal performance and prolongs the lifespan of the unit, making it beneficial for users.

Get more for Cpap Form

- Abkc registration 404962192 form

- Strategic plan for the hunger project sweden hungerprojektet form

- Ohio civil service application gen 4268 fillable form

- Bexar county alarm permit form

- Agsv tennis score sheet other than firsts form

- Hughston clinic medical records form

- Thyroid worksheet ultrasound radiology of indiana form

- The university of tennessee equipment inventory change controller tennessee form

Find out other Cpap Form

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document