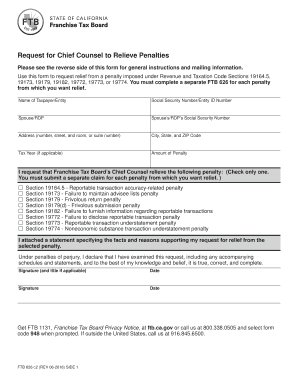

Ftb 626 Form

What is the Ftb 626 Form

The Ftb 626 Form is a California state tax form used primarily for reporting income and calculating tax liabilities for individuals and businesses. This form is essential for taxpayers seeking to comply with state tax regulations. It serves as a declaration of income, deductions, and credits, allowing the California Franchise Tax Board to assess the correct amount of tax owed. Understanding the purpose and requirements of the Ftb 626 Form is crucial for ensuring accurate tax reporting and avoiding potential penalties.

How to use the Ftb 626 Form

Using the Ftb 626 Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check calculations and verify that all required information is included. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference. Utilizing digital tools can streamline this process and enhance accuracy.

Steps to complete the Ftb 626 Form

Completing the Ftb 626 Form requires a systematic approach. Begin by downloading the form from the California Franchise Tax Board's website or utilizing an eSignature platform for easier access. Follow these steps:

- Enter personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, self-employment earnings, and investment income.

- Include any applicable deductions, such as business expenses or contributions to retirement accounts.

- Calculate the total tax owed based on the provided information.

- Review the form for accuracy and completeness before submission.

Legal use of the Ftb 626 Form

The legal use of the Ftb 626 Form is governed by California tax laws. To be considered valid, the form must be filled out accurately and submitted by the appropriate deadlines. Digital signatures are legally recognized under the ESIGN Act, provided that the eSignature platform used complies with relevant regulations. This means that taxpayers can confidently submit their forms electronically, knowing they meet legal requirements. Understanding these legal frameworks is essential for ensuring compliance and avoiding disputes with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 626 Form are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the form must be filed by April 15 of each year for individual taxpayers. Extensions may be available, but it is important to check specific guidelines to ensure compliance. Keeping track of these important dates can help taxpayers manage their filing obligations effectively and avoid unnecessary complications.

Required Documents

When completing the Ftb 626 Form, certain documents are necessary to support the information reported. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts or statements for business expenses.

- Previous tax returns for reference.

Having these documents readily available can facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete ftb 626 form

Effortlessly Prepare Ftb 626 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly option compared to conventional printed and signed documents, as you can easily find the needed form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Ftb 626 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Edit and Electronically Sign Ftb 626 Form with Ease

- Find Ftb 626 Form and click on Get Form to commence.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ftb 626 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 626 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ftb 626 Form and why is it important?

The Ftb 626 Form is a California tax form used for requesting a refund of overpaid taxes or for returning a tax return to the Franchise Tax Board. Understanding how to properly fill out and submit this form is crucial for ensuring you receive any possible refunds and comply with state tax regulations.

-

How can airSlate SignNow simplify the process of completing the Ftb 626 Form?

airSlate SignNow offers an intuitive eSigning solution that allows users to easily fill out the Ftb 626 Form online. With features such as document templates and step-by-step guidance, users can ensure that they complete the form accurately and efficiently.

-

Is there a pricing plan for using airSlate SignNow to file the Ftb 626 Form?

Yes, airSlate SignNow provides flexible pricing plans that cater to both individuals and businesses. You can choose a plan that suits your needs while ensuring you can electronically sign and manage the Ftb 626 Form without breaking the bank.

-

What features does airSlate SignNow offer for document management, including the Ftb 626 Form?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage. These features simplify the management and eSigning process for the Ftb 626 Form, ensuring that users can access and submit their documents easily.

-

Can I integrate airSlate SignNow with other applications to manage the Ftb 626 Form?

Yes, airSlate SignNow allows for seamless integrations with various applications, including Google Drive, Dropbox, and CRM systems. This means you can manage and eSign the Ftb 626 Form alongside other essential documents from a single platform.

-

What are the benefits of using airSlate SignNow for the Ftb 626 Form?

Using airSlate SignNow for the Ftb 626 Form streamlines the signing process, saving you time and reducing the risk of errors. Its user-friendly interface and robust security features also provide peace of mind when handling sensitive tax documents.

-

How does airSlate SignNow ensure the security of my information when filing the Ftb 626 Form?

airSlate SignNow employs state-of-the-art encryption and security protocols to protect your data when filing the Ftb 626 Form. This ensures that your personal and financial information remains confidential and secure throughout the signing process.

Get more for Ftb 626 Form

- Driver evaluation request dolwagov form

- Motor vehicle claim for damages form

- This form must be completed by the registered owner

- Special license plate application dol wa form

- Ga dds 1206 form

- Apply for a new wisconsin identification carddmvorg form

- Wisconsindmv gov dl docs form

- Kentucky motor vehicle power of attorney form

Find out other Ftb 626 Form

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online