Istanza Di Voltura Dei Rimborsi Intestati a Deceduto Agenzia Delle Entrate Form

Understanding the Istanza Di Voltura Dei Rimborsi Intestati A Deceduto

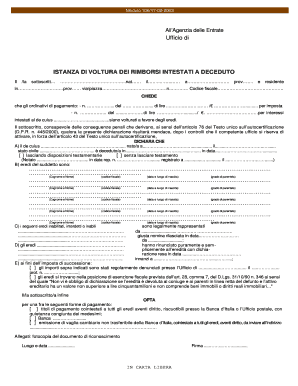

The Istanza di Voltura dei Rimborsi Intestati a Deceduto is a formal request submitted to the Agenzia delle Entrate, the Italian Revenue Agency, to transfer tax refunds owed to a deceased individual to their rightful heirs. This process is essential for ensuring that any outstanding refunds are appropriately redirected to the beneficiaries. The form serves as a legal document that must adhere to specific guidelines to be considered valid.

Steps to Complete the Istanza Di Voltura Dei Rimborsi Intestati A Deceduto

Completing the Istanza di Voltura requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, including the death certificate and proof of heirship.

- Obtain the official form from the Agenzia delle Entrate or download it from their website.

- Fill out the form with accurate information, including the deceased's details and the heirs' information.

- Attach required supporting documents to the completed form.

- Submit the form either online, by mail, or in person at the local Agenzia delle Entrate office.

Required Documents for the Istanza Di Voltura

When submitting the Istanza di Voltura, specific documents must accompany the form to facilitate the process:

- Death certificate of the deceased.

- Proof of heirship, such as a will or court order.

- Identification documents of the heirs.

- Any previous correspondence related to the tax refunds.

Legal Use of the Istanza Di Voltura Dei Rimborsi Intestati A Deceduto

The legal validity of the Istanza di Voltura hinges on compliance with Italian tax laws. The form must be filled out accurately and submitted within the stipulated time frame to avoid penalties. It is crucial for heirs to understand their rights and obligations regarding the deceased's tax refunds to ensure a smooth transfer process.

Filing Deadlines for the Istanza Di Voltura

Timeliness is important when filing the Istanza di Voltura. Heirs should be aware of any deadlines set by the Agenzia delle Entrate to avoid complications. Typically, the form should be submitted within a specific period following the death of the individual to ensure that the tax refunds are processed without delay.

Form Submission Methods

The Istanza di Voltura can be submitted through various methods, providing flexibility for the heirs:

- Online submission via the Agenzia delle Entrate website.

- Mailing the completed form to the appropriate office.

- In-person delivery at the local Agenzia delle Entrate office.

Quick guide on how to complete istanza di voltura dei rimborsi intestati a deceduto agenzia delle entrate

Complete Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric operation today.

The simplest way to modify and eSign Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate without hassle

- Find Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to share your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the istanza di voltura dei rimborsi intestati a deceduto agenzia delle entrate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a voltura di rimborso intestato a deceduto agli eredi?

A voltura di rimborso intestato a deceduto agli eredi refers to the process of transferring a refund entitlement from a deceased person to their heirs. This legal procedure ensures that the financial benefits owed to the deceased are correctly assigned to their rightful beneficiaries, providing clarity and financial support during a difficult time.

-

How can airSlate SignNow help with the voltura di rimborso intestato a deceduto agli eredi?

airSlate SignNow streamlines the process of completing the voltura di rimborso intestato a deceduto agli eredi by allowing users to electronically sign and send necessary documents. Our easy-to-use platform reduces the paperwork hassle, ensuring a fast and efficient transfer of rights to the heirs.

-

What documents are needed for a voltura di rimborso intestato a deceduto agli eredi?

To initiate a voltura di rimborso intestato a deceduto agli eredi, you typically need a death certificate, proof of the heirs’ identities, and any documentation related to the refund claim. airSlate SignNow helps you gather and manage these documents securely through our platform.

-

Is there a fee associated with the voltura di rimborso intestato a deceduto agli eredi process?

Fees related to the voltura di rimborso intestato a deceduto agli eredi can vary based on jurisdiction and the complexity of the case. Using airSlate SignNow, however, can reduce costs associated with printing and mailing documents, enhancing the cost-effectiveness of handling these transactions.

-

Can multiple heirs sign for the voltura di rimborso intestato a deceduto agli eredi using airSlate SignNow?

Yes, airSlate SignNow allows multiple heirs to electronically sign documents needed for the voltura di rimborso intestato a deceduto agli eredi. This feature facilitates a coordinated approach, ensuring that all necessary parties can contribute to the process without unnecessary delays.

-

What are the benefits of using airSlate SignNow for legal processes like voltura di rimborso intestato a deceduto agli eredi?

Using airSlate SignNow simplifies legal processes like the voltura di rimborso intestato a deceduto agli eredi by providing an easy-to-use platform for document management and electronic signing. This leads to faster turnaround times, improved accuracy, and reduced stress for all parties involved.

-

Is airSlate SignNow compatible with other apps for managing voltura di rimborso intestato a deceduto agli eredi?

Absolutely, airSlate SignNow integrates seamlessly with various applications that can help manage the voltura di rimborso intestato a deceduto agli eredi, including cloud storage solutions and CRM systems. This ensures that all documents and communications are efficiently organized and accessible.

Get more for Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate

- Oregon lost boat title form

- Fast facts 24 california department of motor vehicles form

- State of connecticut department of motor vehicles ctgov form

- Ct p 40 form

- Disabled veteran license plates request form cyberdrive illinois

- Ct h109 form

- Complaint new jersey form

- How to file a request to modify a non dissolution ampquotfdampquot court order previously issued by the court how to file a form

Find out other Istanza Di Voltura Dei Rimborsi Intestati A Deceduto Agenzia Delle Entrate

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple