Form F656

What is the Form F656

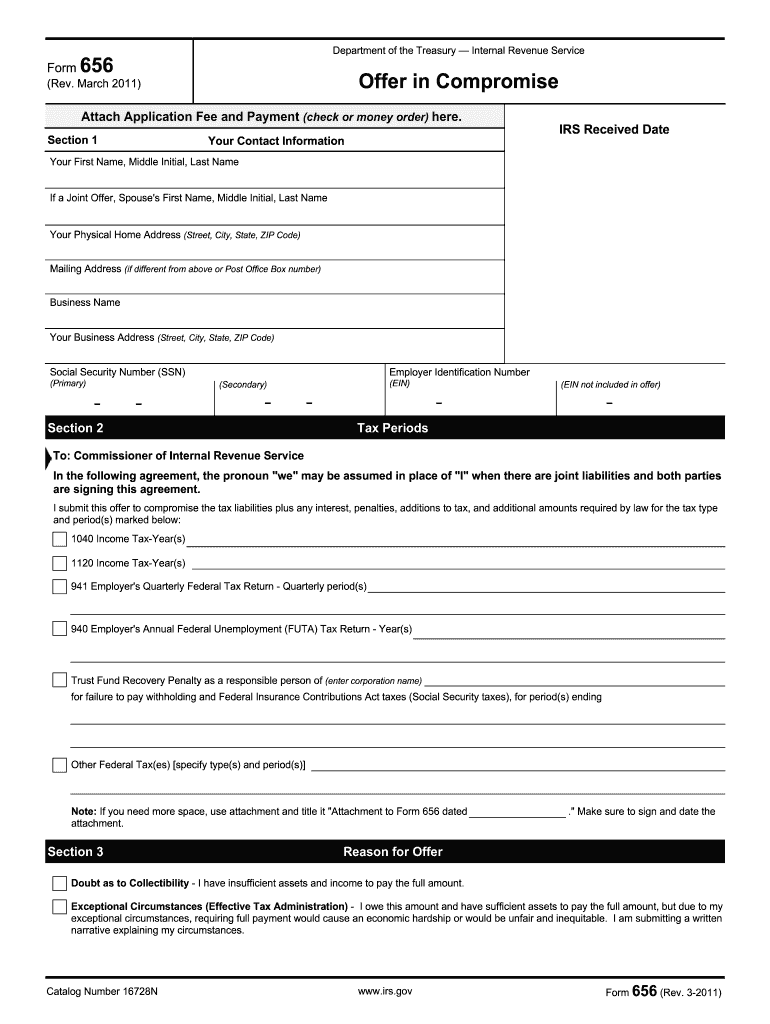

The Form F656 is a specific document used in various legal and administrative contexts, often related to tax or compliance matters. This form serves as an official request or declaration, allowing individuals or businesses to convey necessary information to relevant authorities. Understanding its purpose is essential for ensuring compliance with applicable regulations.

How to use the Form F656

Using the Form F656 involves several key steps to ensure proper completion and submission. First, gather all required information and documentation that pertains to the form. Next, carefully fill out each section, ensuring accuracy and clarity. After completing the form, review it for any errors before submission. It can be submitted electronically or via traditional mail, depending on the requirements set forth by the issuing authority.

Steps to complete the Form F656

Completing the Form F656 requires attention to detail and adherence to specific guidelines. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Collect all necessary documents and information needed to fill out the form.

- Fill in your personal or business information accurately.

- Provide any required signatures or initials as indicated.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Form F656

The legal use of the Form F656 hinges on its compliance with relevant laws and regulations. This form must be completed accurately to ensure it holds legal validity. Electronic submissions are often accepted, provided they meet the standards set by the ESIGN Act and other applicable legislation. Ensuring that the form is signed appropriately is crucial for its acceptance by authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form F656 can vary based on the specific context in which it is used. It is essential to be aware of these deadlines to avoid penalties or complications. Typically, deadlines are set by the issuing authority, and it is advisable to check for any updates or changes that may affect submission timelines. Marking these dates on a calendar can help ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form F656 can be submitted through various methods, depending on the requirements of the issuing agency. Common submission methods include:

- Online: Many agencies allow electronic submission through their official websites.

- Mail: Completed forms can often be sent via postal service to the designated address.

- In-Person: Some situations may require submitting the form directly at an agency office.

Examples of using the Form F656

The Form F656 can be utilized in various scenarios. For instance, it may be required for tax-related submissions, compliance declarations, or as part of an application process for permits or licenses. Understanding the context in which the form is used can help individuals and businesses navigate their obligations effectively.

Quick guide on how to complete form f656

Complete Form F656 effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It presents an ideal eco-friendly option to conventional printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, alter, and electronically sign your documents promptly without delays. Handle Form F656 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form F656 effortlessly

- Find Form F656 and click Get Form to commence.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Don’t worry about lost or misplaced files, strenuous form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form F656 and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form f656

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form f656, and how is it used in business?

Form f656 is a crucial document for businesses that need to collect essential information from clients or stakeholders. This form can be easily created and managed using airSlate SignNow, allowing businesses to streamline their documentation processes and improve efficiency.

-

How can airSlate SignNow help with the digital signing of form f656?

airSlate SignNow offers a secure and user-friendly platform for electronically signing form f656. With just a few clicks, users can send the form to relevant parties for eSignature, eliminating the need for printing and scanning documents, thus saving time and resources.

-

What are the pricing plans for using airSlate SignNow for form f656?

airSlate SignNow provides various pricing plans tailored to different business needs, starting with affordable options for small teams. You can easily manage costs while leveraging powerful features, including those specifically designed for managing form f656.

-

Are there features in airSlate SignNow that specifically enhance the use of form f656?

Yes, airSlate SignNow includes features such as templates, automated workflows, and real-time tracking, which signNowly enhance the use of form f656. These tools help streamline the process, ensure compliance, and reduce the administrative burden on your team.

-

Can I integrate other software with airSlate SignNow for handling form f656?

airSlate SignNow offers robust integrations with various software applications, allowing seamless management of form f656 alongside your existing systems. This capability enhances data synchronization and workflow efficiency, making it easier to handle all aspects of document management.

-

What benefits does using airSlate SignNow offer for form f656?

Using airSlate SignNow for form f656 provides several benefits, including increased efficiency, reduced turnaround time, and secure storage of documents. The platform empowers businesses to manage their forms digitally, making it easier to access and retrieve information whenever needed.

-

Is it easy to create a compliant form f656 using airSlate SignNow?

Absolutely! Creating a compliant form f656 with airSlate SignNow is straightforward, thanks to its intuitive interface and customizable templates. You can design your form to meet compliance standards and ensure it captures all necessary information without hassle.

Get more for Form F656

- Msp application for group enrolment bcrcc form

- 1096 inz form

- Uk form afps

- Application for unregistered vehicle permit b fill out form

- Bus travel assistance safety net application form

- F3518cfdpdf print form reset form vehicle registration

- Licensing and insurance requirements for for hire motor form

- 1025 form nz

Find out other Form F656

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe