Slip Kra Form

What is the Slip Kra

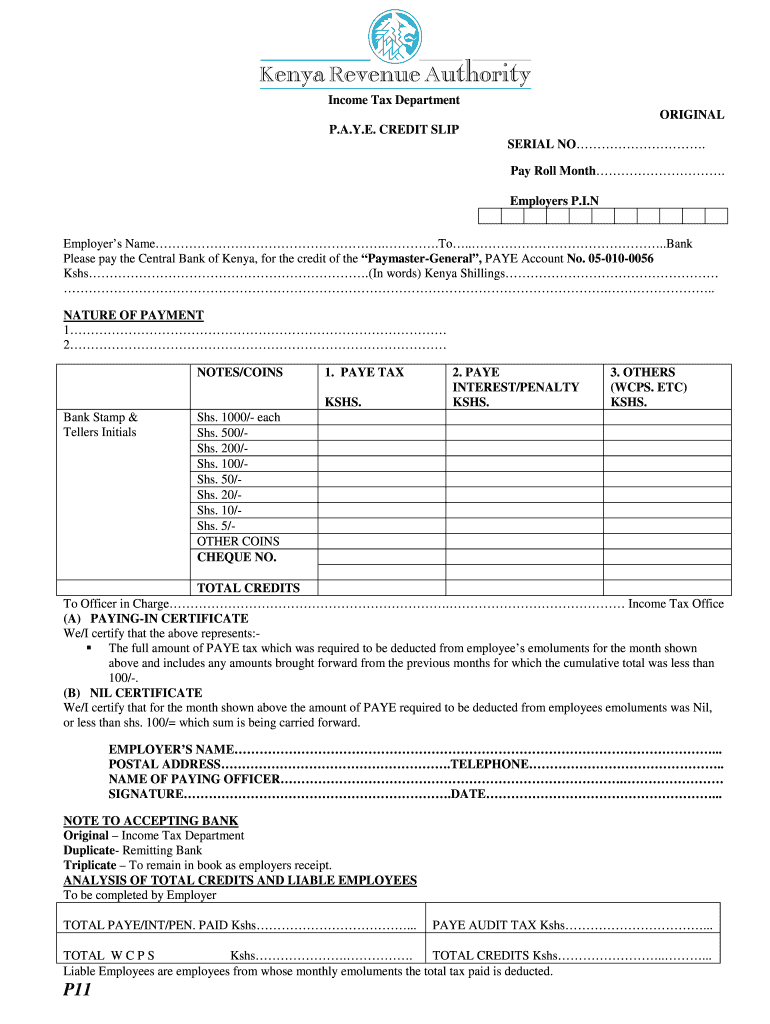

The Slip Kra is an essential document used in Kenya for tax purposes, specifically related to the Pay As You Earn (PAYE) system. It serves as a record of an employee's income and the taxes withheld by the employer. This slip is crucial for both employees and employers, as it provides proof of income and tax contributions, which may be required for various financial transactions or legal purposes.

How to use the Slip Kra

Using the Slip Kra involves several straightforward steps. First, ensure you have the correct details regarding your income and tax deductions. The slip typically includes fields for the employee's name, tax identification number, period of employment, gross income, and the amount of tax withheld. Once filled out, the slip can be used to verify income when applying for loans, mortgages, or other financial services. It is also necessary when filing annual tax returns.

Steps to complete the Slip Kra

Completing the Slip Kra accurately is vital for its validity. Follow these steps:

- Gather necessary information such as your tax identification number and gross income for the relevant period.

- Fill in your personal details, including your name and employment period.

- Enter your gross income and the total amount of tax withheld by your employer.

- Review the slip for accuracy, ensuring all information is correct and complete.

- Submit the completed slip to your employer or retain it for personal records.

Legal use of the Slip Kra

The Slip Kra is legally binding and must be filled out accurately to be considered valid. It serves as proof of income and tax compliance, which can be requested by financial institutions or during audits by tax authorities. Misrepresentation or errors on the slip can lead to penalties or legal repercussions, emphasizing the importance of accuracy and honesty when completing this document.

Key elements of the Slip Kra

Several key elements must be included in the Slip Kra to ensure its validity:

- Employee Information: Name, tax identification number, and employment period.

- Income Details: Gross income for the specified period.

- Tax Withheld: The total amount of tax deducted by the employer.

- Employer Information: Name and tax identification number of the employer.

Who Issues the Form

The Slip Kra is typically issued by the employer as part of the payroll process. Employers are responsible for accurately calculating and reporting the income and tax withheld for each employee. It is essential for employers to issue this slip in a timely manner to ensure employees have the necessary documentation for their tax filings and financial needs.

Quick guide on how to complete slip kra form

A concise guide on how to create your Slip Kra

Locating the correct template can turn into a difficulty when you’re required to submit formal foreign documents. Even if you possess the form you need, it can be cumbersome to swiftly complete it according to all the specifications if you utilize paper copies rather than managing everything digitally. airSlate SignNow is the web-based eSignature platform that enables you to navigate around these obstacles. It allows you to obtain your Slip Kra and promptly fill it out and sign it on-site without needing to reprint documents in case you make an error.

The following are the steps you must follow to create your Slip Kra with airSlate SignNow:

- Press the Get Form button to insert your document into our editor immediately.

- Begin with the first vacant area, enter details, and move on using the Next tool.

- Complete the empty fields utilizing the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important information.

- Click on Image and upload one if your Slip Kra requires it.

- Utilize the right-side pane to add additional fields for you or others to complete if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Create, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing the form by clicking the Done button and selecting your file-sharing preferences.

Once your Slip Kra is ready, you can share it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t spend time on manual form completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

I filled out the application form for Delhi University. How and from where will I get admission slips?

First cutoff will be declared on 24th June. Calculate your best four percentage i.e. language subject + any 3 other core subject as given in the guideline issued by Delhi University. If your best four subject percentage is more than or equal to percentage of the college in which you want admission, apply to that college for admission through your central id of Delhi University. Take a printout of confirmation page. Take this confirmation page alongwith following documents:Migration CertificateTransfer CertificateMarksheet (Printout of CBSE online result, in case you didn't got your marksheet)Relevant Certificates (If seeking reservation)Central Application confirmation pagePhotographsTake above documents to the college in which you are seeking admission. They will verify your documents and if you are eligible they will provide you with admission slip. You have to make payment of fees online within a day.

-

How do I fill out a deposit slip?

You go to the bank of your choice, preferably where you have an account, and ask for a deposit slip. You then technically do a “fill in the blank” and then write the number of notes of relevant denomination note. Like thisCredit: http://mindpowerindia.com/sbi.phpNow go and deposit your Rs. 500 and Rs. 1000 notes, if you are in India :-)EDIT: As rightly pointed out by Lara Taylor sorry for being judgemental.

-

How can I fill out a savings deposit slip?

“How can I fill out a savings deposit slip?”Do you have some savings to deposit?Do you have a savings account?Do you know the savings account number?Do you have a way to obtain a savings deposit slip?Do you have a pen with which to fill out the savings deposit slip?Are you physically able to enter the appropriate information on the slip?When you’ve answered these questions, then someone can probably provide an appropriate answer to your question.

-

How do I fill out a bank deposit slip?

You would have to show up in person at a branch location that belongs to your bank where your bank account is open. Most banks have a lines for the customers to get in line and wait for their turn to talk to the bank teller. Most banks will have a section in the middle of this section where they have a bunch of blank documents and a deposit slip is included there.There is specific information that you need to know in order to fill the bank deposit slip correctly and you don't have to spend time memorizing it or take documents of that information with you. All you have to do is just write it down in a piece of paper and then reap into pieces the paper when you are done. The information that you need to fill out the deposit slip is your account number. What is it that you are depositing a check or cash and what is the exact amount to be deposited. The deposit slip should include your name and your signature.In type of deposit slip, you would have to also check whether you are depositing the funds into your bank checkings account or into your bank savings account and your address. The signature section is a part that can only be signed in the presence of a bank teller. You would also have to write the date on which this deposit takes place.Some deposit slips differ in one or two things from the others but for the most part they all are very similar in many ways. In this deposit slip, you would not have to write the date or your address or whether it goes to a savings or checking accounts but all other information still applies.Note that in the two types of the deposits samples there is a section that says “subtotal” and another that says “less cash”. Those two sections are only applicable when you present a check to be cash but you also want part of that check to deposit into your account. For example, let us say that you present a check with the total funds of 1458 but you want to receive 800 in cash and the remaining balance is two be deposited. In that case, the subtotal would say “1458” and the “less cash” section would say “800” the the “total” section would say “658”. Those types of deposit slips are provided to you free of charge at the bank.The deposit slip shown above is another type of bank deposit slip which is more convenient and you have less possibilities of making entry errors because those types of deposit slips are already personalized and they already have your bank account, name and address printed on them. All you have to do is fill out the amount that you depositing into your bank account and whether it is a check or cash. However, the personalized deposit slips costs money.At the end of the successful deposit transaction, you should received from the bank teller a deposit receipt which summarizes the how much was deposited and your new bank account balance. Some advanced banks will even print a receipt with an image of the check that was deposited.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

What are the steps to fill out a deposit slip?

There are following steps to fillout a deposit slip:1.fill your branch name in which you have maintained your account.2. your name3.Your bank account no.4.Rupees with denominations and then in words5.your mobile no.6.your signature

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the slip kra form

How to create an electronic signature for your Slip Kra Form online

How to generate an electronic signature for your Slip Kra Form in Google Chrome

How to create an eSignature for signing the Slip Kra Form in Gmail

How to create an eSignature for the Slip Kra Form straight from your smartphone

How to make an electronic signature for the Slip Kra Form on iOS devices

How to generate an electronic signature for the Slip Kra Form on Android OS

People also ask

-

What is Slip Kra in relation to airSlate SignNow?

Slip Kra refers to the streamlined document signing process that airSlate SignNow offers. This feature allows users to efficiently send, eSign, and manage documents, ensuring a smooth workflow. With Slip Kra, businesses can enhance their productivity and reduce turnaround time for contract approvals.

-

How does Slip Kra improve document signing efficiency?

Slip Kra improves document signing efficiency by providing an intuitive interface that simplifies the eSigning process. Users can easily upload documents, add signers, and track the status of signatures in real-time. This not only speeds up the signing process but also minimizes errors and ensures compliance.

-

What are the pricing options for using Slip Kra with airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses using Slip Kra. Plans start at an affordable monthly rate, allowing companies to choose the features that best suit their requirements. Additionally, there is a free trial available so users can explore the benefits of Slip Kra before committing.

-

Can I integrate Slip Kra with other software platforms?

Yes, Slip Kra can be integrated with a variety of software platforms to enhance its functionality. airSlate SignNow supports integrations with popular applications like Google Workspace, Salesforce, and Microsoft Office. This ensures that users can seamlessly incorporate eSigning into their existing workflows without disruption.

-

What features does Slip Kra include for document management?

Slip Kra includes a range of features for effective document management, such as customizable templates, automated reminders, and secure storage. Users can create templates for frequently used documents, set up notifications for pending signatures, and access signed documents anytime, anywhere. This comprehensive approach helps businesses stay organized and efficient.

-

How secure is the Slip Kra eSigning process?

The Slip Kra eSigning process is highly secure, utilizing industry-standard encryption and compliance with global eSignature laws. airSlate SignNow ensures that all documents are protected during transmission and storage, giving users peace of mind. This commitment to security makes Slip Kra a reliable choice for sensitive documents.

-

What are the key benefits of using Slip Kra for my business?

Using Slip Kra with airSlate SignNow offers numerous benefits, including faster turnaround times, reduced paper usage, and improved team collaboration. Businesses can save time and resources by adopting digital signatures, which also enhances customer satisfaction. Overall, Slip Kra helps organizations operate more efficiently and effectively.

Get more for Slip Kra

- Lsv m budget mobile form

- Snrha forms

- Music theory test pdf level 3 form

- Civil service personal data sheet form

- Common name special name worksheet form

- Instructions for medical certification for disabil form

- Imm 1295 e application for work permit made outside of canada imm1295e pdf 732222097 form

- Permit number this number will be generated form

Find out other Slip Kra

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence