401k Contribution Remittance Form Fidelity

Understanding the 401k Contribution Remittance Form

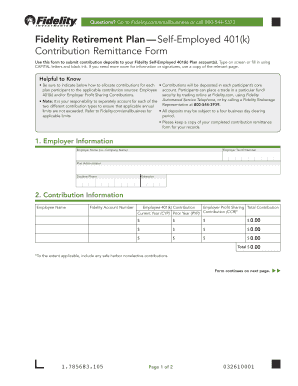

The 401k contribution remittance form is a crucial document used by employees to designate their contributions to a 401k retirement plan. This form typically includes essential information such as the employee's name, Social Security number, and the percentage or amount they wish to contribute from their paycheck. It serves as a formal request to the employer to withhold a specified amount for retirement savings, ensuring that employees can build their financial future effectively.

Steps to Complete the 401k Contribution Remittance Form

Completing the 401k contribution remittance form involves several straightforward steps:

- Gather necessary personal information, including your full name, Social Security number, and employment details.

- Determine the contribution amount or percentage you wish to allocate to your 401k plan.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to your employer’s HR or payroll department, following their specific submission guidelines.

Legal Use of the 401k Contribution Remittance Form

The 401k contribution remittance form is legally binding once it is completed and submitted according to your employer's policies. For the form to be valid, it must meet specific requirements set forth by the Employee Retirement Income Security Act (ERISA). This includes ensuring that the form is signed and dated appropriately. Employers are required to maintain accurate records of all contributions made on behalf of employees, which reinforces the importance of properly completing and submitting this form.

Obtaining the 401k Contribution Remittance Form

Employees can typically obtain the 401k contribution remittance form through their employer's human resources or payroll department. Many companies also provide the form on their internal employee portals or websites. If you cannot find the form, it is advisable to contact your HR representative directly for assistance. Additionally, some financial institutions that manage 401k plans may offer downloadable versions of the form on their websites.

Key Elements of the 401k Contribution Remittance Form

Several key elements are essential to include on the 401k contribution remittance form:

- Employee Information: Name, Social Security number, and contact details.

- Contribution Amount: The specific dollar amount or percentage of salary to be contributed.

- Employer Information: Company name and relevant identification numbers.

- Signature: The employee's signature and date to validate the form.

Form Submission Methods

Employees can submit the 401k contribution remittance form through various methods, depending on their employer's policies. Common submission methods include:

- Online Submission: Many employers allow electronic submission through employee portals.

- Mail: Employees may send the completed form via postal service to the HR or payroll department.

- In-Person: Submitting the form directly to HR or payroll can ensure it is received promptly.

Quick guide on how to complete 401k contribution remittance form fidelity

Effortlessly Create 401k Contribution Remittance Form Fidelity on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely maintain it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hold-ups. Handle 401k Contribution Remittance Form Fidelity on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Simple Way to Modify and eSign 401k Contribution Remittance Form Fidelity

- Obtain 401k Contribution Remittance Form Fidelity and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools designed specifically for that by airSlate SignNow.

- Craft your signature using the Sign tool, which requires only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your selection. Revise and eSign 401k Contribution Remittance Form Fidelity and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 401k contribution remittance form fidelity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 401k Contribution Remittance Form Fidelity?

The 401k Contribution Remittance Form Fidelity is a standardized document used by employers to submit employee contributions to their 401k retirement plans. This form ensures that contributions are accurately recorded and processed, making it essential for compliance and proper fund management.

-

How do I complete the 401k Contribution Remittance Form Fidelity?

To complete the 401k Contribution Remittance Form Fidelity, you need to gather employee contribution details, including the amount and frequency. Then, fill out the required fields on the form accurately before submitting it through your payroll system or directly to Fidelity for processing.

-

What are the benefits of using the 401k Contribution Remittance Form Fidelity?

Using the 401k Contribution Remittance Form Fidelity simplifies the contribution process and ensures compliance with regulatory requirements. It automates the tracking of contributions, reduces administrative errors, and provides a clear record for both employers and employees regarding their retirement savings.

-

Is there a cost associated with using the 401k Contribution Remittance Form Fidelity?

There is no direct cost to use the 401k Contribution Remittance Form Fidelity itself; however, businesses may incur fees based on their payroll processing services. It's advisable to check with Fidelity or your payroll provider to understand any applicable charges related to managing contributions.

-

How does airSlate SignNow integrate with the 401k Contribution Remittance Form Fidelity?

airSlate SignNow allows businesses to easily create, send, and eSign the 401k Contribution Remittance Form Fidelity electronically. This integration streamlines the process, enabling quick submissions and ensuring that all necessary documents are securely stored for future reference.

-

What features does airSlate SignNow offer for managing the 401k Contribution Remittance Form Fidelity?

airSlate SignNow provides features such as customizable templates for the 401k Contribution Remittance Form Fidelity, automated reminders, and real-time tracking of document status. These tools help ensure that your contributions are submitted on time and that compliance is maintained effortlessly.

-

Who can benefit from using the 401k Contribution Remittance Form Fidelity?

Employers managing retirement plans can greatly benefit from using the 401k Contribution Remittance Form Fidelity. Additionally, HR professionals and payroll departments will find it essential for accurately documenting and submitting contributions on behalf of employees.

Get more for 401k Contribution Remittance Form Fidelity

Find out other 401k Contribution Remittance Form Fidelity

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy