Oklahoma Backup Withholding Form

What is the Oklahoma Backup Withholding

The Oklahoma backup withholding is a tax mechanism that requires certain payers to withhold a percentage of payments made to individuals or businesses. This process is primarily applicable when the taxpayer fails to provide a correct taxpayer identification number (TIN) or when the IRS notifies the payer that the taxpayer is subject to backup withholding. The withheld amount is then remitted to the state of Oklahoma, ensuring compliance with tax obligations.

Steps to Complete the Oklahoma Backup Withholding

Completing the Oklahoma backup withholding involves several key steps:

- Determine if the taxpayer is subject to backup withholding by checking their TIN and IRS notifications.

- Calculate the appropriate withholding amount based on the payment type and current withholding rate.

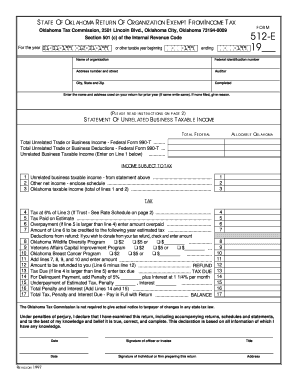

- Complete the necessary forms, ensuring all information is accurate and up to date.

- Submit the withheld amount to the Oklahoma Tax Commission along with the completed forms.

- Keep detailed records of all transactions and correspondence related to the withholding for future reference.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding backup withholding, which apply to Oklahoma as well. These guidelines outline when backup withholding is necessary, the rates to apply, and the proper procedures for remitting withheld amounts. It is essential for taxpayers and payers to familiarize themselves with these regulations to ensure compliance and avoid potential penalties.

Eligibility Criteria

To be subject to backup withholding in Oklahoma, certain criteria must be met. Taxpayers who fail to provide a valid TIN, or who have been notified by the IRS regarding their backup withholding status, fall under this category. Additionally, taxpayers who have had their payments reported as incorrect by the IRS may also be required to undergo backup withholding.

Penalties for Non-Compliance

Failure to comply with backup withholding requirements can result in significant penalties for both payers and taxpayers. Payers may face fines for not withholding the required amounts, while taxpayers could incur additional tax liabilities and interest on unpaid amounts. It is crucial to adhere to all guidelines to avoid these repercussions.

Form Submission Methods

Submitting the Oklahoma backup withholding forms can be done through various methods, including online submissions, mailing the forms to the Oklahoma Tax Commission, or delivering them in person. Each method has its own set of requirements and processing times, so it is advisable to choose the one that best suits the payer's needs and ensure timely compliance.

Key Elements of the Oklahoma Backup Withholding

Understanding the key elements of the Oklahoma backup withholding is vital for effective compliance. These elements include:

- The specific withholding rate applicable to various payment types.

- The requirement for accurate TIN submission by the taxpayer.

- The process for notifying the taxpayer of their backup withholding status.

- The timeline for remitting withheld amounts to the state.

Quick guide on how to complete oklahoma backup withholding

Effortlessly Complete Oklahoma Backup Withholding on Any Device

Web-based document management has gained traction among entities and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents rapidly and without complications. Handle Oklahoma Backup Withholding on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to Edit and eSign Oklahoma Backup Withholding with Ease

- Find Oklahoma Backup Withholding and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Oklahoma Backup Withholding to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma backup withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is backup withholding tax?

Backup withholding tax is a tax requirement for certain payments made to individuals and businesses. It ensures that the IRS can collect income tax from those who might not report this income on their tax returns. Understanding what is backup withholding tax is crucial for compliance and financial planning.

-

Who is subject to backup withholding tax?

Individuals and businesses can be subject to backup withholding tax if they fail to provide a taxpayer identification number (TIN) or if the IRS notifies the payer to withhold tax. It is important to determine whether you fall under these conditions to avoid unexpected tax liabilities. Knowing what is backup withholding tax helps in understanding who might be affected.

-

How can airSlate SignNow help with backup withholding tax documentation?

airSlate SignNow simplifies the process of collecting necessary documentation that relates to backup withholding tax. With electronic signatures and streamlined workflows, you can efficiently gather TINs and other required forms, keeping your documents organized. This way, you can stay compliant with what is backup withholding tax regulations.

-

What features does airSlate SignNow offer to manage backup withholding tax?

airSlate SignNow offers features such as customizable templates, secure signing, and document tracking to help manage backup withholding tax needs. These tools ensure you have all necessary forms and can easily monitor the status of your documents. Understanding what is backup withholding tax is easier when you have the right software at your disposal.

-

Are there any costs associated with using airSlate SignNow for backup withholding tax management?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on backup withholding tax management. The cost is designed to be cost-effective while providing essential features to simplify your document handling. Explore our pricing to see how you can address what is backup withholding tax without breaking the bank.

-

How does airSlate SignNow integrate with accounting software for tax compliance?

airSlate SignNow seamlessly integrates with various accounting software programs to enhance tax compliance, including handling backup withholding tax. This integration allows you to streamline your financial processes and ensure accurate record-keeping. By leveraging these integrations, you can better understand what is backup withholding tax in relation to your overall accounting practices.

-

Can airSlate SignNow assist in educating my team about backup withholding tax?

Yes, airSlate SignNow can help educate your team about backup withholding tax through its user-friendly interface and comprehensive support resources. We provide access to guides and tutorials on how to navigate tax documentation effectively. Staying informed about what is backup withholding tax is essential for your team’s compliance and financial management.

Get more for Oklahoma Backup Withholding

Find out other Oklahoma Backup Withholding

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement