Schedule C Worksheet 2008-2026

What is the Schedule C Worksheet

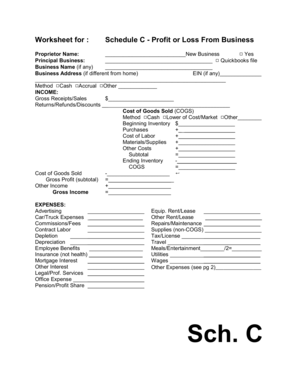

The Schedule C Worksheet is a crucial tax form used by self-employed individuals and sole proprietors in the United States to report income and expenses related to their business activities. This form allows taxpayers to detail their business income, deduct eligible expenses, and calculate their net profit or loss. The information provided on the Schedule C is then transferred to the individual’s personal tax return, specifically Form 1040. Understanding this worksheet is essential for accurate tax reporting and ensuring compliance with IRS regulations.

How to use the Schedule C Worksheet

Using the Schedule C Worksheet involves several steps to ensure all relevant information is captured accurately. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill in the business information section, which includes your business name, address, and the type of business entity. Then, report your total income from all sources related to your business. Following this, list your business expenses in the appropriate categories, such as advertising, utilities, and supplies. Finally, calculate your net profit or loss by subtracting total expenses from total income. Review the completed worksheet to ensure accuracy before submitting it with your tax return.

Steps to complete the Schedule C Worksheet

Completing the Schedule C Worksheet requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial records, including income and expense documents.

- Complete the business information section, including your business name and address.

- Report your gross receipts or sales for the year.

- List all business expenses, categorizing them appropriately.

- Calculate total income and total expenses.

- Determine your net profit or loss by subtracting total expenses from total income.

- Review the worksheet for accuracy before filing.

Legal use of the Schedule C Worksheet

The Schedule C Worksheet is legally binding when completed accurately and submitted as part of your tax return. It is essential to ensure that all reported figures are truthful and reflect your actual business activities. Misrepresentation or inaccuracies can lead to penalties or audits by the IRS. Utilizing a reliable eSignature solution, such as airSlate SignNow, can enhance the legal standing of your completed forms by providing secure digital signatures that comply with relevant eSignature laws.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C Worksheet. Taxpayers must adhere to these guidelines to ensure compliance and avoid potential issues. Key points include understanding which expenses are deductible, maintaining accurate records to substantiate claims, and being aware of any changes in tax laws that may affect reporting. The IRS also emphasizes the importance of filing the Schedule C accurately to avoid delays in processing your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Worksheet align with the overall tax return deadlines. Typically, individual taxpayers must file their tax returns, including the Schedule C, by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers may also request an extension, but it is crucial to understand that an extension to file does not extend the time to pay any taxes owed.

Quick guide on how to complete schedule c worksheet 242458815

Accomplish Schedule C Worksheet effortlessly on any device

Web-based document management has become widely adopted by enterprises and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the features you require to create, edit, and eSign your documents promptly without any delays. Manage Schedule C Worksheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Schedule C Worksheet with ease

- Locate Schedule C Worksheet and click on Access Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive details with tools specifically provided by airSlate SignNow for that intention.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information carefully and click on the Finish button to save your modifications.

- Select how you prefer to distribute your form, via email, text message, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate reprinting new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your liking. Modify and eSign Schedule C Worksheet to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c worksheet 242458815

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule C worksheet?

A Schedule C worksheet is a form used by sole proprietors to report income or loss from their business activities. This worksheet helps in calculating tax obligations and provides a clear overview of business revenue, expenses, and profits. Utilizing an efficient tool like airSlate SignNow can streamline the process of preparing your Schedule C worksheet.

-

How can airSlate SignNow help with completing a Schedule C worksheet?

airSlate SignNow offers features that allow users to create, edit, and sign documents online, making it easier to manage your Schedule C worksheet. With our user-friendly interface, you can quickly input business information and securely share the document with your accountant or tax professional. This saves time and ensures accuracy in your tax filing.

-

Is airSlate SignNow cost-effective for small businesses needing a Schedule C worksheet?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With our flexible pricing plans, you can access essential features to manage your Schedule C worksheet without breaking the bank. This ensures you can focus on growing your business while keeping track of your finances efficiently.

-

Can I collaborate with my accountant on my Schedule C worksheet using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration with your accountant on your Schedule C worksheet. You can share the document for review and approval, add comments, and receive electronic signatures, ensuring a smooth and transparent workflow that enhances communication.

-

Does airSlate SignNow integrate with other accounting software for Schedule C worksheets?

Yes, airSlate SignNow offers integrations with various accounting software platforms. This means you can easily import and export data relevant to your Schedule C worksheet, allowing for seamless transitions between your financial records and your e-signed documents. This integration enhances the accuracy of your calculations and filing process.

-

What features does airSlate SignNow offer for creating a Schedule C worksheet?

airSlate SignNow provides a range of features for creating a Schedule C worksheet, including customizable templates, easy document editing, and mobile access. These tools make it simple to craft an accurate and professional worksheet tailored to your business needs, ensuring you can confidently prepare for tax season.

-

How secure is my Schedule C worksheet with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and data protection measures to ensure your Schedule C worksheet and sensitive business information are kept safe. You can eSign documents with peace of mind, knowing your data is secure.

Get more for Schedule C Worksheet

- Principal product or service 1065 form

- Scrabble rules pdf form

- Earned income credit eic worksheet cp 09 form

- Tdp option selection worksheet 391359219 form

- 17 210 affidavit of service of original notice and petition for dissolution of marriage form

- Legacy introduction form pi beta phi international

- Cdcr transcript request form

- Transcript request form california department of corrections and cdcr ca

Find out other Schedule C Worksheet

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online