APPLICANTS TAXPAYER Form

What is the APPLICANTS TAXPAYER

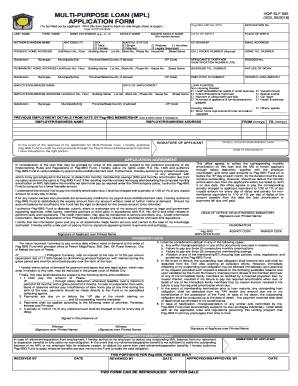

The applicants taxpayer form is a crucial document used in various tax-related processes within the United States. It typically serves to identify individuals or entities applying for taxpayer identification, which is essential for tax reporting and compliance purposes. This form is often required by the Internal Revenue Service (IRS) to ensure that all taxpayers are accurately accounted for and that tax obligations are met. Understanding its purpose is vital for anyone navigating the tax system.

Steps to complete the APPLICANTS TAXPAYER

Completing the applicants taxpayer form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, address, and Social Security number or Employer Identification Number (EIN). Next, fill out the form carefully, ensuring that all information is correct and matches your official documents. After completing the form, review it for any errors or omissions. Finally, submit the form according to the instructions provided, whether online, by mail, or in person.

Legal use of the APPLICANTS TAXPAYER

The legal use of the applicants taxpayer form is governed by various regulations set forth by the IRS. This form must be filled out accurately to comply with federal tax laws. Failure to provide correct information can lead to legal repercussions, including penalties or delays in processing your tax identification. It is important to understand the legal implications of the information provided on the form, as it serves as a formal declaration to the IRS regarding your taxpayer status.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the applicants taxpayer form. These guidelines include details on eligibility criteria, required documentation, and submission methods. Familiarizing yourself with these guidelines is essential to avoid common pitfalls and ensure that your application is processed efficiently. The IRS website offers comprehensive resources that can help clarify any questions regarding the form's requirements.

Required Documents

When completing the applicants taxpayer form, certain documents may be required to verify your identity and taxpayer status. Typically, you will need to provide a valid Social Security number or EIN, proof of residency, and any relevant tax documentation from previous years. Ensuring that you have all required documents ready can streamline the application process and help prevent delays.

Form Submission Methods

The applicants taxpayer form can be submitted through various methods, depending on your preference and the requirements of the IRS. Common submission methods include online submission through the IRS website, mailing a physical copy to the appropriate address, or delivering it in person at designated IRS offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your situation.

Eligibility Criteria

Eligibility criteria for the applicants taxpayer form vary based on the type of taxpayer you are. Generally, individuals, businesses, and organizations can apply for a taxpayer identification number if they meet specific requirements set by the IRS. This may include being a resident or non-resident alien, having a business entity, or being a dependent of a taxpayer. Understanding these criteria is essential for ensuring that your application is valid and accepted.

Quick guide on how to complete applicants taxpayer

Prepare APPLICANTS TAXPAYER effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly and without hindrances. Manage APPLICANTS TAXPAYER on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-oriented process today.

The easiest way to modify and eSign APPLICANTS TAXPAYER with minimal effort

- Obtain APPLICANTS TAXPAYER and click Get Form to begin.

- Make use of the provided tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Alter and eSign APPLICANTS TAXPAYER and ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the applicants taxpayer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow provide for APPLICANTS TAXPAYER?

airSlate SignNow offers a range of features that benefit APPLICANTS TAXPAYER, including customizable templates, real-time document tracking, and secure eSignature options. These tools streamline the document signing process, making it easy for taxpayers to manage their filings. With user-friendly interfaces, APPLICANTS TAXPAYER can quickly navigate through their tasks.

-

How much does airSlate SignNow cost for APPLICANTS TAXPAYER?

The pricing for airSlate SignNow varies depending on the plan you choose, but it is generally cost-effective for APPLICANTS TAXPAYER. We offer flexible subscription options and discounts for annual commitments. This ensures that taxpayers can find a plan that fits their budget while accessing essential features.

-

How does airSlate SignNow enhance the experience for APPLICANTS TAXPAYER?

By utilizing airSlate SignNow, APPLICANTS TAXPAYER can experience a signNowly improved document management process. The platform automates workflows and reduces turnaround times, allowing taxpayers to focus on their responsibilities rather than paperwork. This increased efficiency translates to better service and satisfaction for APPLICANTS TAXPAYER.

-

Can APPLICANTS TAXPAYER integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers robust integrations with various software applications, making it ideal for APPLICANTS TAXPAYER. Whether you use accounting tools, CRM software, or other business platforms, our seamless integrations allow for a smoother workflow. APPLICANTS TAXPAYER can easily connect with systems they already use, enhancing overall productivity.

-

Is airSlate SignNow compliant with regulations for APPLICANTS TAXPAYER?

Absolutely, airSlate SignNow is designed to be compliant with various regulatory requirements that impact APPLICANTS TAXPAYER. We prioritize data security and ensure that our eSigning processes adhere to legal standards. This compliance provides peace of mind, knowing that taxpayer information is handled securely and responsibly.

-

What benefits do APPLICANTS TAXPAYER gain by using airSlate SignNow?

APPLICANTS TAXPAYER gain numerous benefits by utilizing airSlate SignNow, such as enhanced speed and convenience in document handling. Our solution reduces the need for physical signatures, which saves time and resources. Additionally, the tracking features ensure that APPLICANTS TAXPAYER can monitor their documents efficiently.

-

How user-friendly is airSlate SignNow for APPLICANTS TAXPAYER?

airSlate SignNow is designed to be highly user-friendly, making it accessible for all APPLICANTS TAXPAYER. The intuitive interface allows users to navigate the platform easily, even if they have limited technological expertise. This ease of use ensures that APPLICANTS TAXPAYER can quickly adapt and benefit from our services.

Get more for APPLICANTS TAXPAYER

- Lax badge form

- No po box apt city state zip code mmddyyyy form

- Lausd special education paraprofessional handbook form

- Homelessness verification form

- Commercial animal facility permit application form

- In the matter of application 24729 of northern california form

- Use agreement application for churches and schoolspdf form

- Connected thermostat verification elmhurst mutual power form

Find out other APPLICANTS TAXPAYER

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online