Form 8892 Instructions

What is the Form 8892 Instructions

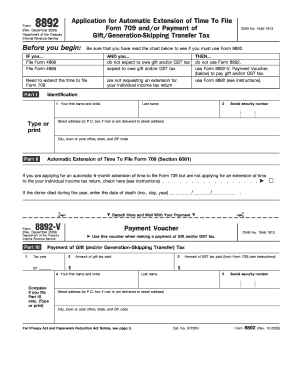

The Form 8892, officially known as the IRS Form 8892 Instructions, is a crucial document for U.S. taxpayers who need to request an automatic extension of time to file their tax returns. This form is particularly relevant for those who are unable to meet the regular filing deadlines due to various reasons, including international circumstances or personal issues. Understanding the specific instructions associated with this form ensures that taxpayers can accurately complete it and avoid potential penalties.

Steps to complete the Form 8892 Instructions

Completing the Form 8892 requires careful attention to detail. Here are the essential steps to follow:

- Begin by downloading the latest version of the Form 8892 from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the type of extension you are requesting and provide the necessary details regarding your tax situation.

- Review all entries for accuracy, ensuring that you have included all relevant information.

- Sign and date the form, as an unsigned form may be considered invalid.

Legal use of the Form 8892 Instructions

The legal use of the Form 8892 is essential for ensuring compliance with IRS regulations. When correctly completed and submitted, this form serves as a formal request for an extension, protecting taxpayers from late filing penalties. It is important to adhere to the guidelines provided in the instructions to maintain the legal validity of the form. Additionally, using a reliable electronic signature solution can further enhance the legitimacy of the submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 8892 is critical for taxpayers. The form must typically be submitted before the original due date of the tax return for which the extension is being requested. This ensures that the request is considered timely. It is advisable to check the IRS website for any updates on deadlines, as they may vary from year to year.

Required Documents

When completing the Form 8892, certain documents may be necessary to support your request for an extension. These documents can include:

- Your previous year's tax return for reference.

- Any relevant financial statements that may impact your current tax situation.

- Identification documents, such as a driver's license or Social Security card, to verify your identity.

Form Submission Methods (Online / Mail / In-Person)

The Form 8892 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the IRS e-file system, which is the fastest way to ensure your request is processed.

- Mailing the completed form to the appropriate IRS address, which can be found in the instructions.

- In-person submission at designated IRS offices, although this method may require an appointment.

Quick guide on how to complete form 8892 instructions

Complete Form 8892 Instructions effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents promptly without delays. Manage Form 8892 Instructions on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest method to edit and eSign Form 8892 Instructions without stress

- Find Form 8892 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign function, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8892 Instructions and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8892 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8892 and why is it important?

Form 8892 is a crucial document used for requesting an extension of time to file certain U.S. income tax returns for corporations. Using airSlate SignNow simplifies the eSigning process for Form 8892, ensuring that you can submit it efficiently and accurately, avoiding any potential penalties for late filing.

-

How can airSlate SignNow help with filling out Form 8892?

airSlate SignNow provides intuitive templates and customizable fields that streamline the process of filling out Form 8892. Users can access pre-built forms, making it easier to gather the necessary information and complete your tax filings with confidence.

-

Is there a cost associated with using airSlate SignNow for Form 8892?

Yes, airSlate SignNow offers various pricing plans that cater to different budgets and business needs. You can choose a plan that fits your usage requirements, ensuring you have the tools to manage Form 8892 without breaking the bank.

-

Can I integrate airSlate SignNow with my existing systems for handling Form 8892?

Absolutely! airSlate SignNow supports a wide range of integrations with popular business applications, allowing you to manage Form 8892 seamlessly alongside your existing workflows. This interoperability enhances your efficiency and minimizes errors in document processing.

-

What are the key benefits of using airSlate SignNow for Form 8892?

Using airSlate SignNow for Form 8892 offers numerous benefits, including enhanced security, easy access, and faster processing times. The platform's user-friendly interface ensures that even those unfamiliar with digital forms can navigate and eSign documents with ease.

-

Are there any limits on the number of Form 8892 documents I can send with airSlate SignNow?

The number of Form 8892 documents you can send through airSlate SignNow depends on the pricing plan you choose. Each plan comes with different limits, but you can always upgrade to a higher tier if you anticipate sending more documents.

-

How secure is airSlate SignNow for sending Form 8892?

airSlate SignNow prioritizes the security of your documents, including Form 8892. The platform employs advanced encryption and robust security protocols to ensure that your sensitive information remains protected during transmission and storage.

Get more for Form 8892 Instructions

- Pdf considerations and guidance for countries adopting national health form

- Emergency arbitrator form

- Lung foundation action plan form

- Annual performance report proforma

- Pakistan pc1 form

- Annexure 3 planning commission feasibility study requirements form

- Pdf building for the next 100 years nestl india limited form

- Pakistan executive summary form

Find out other Form 8892 Instructions

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal