Form No 101

What is the Form No 101

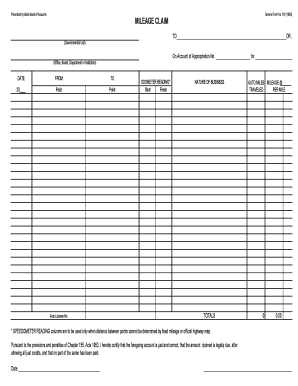

The Form No 101 is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). This form is crucial for ensuring compliance with federal tax regulations and helps in the accurate assessment of tax liabilities. Understanding the purpose and requirements of the Form No 101 is essential for anyone who needs to file it.

How to use the Form No 101

Using the Form No 101 involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or trusted tax software. Next, gather all necessary information, including income details, deductions, and any relevant financial records. When filling out the form, be precise and thorough to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific guidelines provided by the IRS.

Steps to complete the Form No 101

Completing the Form No 101 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the IRS.

- Gather required documents, such as income statements and previous tax returns.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Claim any eligible deductions and credits to minimize your tax liability.

- Review the form thoroughly for any mistakes before submission.

Legal use of the Form No 101

The legal use of the Form No 101 hinges on compliance with IRS regulations. This form must be filled out accurately and submitted within the designated time frame to avoid legal repercussions. Failing to file or providing false information can result in penalties, including fines or audits. It is advisable to retain copies of the submitted form and any supporting documents for your records, as they may be required in case of an IRS inquiry.

Filing Deadlines / Important Dates

Filing deadlines for the Form No 101 are critical to ensure compliance with tax laws. Typically, the form must be submitted by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to stay informed about any changes to these deadlines, as they can vary from year to year. Marking these dates on your calendar can help prevent late submissions and associated penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form No 101 can be submitted through various methods, providing flexibility for filers. Electronic submission is often the quickest and most efficient way to file, allowing for immediate processing by the IRS. Alternatively, you can mail a paper version of the form to the appropriate IRS address, ensuring it is postmarked by the filing deadline. In-person submissions are less common but may be available at certain IRS offices for those who prefer direct interaction.

Quick guide on how to complete form no 101

Easily Prepare form no 101 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage form no 101 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign 101 form effortlessly

- Locate 101form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all information and click the Done button to finalize your changes.

- Decide how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign 101 form online and ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form no 101

Create this form in 5 minutes!

How to create an eSignature for the 101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 101 form online

-

What is form no 101 and how can it be used with airSlate SignNow?

Form no 101 is a specific document template that can streamline your business processes. With airSlate SignNow, you can easily create, send, and eSign form no 101, ensuring that your documents are signed electronically in a secure manner.

-

Is there a cost associated with using form no 101 on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which includes access to all features for managing documents like form no 101. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from eSigning and document management.

-

What features does airSlate SignNow offer for managing form no 101?

AirSlate SignNow provides various features for managing form no 101, including templates, cloud storage, and real-time collaboration. These features make it easy for teams to work together and ensure that every step of the document process is as efficient as possible.

-

How does airSlate SignNow enhance the efficiency of form no 101 processing?

Using airSlate SignNow to process form no 101 enhances efficiency by automating workflows, reducing manual efforts, and speeding up the signing process. This allows you to get documents signed faster and track their status in real-time.

-

Can I integrate airSlate SignNow with other software to manage form no 101?

Yes, airSlate SignNow offers robust integrations with various third-party applications, which can help you manage form no 101 seamlessly. Integrating with tools like CRM systems or cloud storage solutions can streamline your document management process.

-

What benefits do businesses gain from using form no 101 with airSlate SignNow?

By using form no 101 with airSlate SignNow, businesses can reduce paper usage, save time on document processing, and enhance security. Additionally, it allows for easier tracking and management of important documents, improving overall productivity.

-

How secure is the signing process for form no 101 in airSlate SignNow?

The signing process for form no 101 in airSlate SignNow is highly secure, utilizing advanced encryption methods to protect sensitive information. This ensures that all signatures and documents are safe and comply with industry standards.

Get more for form no 101

Find out other 101 form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free