Form 3539

What is the Form 3539

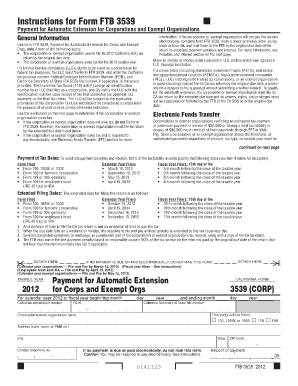

The Form 3539, also known as the California form 3539, is a crucial document used by taxpayers in the state of California. It is primarily utilized to request a refund of overpaid taxes or to claim a credit. This form is essential for ensuring that taxpayers receive the appropriate amount of funds back from the state, reflecting any discrepancies in their tax payments. Understanding the purpose and function of the form is vital for accurate tax reporting and compliance with state regulations.

How to use the Form 3539

Using the Form 3539 involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents, such as income statements and previous tax returns, to provide accurate information. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Be sure to accurately report your tax payments and any credits you are claiming. Finally, review the form for any errors before submitting it to the appropriate tax authority.

Steps to complete the Form 3539

Completing the Form 3539 requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Form 3539 from the California Franchise Tax Board (FTB) website.

- Fill in your personal information at the top of the form, ensuring it matches your tax records.

- Report your total tax payments and any applicable credits accurately.

- Double-check all entries for accuracy, including calculations.

- Sign and date the form before submission.

Legal use of the Form 3539

The legal use of the Form 3539 is governed by California tax laws. It is essential that the form is filled out truthfully and accurately, as any discrepancies may lead to penalties or delays in processing. The form must be submitted within the designated timeframe to ensure compliance with state regulations. Additionally, utilizing electronic signatures through a secure platform can enhance the form's legitimacy and protect against fraud.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3539 are critical for taxpayers to observe. Typically, the form should be submitted within a specific timeframe following the end of the tax year. It is advisable to check the California Franchise Tax Board’s official website for the most current deadlines and any updates related to extensions or changes in filing requirements. Missing these deadlines may result in forfeiting your right to a refund or credit.

Form Submission Methods (Online / Mail / In-Person)

The Form 3539 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online through the California Franchise Tax Board’s website, which offers a streamlined and efficient process. Alternatively, the form can be mailed to the appropriate address provided on the form, ensuring it is sent well before the deadline. In-person submissions may also be possible at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete form 3539

Prepare Form 3539 easily on any device

Web-based document management has become favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle Form 3539 on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 3539 effortlessly

- Find Form 3539 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 3539 and guarantee exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3539

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3539 used for?

The form 3539 is used to request an extension of time to file your tax return. It provides essential information to the IRS and allows taxpayers to file their returns without incurring penalties for late submission.

-

How can airSlate SignNow assist with the form 3539?

airSlate SignNow streamlines the process of completing and signing the form 3539 electronically. With its user-friendly interface, businesses can easily fill out the form, obtain signatures, and submit it directly to the IRS, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for form 3539?

Yes, airSlate SignNow offers affordable pricing plans for its eSignature services, which include features for managing the form 3539. The pricing structure is designed to cater to businesses of all sizes, ensuring you get great value for your investment.

-

What features does airSlate SignNow provide for the form 3539?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the form 3539. These features enhance productivity and ensure compliance by making document management seamless and efficient.

-

Can I integrate airSlate SignNow with other applications for the form 3539?

Absolutely! airSlate SignNow integrates with various applications, allowing you to manage the form 3539 alongside other tools you use. This seamless integration improves workflow and ensures that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the form 3539?

Using airSlate SignNow for the form 3539 offers several benefits, including increased speed, enhanced security, and improved document accuracy. The electronic signature process reduces paperwork, saving you valuable time while ensuring your submissions are processed securely.

-

Is remote signing supported for the form 3539 with airSlate SignNow?

Yes, remote signing is fully supported for the form 3539 through airSlate SignNow. This feature allows users to sign documents from anywhere, making it convenient for businesses and individuals who may not be in the same location.

Get more for Form 3539

Find out other Form 3539

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors