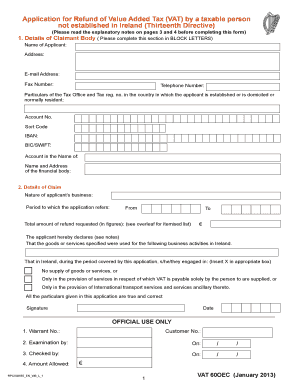

Vat 60 Oec Form

What is the Vat 60 Oec

The Vat 60 Oec form is a specific document used primarily for tax purposes in the United States. It serves as a declaration for certain tax-related transactions, ensuring compliance with federal and state regulations. This form is essential for individuals and businesses who need to report specific financial activities, allowing them to maintain transparency with tax authorities.

How to use the Vat 60 Oec

Using the Vat 60 Oec form involves several key steps. First, gather all necessary information related to the financial activity you are reporting. This may include income details, expenses, and any relevant identification numbers. Next, fill out the form accurately, ensuring that all sections are completed. Once the form is filled, it can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the tax authority.

Steps to complete the Vat 60 Oec

Completing the Vat 60 Oec form requires careful attention to detail. Follow these steps for a smooth process:

- Gather relevant financial documents and information.

- Access the Vat 60 Oec form through the appropriate channels.

- Fill in your personal and financial information accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, as required.

Legal use of the Vat 60 Oec

The legal use of the Vat 60 Oec form is crucial for ensuring compliance with tax laws. This form must be filled out accurately and submitted within the designated time frames to avoid penalties. It is important to understand the legal implications of the information provided, as inaccuracies can lead to audits or legal consequences. Consulting with a tax professional can help ensure that the form is used correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Vat 60 Oec form vary depending on the specific tax year and the nature of the financial activity being reported. Generally, it is advisable to submit the form by the end of the tax season to avoid any late fees or penalties. Keeping track of important dates and deadlines can help ensure timely submission and compliance with tax regulations.

Required Documents

To complete the Vat 60 Oec form, certain documents are typically required. These may include:

- Proof of income, such as pay stubs or bank statements.

- Receipts for any deductible expenses.

- Your Social Security number or Employer Identification Number (EIN).

- Any prior year tax returns if applicable.

Eligibility Criteria

Eligibility to use the Vat 60 Oec form depends on various factors, including the nature of the financial activity and the individual's or business's tax status. Generally, those who engage in specific transactions that require reporting to tax authorities must use this form. It is advisable to review the eligibility criteria carefully to ensure compliance and avoid issues during the filing process.

Quick guide on how to complete vat 60 oec

Prepare Vat 60 Oec effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to retrieve the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents rapidly without delays. Manage Vat 60 Oec across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The most efficient way to edit and eSign Vat 60 Oec with ease

- Download Vat 60 Oec and click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your adjustments.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Vat 60 Oec and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 60 oec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT60 and how does it work with airSlate SignNow?

VAT60 is a document format that simplifies VAT reporting for businesses. With airSlate SignNow, you can easily create, send, and eSign VAT60 documents, ensuring compliance and efficiency in your VAT submissions.

-

How much does airSlate SignNow cost for using VAT60 documents?

The pricing for airSlate SignNow varies based on the subscription plan you choose. Each plan allows unlimited access to features including the creation and management of VAT60 documents, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for VAT60 document management?

airSlate SignNow provides a variety of features for VAT60 document management, including customizable templates, secure eSigning, and real-time tracking. This simplifies the process of sending and managing your VAT60 submissions.

-

Can I integrate airSlate SignNow with other platforms for VAT60 management?

Yes, airSlate SignNow offers seamless integrations with various platforms, facilitating easy handling of your VAT60 documents. Whether it's CRM systems or accounting software, these integrations help streamline your workflow.

-

Is airSlate SignNow secure for handling VAT60 documents?

Absolutely. airSlate SignNow utilizes state-of-the-art encryption and security protocols to ensure that your VAT60 documents are safe and confidential. You can trust that your sensitive information is protected at all times.

-

How does eSigning VAT60 documents enhance efficiency?

eSigning VAT60 documents with airSlate SignNow eliminates the need for printing and mailing, signNowly speeding up the approval process. This efficiency translates into quicker VAT submissions and a more streamlined workflow for your business.

-

What are the benefits of using airSlate SignNow for VAT60 compliance?

Using airSlate SignNow for VAT60 compliance offers numerous benefits, including improved accuracy, time savings, and cost-effectiveness. The platform’s intuitive design makes it easy for users to ensure all VAT60 submissions are accurate and on time.

Get more for Vat 60 Oec

- Etsu change form

- Application for admission smith college form

- Contact us office of the registrar uthealth form

- Duke release information form

- Release of examination bmcc cuny form

- 24 printable fafsa id forms and templates fillable samples in pdf

- Core residency questions tamu registrar office texas aampm form

- Tcu reactivate form

Find out other Vat 60 Oec

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online