Dte Form 100 Ex

What is the DTE Form 100 Ex

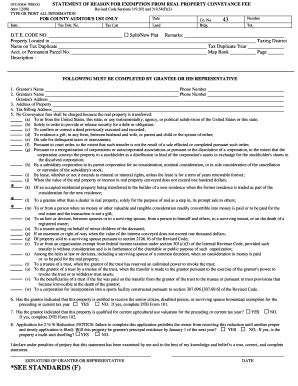

The DTE Form 100 Ex is a specific form used in the United States for property tax exemption purposes. It is typically utilized by organizations, such as nonprofits or religious institutions, to apply for exemptions from certain property taxes. This form provides the necessary information to the appropriate tax authority, demonstrating eligibility for the exemption based on the organization’s status and activities.

How to obtain the DTE Form 100 Ex

To obtain the DTE Form 100 Ex, individuals or organizations can visit the official website of their state’s tax authority or department of revenue. Many states provide downloadable versions of the form in PDF format, allowing users to print and fill them out. Alternatively, some tax offices may offer physical copies of the form upon request. It is essential to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the DTE Form 100 Ex

Completing the DTE Form 100 Ex involves several key steps:

- Gather necessary documentation, including proof of the organization’s tax-exempt status.

- Fill out the form with accurate information, including the organization’s name, address, and the specific property for which the exemption is being requested.

- Provide details regarding the nature of the organization and its activities that justify the exemption.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the specified deadline, either online, by mail, or in person, depending on state guidelines.

Legal use of the DTE Form 100 Ex

The DTE Form 100 Ex is legally binding when filled out correctly and submitted to the appropriate authorities. To ensure its legal validity, the form must be completed in accordance with state laws governing property tax exemptions. This includes providing accurate information and supporting documentation. Failure to comply with these requirements may result in denial of the exemption or penalties.

Key elements of the DTE Form 100 Ex

Key elements of the DTE Form 100 Ex include:

- Organization Information: Name, address, and type of organization.

- Property Details: Description of the property for which the exemption is requested.

- Exemption Justification: Explanation of how the organization meets the criteria for exemption.

- Signature: An authorized representative must sign the form, affirming the accuracy of the information provided.

Form Submission Methods

The DTE Form 100 Ex can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online: Many states allow electronic submission through their tax authority’s website.

- Mail: The form can be printed and mailed to the designated tax office.

- In-Person: Some jurisdictions permit submission directly at local tax offices.

Quick guide on how to complete dte form 100 ex

Complete Dte Form 100 Ex effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Dte Form 100 Ex on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Dte Form 100 Ex with ease

- Find Dte Form 100 Ex and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form: by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Dte Form 100 Ex and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dte form 100 ex

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dte form 100 ex?

The dte form 100 ex is a document used in specific tax situations that allows individuals to report various forms of income. Utilizing airSlate SignNow simplifies the submission of your dte form 100 ex by providing a user-friendly platform for electronic signatures and document management.

-

How can airSlate SignNow help with the dte form 100 ex?

airSlate SignNow offers an efficient way to eSign and send your dte form 100 ex. With our platform, you can easily upload your document, collect signatures from relevant parties, and securely store your submissions, ensuring that your dte form 100 ex is processed smoothly and promptly.

-

Is there a cost associated with using airSlate SignNow for the dte form 100 ex?

Yes, there is a subscription fee for using airSlate SignNow services, which provides you with access to eSigning and document management features. We offer different pricing plans to accommodate various business needs, making it a cost-effective solution for handling your dte form 100 ex.

-

What features does airSlate SignNow provide for processing dte form 100 ex?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage to streamline your dte form 100 ex handling. Additionally, our platform supports multiple signature workflows, making it easier for you to gather necessary approvals efficiently.

-

Can I integrate airSlate SignNow with my existing software for filing the dte form 100 ex?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, allowing you to streamline your workflow when handling the dte form 100 ex. Whether you use CRM systems, document management software, or cloud storage, our platform can enhance your productivity.

-

How secure is airSlate SignNow when dealing with the dte form 100 ex?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols to protect your sensitive information, including the dte form 100 ex, ensuring that your documents are safe from unauthorized access during the signing process.

-

What are the benefits of using airSlate SignNow for my dte form 100 ex?

Using airSlate SignNow for your dte form 100 ex offers several benefits, such as increased efficiency, reduced turnaround time, and improved accessibility. By utilizing our eSignature solution, you can ensure that your document processes are hassle-free and compliant with legal standards.

Get more for Dte Form 100 Ex

- Teach grant appeal form

- Berkeley tb medical clearance form

- Overseas registration application request form

- Septic addendum form

- Mycase securepa form

- Arizona personal representative appointment form

- Cbp form 4609 petition for remission or mitigation of forfeitures and penalities incurred

- Houston ocd relapse prevention form

Find out other Dte Form 100 Ex

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer