Form 8396

What is the Form 8396

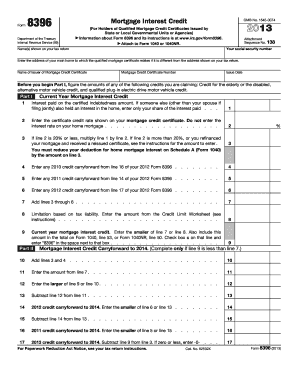

The Form 8396, also known as the Mortgage Interest Credit, is a tax form used by eligible homeowners in the United States to claim a credit for a portion of the mortgage interest paid on their home. This form is particularly beneficial for low-income taxpayers who may not have enough taxable income to fully utilize their mortgage interest deduction. By completing this form, taxpayers can reduce their overall tax liability, making homeownership more affordable.

How to use the Form 8396

To use the Form 8396 effectively, taxpayers must first determine their eligibility based on income and the amount of mortgage interest paid. Once eligibility is confirmed, they can fill out the form by providing necessary information such as the mortgage amount, interest paid, and personal details. After completing the form, it should be attached to the taxpayer's annual tax return, allowing for the credit to be applied against their tax owed.

Steps to complete the Form 8396

Completing the Form 8396 involves several key steps:

- Gather necessary documents, including mortgage statements and income information.

- Determine eligibility based on IRS guidelines, including income limits.

- Fill out the form, ensuring all fields are accurately completed.

- Calculate the mortgage interest credit based on the provided information.

- Review the form for accuracy before submitting it with your tax return.

Legal use of the Form 8396

The legal use of the Form 8396 is governed by IRS regulations, which stipulate that only eligible taxpayers may claim the mortgage interest credit. Proper completion and submission of the form are essential to ensure compliance with tax laws. Failing to adhere to these regulations can result in penalties or the disallowance of the credit.

Eligibility Criteria

To be eligible for the Form 8396, taxpayers must meet specific criteria set by the IRS. This includes having a qualified mortgage, being a first-time homebuyer, and meeting income limits based on the number of dependents. Additionally, the home must be used as the taxpayer's principal residence. It is important for taxpayers to review these criteria carefully to ensure they qualify before filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8396 align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of each year. However, if taxpayers require an extension, they may file for an extension, allowing additional time to submit their Form 8396. It is crucial to keep track of these dates to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 8396 can be submitted through various methods. Taxpayers may file electronically using tax preparation software or through a tax professional. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not available for this form, as it is primarily processed through electronic or mail channels. Choosing the right submission method can help ensure timely processing of the tax return.

Quick guide on how to complete form 8396

Effortlessly Prepare Form 8396 on Any Device

Digital document management has become widespread among companies and individuals alike. It presents a superb eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 8396 across all platforms with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Form 8396 with ease

- Obtain Form 8396 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 8396 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8396

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8396 and how is it used?

Form 8396 is a tax form used to claim the mortgage interest credit for eligible homeowners. It is important for those who have qualified for the credit to fill out this form accurately to receive the benefits they deserve. Utilizing airSlate SignNow can streamline the signing process for form 8396, making it easier to manage.

-

How does airSlate SignNow simplify the eSigning process for form 8396?

airSlate SignNow simplifies the eSigning process for form 8396 by providing an intuitive platform that allows users to electronically sign documents securely. Users can easily upload their form 8396, add signatures, and send it to other parties without needing to print or scan documents. This saves time and enhances the overall efficiency of the process.

-

What are the pricing options for using airSlate SignNow with form 8396?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs when handling forms like form 8396. Pricing starts with a free trial, allowing users to test the platform before committing. The paid plans include additional features such as advanced document management and integrations with other software.

-

Does airSlate SignNow integrate with other software for processing form 8396?

Yes, airSlate SignNow integrates seamlessly with various software applications, which can enhance the workflow for managing form 8396. Users can connect it with CRM systems, cloud storage, and accounting software to streamline the documentation processes, ensuring that their form 8396 is handled efficiently.

-

What are the benefits of using airSlate SignNow for form 8396 over traditional methods?

Using airSlate SignNow for form 8396 provides numerous benefits, including reduced paperwork, faster processing times, and improved accuracy. Its digital format minimizes the risk of errors and makes it easy to track the status of a document. Additionally, the platform allows for real-time collaboration, making it easier for all parties involved.

-

Is airSlate SignNow secure for signing sensitive documents like form 8396?

Yes, airSlate SignNow prioritizes security and is designed to protect sensitive documents such as form 8396. The platform uses advanced encryption protocols and complies with industry standards to ensure that all transactions and signatures are secure. Users can feel confident that their personal and financial information is safe.

-

Can I access my completed form 8396 in airSlate SignNow anytime?

Absolutely! airSlate SignNow allows users to access their completed form 8396 anytime and from anywhere. The cloud-based platform ensures that your documents are securely stored and easily retrievable, providing you with peace of mind and quick access when needed.

Get more for Form 8396

- Measurement fire form

- Estate planning questionnaire unmarried person form

- Health information quality authority 456685553

- Pssap beneficiary form

- F1002a financial statement the law courts of newfoundland form

- 2020 uk passport application form

- City of bozeman montana development review application form a 1

- Fillable personnel action form

Find out other Form 8396

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online