CCL200X Climate Change Levy Tax Credit Claim Use This Form to Claim for Payment of Overpaid Climate Change Levy Hmrc Gov

Understanding the CCL200X Climate Change Levy Tax Credit Claim

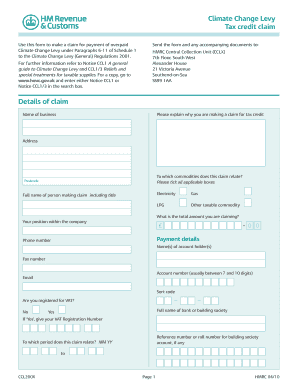

The CCL200X Climate Change Levy Tax Credit Claim is a specific form used to request payment for any overpaid Climate Change Levy. This levy is a tax on energy use in the UK, aimed at encouraging businesses to reduce their carbon emissions. Although primarily a UK tax initiative, the form serves as an important reference for understanding tax credits and claims related to energy efficiency and sustainability efforts. Businesses that have overpaid this levy can utilize this form to reclaim their funds, ensuring they receive the correct financial adjustments.

Steps to Complete the CCL200X Climate Change Levy Tax Credit Claim

Completing the CCL200X form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of overpayment and any relevant energy usage records. Next, fill out the form with precise details about your business, including your tax identification number and contact information. Ensure that all calculations regarding the overpaid levy are correct, as inaccuracies can lead to delays. Finally, review the completed form thoroughly before submission to ensure all required fields are filled out correctly.

Legal Use of the CCL200X Climate Change Levy Tax Credit Claim

The CCL200X form is legally binding when completed according to established guidelines. For the claim to be valid, it must be signed and submitted in compliance with relevant tax regulations. Utilizing a trusted digital platform for e-signatures can enhance the legal standing of the claim, as it provides a secure method for signing and storing the document. Compliance with eSignature laws ensures that the form is recognized by authorities, safeguarding against potential disputes regarding its validity.

Required Documents for the CCL200X Climate Change Levy Tax Credit Claim

To successfully submit the CCL200X form, certain documents are required. These typically include proof of overpayment, such as invoices or payment receipts related to the Climate Change Levy. Additionally, businesses may need to provide financial statements or energy usage reports that substantiate their claims. Having these documents ready can streamline the process and reduce the likelihood of complications during review.

Filing Deadlines for the CCL200X Climate Change Levy Tax Credit Claim

Timeliness is crucial when submitting the CCL200X form. There are specific deadlines for filing claims related to overpaid levies, which can vary based on the tax year and individual circumstances. It is important for businesses to stay informed about these deadlines to ensure their claims are processed without delay. Missing a deadline could result in the loss of the opportunity to recover overpaid amounts.

Eligibility Criteria for the CCL200X Climate Change Levy Tax Credit Claim

Eligibility for filing the CCL200X claim is generally based on the amount of Climate Change Levy overpaid by a business. Companies must be able to demonstrate that they have indeed overpaid their levies and that they meet the necessary criteria set forth by tax authorities. This may include maintaining proper records of energy usage and payments made. Understanding the eligibility requirements is essential for a successful claim.

Quick guide on how to complete ccl200x climate change levy tax credit claim use this form to claim for payment of overpaid climate change levy hmrc gov

Effortlessly Prepare CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without hassle. Manage CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Modify and eSign CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov Effortlessly

- Obtain CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Modify and eSign CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ccl200x climate change levy tax credit claim use this form to claim for payment of overpaid climate change levy hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CCL200X Climate Change Levy Tax Credit Claim form?

The CCL200X Climate Change Levy Tax Credit Claim form is an official document provided by HMRC that allows businesses to claim back payments for overpaid Climate Change Levy. This form is essential for ensuring that companies receive the correct refunds and maintain compliance with tax regulations. To claim your payment, simply utilize this form for a streamlined process.

-

Who is eligible to use the CCL200X form?

Any business that has overpaid the Climate Change Levy may be eligible to use the CCL200X Climate Change Levy Tax Credit Claim form. It is particularly beneficial for companies that have made climate-related payments in excess over the thresholds established by HMRC. Ensure your claim is compliant with all guidelines to maximize your refund.

-

How can I submit the CCL200X Climate Change Levy Tax Credit Claim form?

You can submit the CCL200X Climate Change Levy Tax Credit Claim form electronically through the HMRC portal or by post, depending on your preference. Using an electronic service like airSlate SignNow can simplify the eSigning and submission process, ensuring that your claim is processed swiftly and efficiently. Remember to keep a copy for your records.

-

What are the benefits of using airSlate SignNow for the CCL200X claim?

Using airSlate SignNow to handle your CCL200X Climate Change Levy Tax Credit Claim simplifies document management and enhances efficiency. Our platform allows you to eSign documents quickly, track submissions, and streamline your workflow. With our user-friendly interface, you can ensure that your claim is completed accurately and submitted on time.

-

Is there a cost associated with using the CCL200X Climate Change Levy Tax Credit Claim form?

The use of the CCL200X Climate Change Levy Tax Credit Claim form itself is free; however, businesses should be aware of any potential fees associated with consulting services or electronic filing platforms. airSlate SignNow offers a cost-effective solution for eSigning and document management to help you process your claims efficiently. Check our pricing plans for more details.

-

Are there deadlines for submitting the CCL200X claims?

Yes, there are specific deadlines for submitting your CCL200X Climate Change Levy Tax Credit Claim form with HMRC. It is crucial to submit your claim within the stipulated time frame to ensure you are eligible for a refund of any overpaid levy. Check HMRC’s guidelines or consult with a tax professional to ensure your submission is timely.

-

Can I integrate airSlate SignNow with other software for my CCL200X claims?

Yes, airSlate SignNow offers integrations with various software platforms to assist in managing your CCL200X Climate Change Levy Tax Credit Claim forms. This integration allows for seamless documentation and electronic signature processes, ensuring that you can handle your tax claims without hassle. Explore our API options for optimal integration solutions.

Get more for CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov

- Umh properties application form

- Dermalogica consultation card form

- Mn birth certificate application form

- W 4 withholding form

- Doaalaskagovhome department of administration state of alaska form

- Workers compensation report r4indd form

- Municipal credit time served form

- Hybrid analysiscom sample 3ed08121d82fc0070eebfhttpsapi1ilovepdfcom form

Find out other CCL200X Climate Change Levy Tax Credit Claim Use This Form To Claim For Payment Of Overpaid Climate Change Levy Hmrc Gov

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document