W2G and WinLoss Form Osage Casinos

What is the W2G And WinLoss Form Osage Casinos

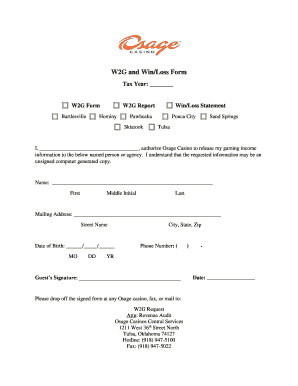

The W2G and WinLoss form Osage Casinos is a tax document used to report gambling winnings and losses for individuals participating in gaming activities at Osage Casinos. This form is essential for players who have won a significant amount, as it helps to ensure compliance with IRS regulations regarding taxable income. The W2G form specifically details the amount won, while the WinLoss statement provides a summary of winnings and losses over a specified period. Both documents are crucial for accurate tax reporting and can assist in claiming deductions for gambling losses.

How to use the W2G And WinLoss Form Osage Casinos

Using the W2G and WinLoss form Osage Casinos involves several steps to ensure accurate completion and submission. First, gather all relevant information, including your Social Security number, details of your winnings, and any losses incurred. When filling out the W2G form, ensure that you accurately report the amount won and any applicable taxes withheld. The WinLoss form should reflect your total gambling activity, including both wins and losses. It is important to keep these documents for your records, as they may be required when filing your taxes.

Steps to complete the W2G And WinLoss Form Osage Casinos

Completing the W2G and WinLoss form Osage Casinos is straightforward. Follow these steps:

- Collect your gambling records, including receipts and statements.

- Fill out the W2G form with your personal information, including your name, address, and Social Security number.

- Report the total winnings in the designated section of the W2G form.

- Complete the WinLoss form by summarizing your total winnings and losses over the reporting period.

- Review both forms for accuracy before submission.

Legal use of the W2G And WinLoss Form Osage Casinos

The W2G and WinLoss form Osage Casinos must be used in accordance with IRS guidelines to ensure legal compliance. The IRS requires that any gambling winnings over a certain threshold be reported using the W2G form. Failure to report these winnings can result in penalties or fines. Additionally, the WinLoss statement can be used to offset winnings with losses, which is beneficial during tax filing. It is important to retain these documents for at least three years in case of an audit.

Key elements of the W2G And WinLoss Form Osage Casinos

Key elements of the W2G and WinLoss form Osage Casinos include:

- Personal Information: Name, address, and Social Security number of the winner.

- Winnings Amount: Total amount won during the reporting period.

- Tax Withholding: Amount of federal tax withheld from winnings.

- Losses Reported: Total losses claimed on the WinLoss form.

- Signature: Required to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the W2G and WinLoss form Osage Casinos align with the general tax filing deadlines set by the IRS. Typically, these forms must be submitted by April 15 of the following year after the gambling activity took place. It is crucial to be aware of any changes in tax laws or deadlines that may affect your filing requirements. Keeping track of these dates can help avoid penalties and ensure compliance with tax obligations.

Quick guide on how to complete w2g and winloss form osage casinos

Easily Prepare W2G And WinLoss Form Osage Casinos on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Handle W2G And WinLoss Form Osage Casinos on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-driven process today.

The Easiest Way to Alter and Electronically Sign W2G And WinLoss Form Osage Casinos

- Obtain W2G And WinLoss Form Osage Casinos and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of the documents or redact sensitive data using the tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), invite link, or download it to your computer.

No more worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign W2G And WinLoss Form Osage Casinos and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w2g and winloss form osage casinos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do s keep track of your losses?

Some players believe that s track hot/cold players in an effort to see who may be winning or losing, including perhaps those winning or losing too much. STATUS: They do track every player, and how they're doing, but the reasons are generally more benign than some players believe.

-

How does a win loss statement from a work?

A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based when a Players Club card is properly inserted into the gaming device during play.

-

How does a win loss statement work?

A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based when a Players Club card is properly inserted into the gaming device during play.

-

Is a win loss statement the same as a W2G?

A W2-G is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this form at the time the winnings are awarded. This is not the same as an annual win/loss statement.

-

How do you prove you lost money at a ?

You can deduct your gambling losses, but only to offset the income from your gambling winnings. You can't deduct your losses without reporting any winnings....Other documentation to prove your losses can include: Form W-2G. Form 5754. wagering tickets. canceled checks or credit records. receipts from the gambling facility.

-

Can you get a win loss statement from a ?

s provide a win-loss statement for slot players that includes coin-in and coin-out amounts, but their player-tracking procedures for other forms of play differ. The will provide you with a copy of your gaming winnings on Form W-2G and will submit a copy to the IRS.

-

Can I access my W2G online?

If you qualify to receive W2G forms, you will receive in app notifications and emails prior to the start of Tax Season to opt into digital download by visiting this page. By consenting to digital download, you will no longer receive your W2G forms in the mail.

Get more for W2G And WinLoss Form Osage Casinos

- Wwwicc cpiint sites defaultcase information sheet international criminal court

- Participant information sheets ampamp informed consent forms

- Isdup membership instructions form

- Membership application daughters of utah pioneers form

- Georgia rigbys entertainment complex form

- Submission of mitigating circumstances forms notes of guidance

- London met mitigating circumstances form

- Republic south africa application form

Find out other W2G And WinLoss Form Osage Casinos

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template