Mi W4 Form

What is the MI W4?

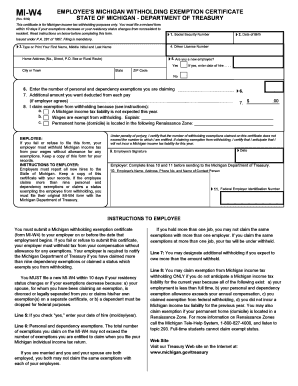

The MI W4 is a state-specific tax form used by employees in Michigan to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted, which helps prevent underpayment or overpayment of state taxes. The MI W4 collects information about the employee's filing status, allowances, and any additional withholding amounts they wish to specify.

How to Use the MI W4

To use the MI W4 effectively, individuals must first gather relevant personal and financial information, including their filing status and the number of allowances they wish to claim. The form requires employees to provide their name, address, Social Security number, and details regarding their tax situation. After completing the form, it must be submitted to the employer, who will use it to adjust the state income tax withholding accordingly.

Steps to Complete the MI W4

Completing the MI W4 involves several straightforward steps:

- Begin by filling in your personal information, including your name, address, and Social Security number.

- Select your filing status, which could be single, married, or head of household.

- Determine the number of allowances you are eligible to claim based on your personal and financial situation.

- If desired, indicate any additional withholding amounts you wish to have deducted from your paycheck.

- Review the completed form for accuracy and sign it before submitting it to your employer.

Legal Use of the MI W4

The MI W4 is legally recognized for determining state income tax withholding in Michigan. It is essential for compliance with state tax laws, ensuring that employers withhold the correct amount of taxes from employee wages. Proper completion and submission of the MI W4 help avoid potential penalties for both employees and employers due to incorrect tax withholding.

Key Elements of the MI W4

Several key elements are crucial when filling out the MI W4:

- Personal Information: Accurate details about the employee, including name and Social Security number.

- Filing Status: Selection of the appropriate filing status, which affects tax withholding rates.

- Allowances: The number of allowances claimed can significantly impact the amount withheld.

- Additional Withholding: Option to specify any extra amounts to be withheld from paychecks.

Form Submission Methods

The MI W4 can be submitted to employers through various methods. Typically, employees provide the completed form directly to their HR or payroll department. In some cases, electronic submission may be permitted, depending on the employer's policies. It is important to ensure that the form is submitted promptly to avoid any delays in tax withholding adjustments.

Quick guide on how to complete mi w4 21659436

Complete Mi W4 effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Mi W4 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to edit and eSign Mi W4 without any hassle

- Obtain Mi W4 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Mi W4 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi w4 21659436

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI W4 form, and why is it important?

The MI W4 form is a Michigan tax withholding form that employees use to determine the amount of state tax withheld from their paychecks. It's crucial for ensuring that you meet your tax obligations and avoid any penalties. Using airSlate SignNow to electronically sign your MI W4 makes this process efficient and secure.

-

How do I create and send a MI W4 using airSlate SignNow?

Creating and sending a MI W4 with airSlate SignNow is straightforward. You can easily upload your prepared MI W4 form, customize it as needed, and send it for electronic signatures. This streamlines the entire process, allowing you to manage your documents from anywhere.

-

What are the benefits of using airSlate SignNow for MI W4 forms?

AirSlate SignNow simplifies the MI W4 submission process by providing convenient eSignature options and easy document tracking. You can ensure that all your forms are compliant and securely stored, reducing the risk of lost paperwork. Many users also appreciate the time savings and increased productivity.

-

Is there a cost associated with using airSlate SignNow for MI W4 forms?

AirSlate SignNow offers a variety of pricing plans to accommodate different needs, including options that allow you to electronically sign and manage your MI W4 forms. Depending on the plan you choose, you may have access to features like templates, document workflows, and more. It's a cost-effective solution for both individuals and businesses.

-

Can I integrate airSlate SignNow with other tools for managing MI W4 forms?

Yes, airSlate SignNow is designed to integrate seamlessly with various applications and tools that you may already be using. This allows you to automate workflows and sync your data, making managing your MI W4 forms and other documents simple and efficient. Check the integration capabilities to see how it fits your business needs.

-

What security measures does airSlate SignNow implement for MI W4 forms?

AirSlate SignNow prioritizes the security of your documents, including MI W4 forms, by employing robust encryption and secure storage. This means your sensitive information is kept safe during transmission and storage. Compliance with industry standards ensures that your data is protected against unauthorized access.

-

How does using airSlate SignNow improve the signing process for MI W4 forms?

Using airSlate SignNow speeds up the signing process for MI W4 forms signNowly. You can send documents for signature instantly, track their status in real-time, and receive notifications once they’re signed. This efficiency reduces delays and simplifies compliance with tax regulations.

Get more for Mi W4

Find out other Mi W4

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online