Ar8453 Ol Form

What is the Ar8453 Ol

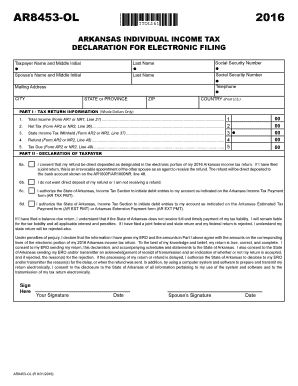

The Ar8453 Ol form is a tax document used in the state of Arkansas. It is primarily utilized for reporting specific income types and ensuring compliance with state tax regulations. This form is essential for individuals and businesses who need to declare income that may not be reported on standard tax forms. Understanding the purpose and requirements of the Ar8453 Ol is crucial for accurate tax filing in Arkansas.

How to use the Ar8453 Ol

Using the Ar8453 Ol involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents that pertain to the income being reported. Next, fill out the form with precise details, including your personal information and the specific income amounts. After completing the form, review it for accuracy before submission. This careful approach helps in avoiding potential issues with the Arkansas Department of Finance and Administration.

Steps to complete the Ar8453 Ol

Completing the Ar8453 Ol requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report the income amounts accurately, ensuring that all figures match your supporting documents.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Ar8453 Ol

The legal use of the Ar8453 Ol is governed by state tax laws. When properly filled out and submitted, this form serves as a legally binding document for reporting income. Compliance with the relevant laws ensures that taxpayers fulfill their obligations and avoid penalties. It is important to understand the legal implications of the information provided on the form, as inaccuracies can lead to legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Ar8453 Ol are crucial for compliance with state tax regulations. Typically, the form must be submitted by April 15 of the tax year. However, taxpayers should verify specific deadlines each year, as they may vary based on holidays or other factors. Staying informed about these important dates helps ensure timely submission and avoids potential penalties for late filing.

Required Documents

To complete the Ar8453 Ol, several documents are required to substantiate the income being reported. These may include:

- W-2 forms from employers, if applicable.

- 1099 forms for other income sources.

- Receipts or records of any deductible expenses.

- Previous tax returns for reference.

Having these documents ready will streamline the completion process and enhance accuracy.

Who Issues the Form

The Ar8453 Ol form is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department’s website or through authorized tax preparation services.

Quick guide on how to complete ar8453 ol

Effortlessly Prepare Ar8453 Ol on Any Device

Online document management has gained traction among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed paperwork, as you can access the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ar8453 Ol on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Easily Change and eSign Ar8453 Ol

- Find Ar8453 Ol and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ar8453 Ol and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar8453 ol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ar8453 ol and how does it work?

Ar8453 ol is a comprehensive eSignature solution offered by airSlate SignNow. It allows users to easily send, sign, and manage documents digitally, streamlining the signing process. With ar8453 ol, you can get documents e-signed in minutes, reducing the turnaround time signNowly.

-

What are the pricing plans available for ar8453 ol?

airSlate SignNow offers flexible pricing for ar8453 ol to cater to various business needs. You can choose from several plans, including monthly and annual subscriptions, making it a cost-effective choice for businesses of all sizes. The diverse options ensure you pay only for what you require.

-

What features does ar8453 ol include?

Ar8453 ol includes a wide range of features designed to enhance document management. Key features include template creation, in-person signing, mobile access, and advanced security options. This makes ar8453 ol a versatile tool for businesses looking to simplify their document signing processes.

-

How can ar8453 ol benefit my business?

Using ar8453 ol can signNowly improve your business operations by reducing paperwork and minimizing delays in document signing. The platform's user-friendly interface helps ensure that teams can quickly adopt the technology. Moreover, it enhances compliance and security for all your document transactions.

-

Is ar8453 ol easy to integrate with other tools?

Yes, ar8453 ol is designed to seamlessly integrate with various third-party applications and tools. Whether you're using CRM systems or other business management software, ar8453 ol can connect to streamline your workflows. This integration capability helps maintain a smooth operational flow across platforms.

-

What types of documents can I send using ar8453 ol?

Ar8453 ol supports a wide range of document types, including contracts, agreements, and forms. You can easily upload these documents for eSigning or create new ones directly within the platform. This versatility makes ar8453 ol valuable for various industries and document needs.

-

Can I track the status of my documents with ar8453 ol?

Absolutely! Ar8453 ol provides real-time tracking of all sent documents. You can easily view the status of each document, whether it’s awaiting signature, signed, or completed, ensuring that you maintain full visibility throughout the signing process.

Get more for Ar8453 Ol

- Office medicare hearings appeals form

- Mn special review awareness form

- Application disabled person placard form

- Ran band support request form ran band support request form

- Practice incentives program health form

- Member investment choice member investment choice form

- Request for penalty abatementarizona department of revenue form

- Wwwcolinnoruspdfetcptei20201210linn county planning and building department form

Find out other Ar8453 Ol

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure