Cp261 Notice Form

What is the Cp261 Notice

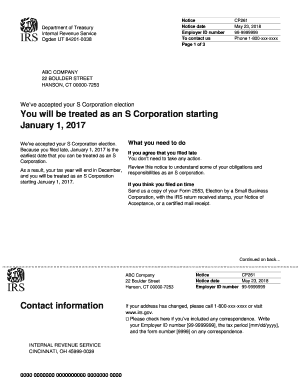

The Cp261 Notice, also known as the IRS letter 385c, is an official communication from the Internal Revenue Service (IRS) that acknowledges the acceptance of an S corporation election. This notice is crucial for businesses that have elected to be taxed as S corporations, as it confirms their status and outlines the implications of this designation. The Cp261 Notice serves as an important document for record-keeping and tax purposes, ensuring that the business complies with federal tax regulations.

How to use the Cp261 Notice

The Cp261 Notice is primarily used to verify S corporation status for tax filings and other business-related activities. It is essential for shareholders and business owners to keep this notice on file, as it may be requested by financial institutions, during audits, or when filing tax returns. When applying for loans or grants, businesses may need to provide this notice to demonstrate their S corporation status. Additionally, it can be used to clarify tax obligations and eligibility for certain tax benefits associated with S corporations.

Steps to complete the Cp261 Notice

Completing the Cp261 Notice involves several key steps to ensure accuracy and compliance. First, businesses must file Form 2553 to elect S corporation status, which is the precursor to receiving the Cp261 Notice. Once the IRS processes this form, the business will receive the notice confirming acceptance. It is important to review the notice carefully for any discrepancies or errors. If any issues are identified, businesses should contact the IRS promptly to rectify them. Keeping a copy of the completed notice with other important tax documents is advisable for future reference.

Legal use of the Cp261 Notice

The Cp261 Notice is legally binding and serves as proof of S corporation status. This document is essential for ensuring compliance with tax laws and regulations. Businesses must use the notice to substantiate their tax filings and maintain eligibility for S corporation benefits. Failure to provide this notice when required can lead to complications with tax authorities, including potential penalties or loss of S corporation status. Therefore, understanding the legal implications of the Cp261 Notice is vital for any business operating as an S corporation.

Key elements of the Cp261 Notice

The Cp261 Notice contains several key elements that are important for businesses to understand. These include the name and address of the business, the date of acceptance, and the specific tax year for which the S corporation election is effective. Additionally, the notice may outline any conditions or requirements that the business must adhere to maintain its S corporation status. It is crucial for business owners to familiarize themselves with these elements to ensure compliance and proper record-keeping.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Cp261 Notice is critical for businesses. The IRS requires that Form 2553 be submitted within a specific timeframe to ensure timely acceptance of the S corporation election. Generally, this form must be filed by the fifteenth day of the third month of the tax year for which the election is to take effect. Missing this deadline can result in the denial of the S corporation status for that tax year. Keeping track of these important dates helps businesses maintain compliance and avoid potential penalties.

Quick guide on how to complete cp261 notice

Complete Cp261 Notice effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Cp261 Notice on any device using the airSlate SignNow Android or iOS apps and streamline any document-centered process today.

The simplest way to modify and eSign Cp261 Notice effortlessly

- Locate Cp261 Notice and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Cp261 Notice and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp261 notice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 385c letter and why is it important?

A 385c letter is a specific document used to confirm certain information related to tax statuses or addresses. It is essential for businesses and individuals who need to verify their tax-related details. Understanding the use of a 385c letter can streamline your compliance processes.

-

How can airSlate SignNow help me manage my 385c letter?

airSlate SignNow allows users to easily create, send, and eSign a 385c letter securely and efficiently. By utilizing our platform, you can ensure that your documents are legally binding and easily accessible. This simplifies the process and reduces turnaround times.

-

What features does airSlate SignNow offer for handling 385c letters?

With airSlate SignNow, you can use features like template creation for 385c letters, automated workflows, and real-time tracking for document status. These tools enhance efficiency and help you keep your documents organized. Our user-friendly interface also makes it easy for all users to navigate.

-

Is there a pricing plan for using airSlate SignNow for 385c letters?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs. Depending on your usage, you can choose a plan that allows for unlimited document sending and signing, making it cost-effective for managing your 385c letter requirements.

-

Can I integrate airSlate SignNow with other software to manage 385c letters?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications such as Google Drive, Salesforce, and more. This means you can manage your 385c letters alongside your other business processes without hassle.

-

What are the benefits of using airSlate SignNow for a 385c letter?

The primary benefits of using airSlate SignNow for a 385c letter include enhanced security, faster document processing times, and improved compliance. Our platform ensures that your documents are protected while simplifying the eSigning process.

-

Is airSlate SignNow compliant with legal standards for 385c letters?

Yes, airSlate SignNow complies with industry standards for electronic signatures, ensuring that your 385c letters are legally valid. This compliance gives users peace of mind when handling sensitive documents and transactions.

Get more for Cp261 Notice

- By and through hisher attorney form

- What are the grounds for divorce in mississippi the mississippi bar form

- Plaza ins co v lester civil action no 14 cv 01162 ltb cbs form

- In the chancery court of county mississippi form

- Modifications mass legal services form

- State of kentucky hereinafter referred to as the trustor and the trustee form

- Checklist for sale or acquisition of a small business professional form

- Utah registered agent servicesct corporation form

Find out other Cp261 Notice

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document