Irp 5 Form

Understanding the IRP 5 Form

The IRP 5 form is a critical document used in the United States for reporting employee earnings and tax deductions. It is primarily utilized by employers to provide information about wages paid to employees during a tax year. This form plays a significant role in ensuring accurate tax reporting and compliance with federal and state tax regulations. Employers must complete the IRP 5 accurately to avoid penalties and ensure that employees receive proper credit for their earnings and tax withholdings.

Steps to Complete the IRP 5 Form

Completing the IRP 5 form involves several key steps to ensure accuracy and compliance. Follow these steps for effective completion:

- Gather Necessary Information: Collect all relevant data, including employee names, Social Security numbers, and total wages paid.

- Fill Out Employee Details: Enter each employee's information in the designated sections of the form, ensuring all data is accurate.

- Report Earnings and Deductions: Clearly indicate total earnings and any deductions made for taxes, benefits, or other withholdings.

- Review for Accuracy: Double-check all entries for errors or omissions before finalizing the form.

- Submit the Form: File the completed IRP 5 form according to the submission guidelines, ensuring it is sent by the required deadline.

Legal Use of the IRP 5 Form

The legal use of the IRP 5 form is essential for both employers and employees. This form serves as a formal record of employment income and tax withholdings, which can be critical during tax audits or disputes. To ensure legal compliance, employers must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and local tax authorities. Properly completed IRP 5 forms help maintain transparency and accountability in payroll practices.

Obtaining the IRP 5 Form

Employers can obtain the IRP 5 form through various channels. The most common method is to download the form directly from the IRS website or the relevant state tax authority's website. Additionally, many accounting software programs offer the IRP 5 form as part of their payroll services, allowing for easy access and completion. It is important to ensure that the most current version of the form is used to comply with the latest tax regulations.

Filing Deadlines and Important Dates

Timely filing of the IRP 5 form is crucial to avoid penalties. Employers should be aware of the specific deadlines for submission, which may vary by state. Generally, the deadline for filing the IRP 5 form is set for January thirty-first of the following tax year. It is advisable to mark this date on the calendar and prepare the form in advance to ensure compliance.

Examples of Using the IRP 5 Form

The IRP 5 form can be used in various scenarios, including:

- Reporting Employee Wages: Employers use the form to report wages paid to full-time, part-time, and seasonal employees.

- Documenting Tax Deductions: The form is essential for documenting tax withholdings, which employees need for accurate tax filings.

- Providing Information for Audits: The IRP 5 serves as a reliable source of income information during IRS audits or inquiries.

Quick guide on how to complete irp 5

Easily Prepare Irp 5 on Any Device

Managing documents online has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly and without delay. Handle Irp 5 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Alter and eSign Irp 5 Effortlessly

- Locate Irp 5 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Irp 5 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irp 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

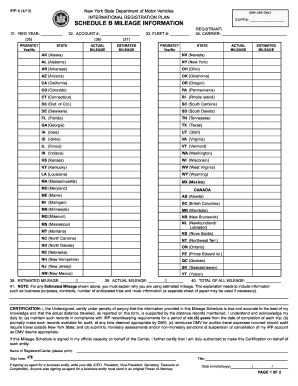

What is the irp schedule b, and why is it important?

The irp schedule b is a critical component for businesses that need to report their international road transportation activities. It categorizes various types of vehicles and their respective uses, ensuring compliance with regulations. Understanding irp schedule b can help streamline your reporting process and avoid penalties.

-

How does airSlate SignNow facilitate the completion of irp schedule b?

airSlate SignNow offers an easy-to-use platform that allows you to electronically sign and manage documents related to your irp schedule b. You can quickly fill out forms, collect signatures from stakeholders, and securely store documents. This makes compliance easier and more efficient for your business.

-

What are the pricing options available for airSlate SignNow related to irp schedule b?

airSlate SignNow provides several flexible pricing plans designed to accommodate businesses of all sizes. Each plan includes features that simplify the management of irp schedule b documentation. By choosing the right plan, you can ensure your team has the necessary tools without overspending.

-

Can I integrate airSlate SignNow with other software for managing irp schedule b?

Yes, airSlate SignNow integrates seamlessly with many other business applications, enhancing your workflow for managing irp schedule b. These integrations allow for automatic document sharing and real-time updates, making it easier to keep your records current and organized. It ensures that your irp schedule b information is accessible where you need it.

-

What are the key features of airSlate SignNow that support irp schedule b processes?

Key features of airSlate SignNow that support the irp schedule b processes include electronic signatures, templates for common documents, and real-time tracking. These tools help streamline the documentation workflow, making it faster and more reliable. By leveraging these features, your business can expedite irp schedule b submissions.

-

How does using airSlate SignNow benefit businesses handling irp schedule b?

Using airSlate SignNow to manage your irp schedule b can signNowly reduce processing time and administrative burdens. The platform ensures documents are signed and processed swiftly, allowing your business to focus on core activities. Additionally, it enhances compliance through secure, easily accessible records.

-

Is airSlate SignNow user-friendly for managing irp schedule b?

Absolutely, airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and manage their irp schedule b. The intuitive interface allows users to complete documents with minimal training. Whether you're tech-savvy or new to digital tools, you'll find it accessible.

Get more for Irp 5

- Ontario health team self assessment form

- Identification waiver form citb

- Labour market impact assessment application high wage and low wage positions emp5602e servicecanada gc form

- Assumption of duty form department of education

- Mr1 application for registration and third party sa gov form

- 492 request for correctionasic australian securities and form

- Asic form 492

- Parentguardian consent of a minors driver licence form

Find out other Irp 5

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later